Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

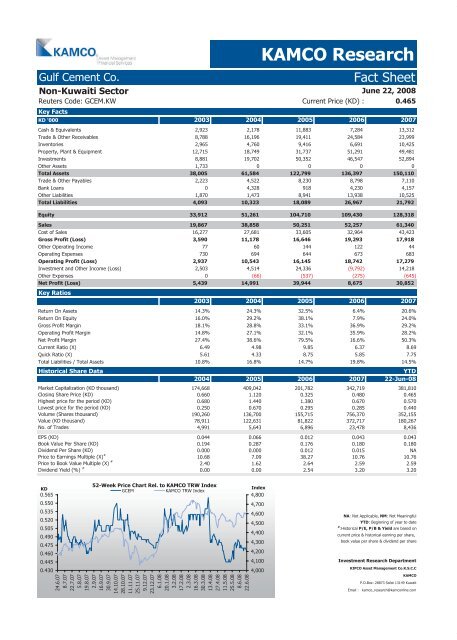

Gulf Cement Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Non-<strong>Kuwait</strong>i Sector<br />

Reuters Code: GCEM.KW Current Price (KD) : 0.465<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalents 2,923 2,178 11,883 7,284 13,312<br />

Trade & Other Receivables 8,788 16,196 19,411 24,584 23,999<br />

Inventories 2,965 4,760 9,416 6,691 10,425<br />

Property, Plant & Equipment 12,715 18,749 31,737 51,291 49,481<br />

Investments 8,881 19,702 50,352 46,547 52,894<br />

Other Assets 1,733 0 0 0 0<br />

Total Assets 38,005 61,584 122,799 136,397 150,110<br />

Trade & Other Payables 2,223 4,522 8,230 8,798 7,110<br />

Bank Loans 0 4,328 918 4,230 4,157<br />

Other Liabilities 1,870 1,473 8,941 13,938 10,525<br />

Total Liabilities 4,093 10,323 18,089 26,967 21,792<br />

Equity 33,912 51,261 104,710 109,430 128,318<br />

Sales 19,867 38,858 50,251 52,257 61,340<br />

Cost of Sales 16,277 27,681 33,605 32,964 43,423<br />

Gross Profit (Loss) 3,590 11,178 16,646 19,293 17,918<br />

Other Operating Income 77 60 144 122 44<br />

Operating Expenses 730 694 644 673 683<br />

Operating Profit (Loss) 2,937 10,543 16,145 18,742 17,279<br />

Investment and Other Income (Loss) 2,503 4,514 24,336 (9,792) 14,218<br />

Other Expenses 0 (66) (537) (275) (645)<br />

Net Profit (Loss)<br />

Key Ratios<br />

5,439 14,991 39,944 8,675 30,852<br />

2003 2004 2005 2006 2007<br />

Return On Assets 14.3% 24.3% 32.5% 6.4% 20.6%<br />

Return On Equity 16.0% 29.2% 38.1% 7.9% 24.0%<br />

Gross Profit Margin 18.1% 28.8% 33.1% 36.9% 29.2%<br />

Operating Profit Margin 14.8% 27.1% 32.1% 35.9% 28.2%<br />

Net Profit Margin 27.4% 38.6% 79.5% 16.6% 50.3%<br />

Current Ratio (X) 6.49 4.98 9.85 6.37 8.69<br />

Quick Ratio (X) 5.61 4.33 8.75 5.85 7.75<br />

Total Liabilities / Total Assets 10.8% 16.8% 14.7% 19.8% 14.5%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 174,668 409,042 201,782 342,719 381,810<br />

Closing Share Price (KD) 0.660 1.120 0.325 0.480 0.465<br />

Highest price for the period (KD) 0.680 1.440 1.380 0.670 0.570<br />

Lowest price for the period (KD) 0.250 0.670 0.295 0.285 0.440<br />

Volume (Shares thousand) 190,260 136,700 155,715 756,370 352,155<br />

Value (KD thousand) 78,911 122,631 81,822 372,717 180,267<br />

No. of Trades 4,991 5,643 6,896 23,478 8,436<br />

EPS (KD) 0.044 0.066 0.012 0.043 0.043<br />

Book Value Per Share (KD) 0.194 0.287 0.176 0.180 0.180<br />

Dividend Per Share (KD) 0.000 0.000 0.012 0.015 NA<br />

Price to Earnings Multiple (X) #<br />

10.68 7.09 38.27 10.76 10.76<br />

Price to Book Value Multiple (X) #<br />

2.40 1.62 2.64 2.59 2.59<br />

Dividend Yield (%) #<br />

0.00 0.00 2.54 3.20 3.20<br />

KD<br />

0.565<br />

0.550<br />

0.535<br />

0.520<br />

0.505<br />

0.490<br />

0.475<br />

0.460<br />

0.445<br />

0.430<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

GCEM KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com