Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

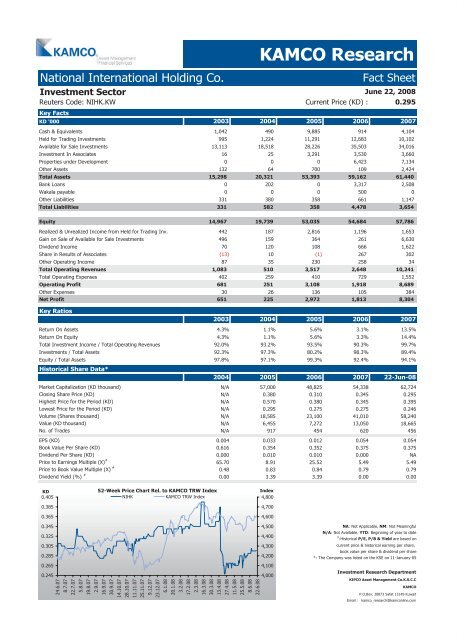

National International Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: NIHK.KW Current Price (KD) : 0.295<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalents 1,042 490 9,885 914 4,104<br />

Held for Trading Investments 995 1,224 11,291 12,683 10,102<br />

Available for Sale Investments 13,113 18,518 28,226 35,503 34,016<br />

Investment In Associates 16 25 3,291 3,530 3,660<br />

Properties under Development 0 0 0 6,423 7,134<br />

Other Assets 132 64 700 109 2,424<br />

Total Assets 15,298 20,321 53,393 59,162 61,440<br />

Bank Loans 0 202 0 3,317 2,508<br />

Wakala payable 0 0 0 500 0<br />

Other Liabilities 331 380 358 661 1,147<br />

Total Liabilities 331 582 358 4,478 3,654<br />

Equity 14,967 19,739 53,035 54,684 57,786<br />

Realized & Unrealized Income from Held for Trading Inv. 442 187 2,816 1,196 1,653<br />

Gain on Sale of Available for Sale Investments 496 159 364 261 6,630<br />

Dividend Income 70 120 108 666 1,622<br />

Share in Results of Associates (13) 10 (1) 267 302<br />

Other Operating Income 87 35 230 258 34<br />

Total Operating Revenues 1,083 510 3,517 2,648 10,241<br />

Total Operating Expenses 402 259 410 729 1,552<br />

Operating Profit 681 251 3,108 1,918 8,689<br />

Other Expenses 30 26 136 105 384<br />

Net Profit 651 225 2,972 1,813 8,304<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 4.3% 1.1% 5.6% 3.1% 13.5%<br />

Return On Equity 4.3% 1.1% 5.6% 3.3% 14.4%<br />

Total Investment Income / Total Operating Revenues 92.0% 93.2% 93.5% 90.3% 99.7%<br />

Investments / Total Assets 92.3% 97.3% 80.2% 98.3% 89.4%<br />

Equity / Total Assets<br />

Historical Share Data*<br />

97.8% 97.1% 99.3% 92.4% 94.1%<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 57,000 48,825 54,338 62,724<br />

Closing Share Price (KD) N/A 0.380 0.310 0.345 0.295<br />

Highest Price for the Period (KD) N/A 0.570 0.380 0.345 0.395<br />

Lowest Price for the Period (KD) N/A 0.295 0.275 0.275 0.246<br />

Volume (Shares thousand) N/A 18,585 23,100 41,010 58,240<br />

Value (KD thousand) N/A 6,455 7,272 13,050 18,665<br />

No. of Trades N/A 917 454 620 456<br />

EPS (KD) 0.004 0.033 0.012 0.054 0.054<br />

Book Value Per Share (KD) 0.616 0.354 0.352 0.375 0.375<br />

Dividend Per Share (KD) 0.000 0.010 0.010 0.000 NA<br />

Price to Earnings Multiple (X) #<br />

65.70 8.91 25.52 5.49 5.49<br />

Price to Book Value Multiple (X) #<br />

0.48 0.83 0.84 0.79 0.79<br />

Dividend Yield (%) #<br />

0.00 3.39 3.39 0.00 0.00<br />

KD<br />

0.405<br />

0.385<br />

0.365<br />

0.345<br />

0.325<br />

0.305<br />

0.285<br />

0.265<br />

0.245<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

NIHK KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on the KSE on 11-January-05<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com