Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

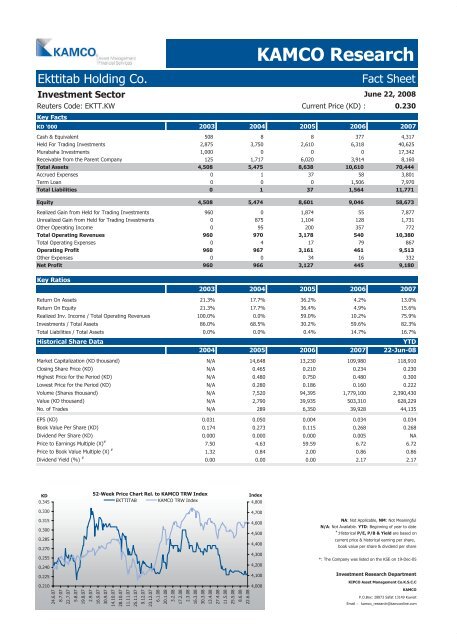

Ekttitab Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: EKTT.KW Current Price (KD) : 0.230<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 508<br />

8<br />

8<br />

377<br />

4,317<br />

Held For Trading Investments 2,875<br />

3,750<br />

2,610<br />

6,318<br />

40,625<br />

Murabaha Investments 1,000<br />

0 0 0 17,342<br />

Receivable from the Parent Company 125<br />

1,717<br />

6,020<br />

3,914<br />

8,160<br />

Total Assets 4,508<br />

5,475<br />

8,638<br />

10,610<br />

70,444<br />

Accrued Expenses 0 1<br />

37<br />

58<br />

3,801<br />

Term Loan 0 0 0 1,506<br />

7,970<br />

Total Liabilities 0 1 37 1,564 11,771<br />

Equity 4,508 5,474 8,601 9,046 58,673<br />

Realized Gain from Held for Trading Investments 960 0 1,874 55 7,877<br />

Unrealized Gain from Held for Trading Investments 0 875 1,104 128 1,731<br />

Other Operating Income 0 95 200 357 772<br />

Total Operating Revenues 960 970 3,178 540 10,380<br />

Total Operating Expenses 0 4 17 79 867<br />

Operating Profit 960 967 3,161 461 9,513<br />

Other Expenses 0 0 34 16 332<br />

Net Profit 960 966 3,127 445 9,180<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 21.3% 17.7% 36.2% 4.2% 13.0%<br />

Return On Equity 21.3% 17.7% 36.4% 4.9% 15.6%<br />

Realized Inv. Income / Total Operating Revenues 100.0% 0.0% 59.0% 10.2% 75.9%<br />

Investments / Total Assets 86.0% 68.5% 30.2% 59.6% 82.3%<br />

Total Liabilities / Total Assets 0.0% 0.0% 0.4% 14.7% 16.7%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 14,648 13,230 109,980 118,910<br />

Closing Share Price (KD) N/A 0.465 0.210 0.234 0.230<br />

Highest Price for the Period (KD) N/A 0.480 0.750 0.480 0.300<br />

Lowest Price for the Period (KD) N/A 0.280 0.186 0.160 0.222<br />

Volume (Shares thousand) N/A 7,520 94,395 1,779,100 2,390,430<br />

Value (KD thousand) N/A 2,790 39,935 503,310 628,229<br />

No. of Trades N/A 289 6,350 39,928 44,135<br />

EPS (KD) 0.031 0.050 0.004 0.034 0.034<br />

Book Value Per Share (KD) 0.174 0.273 0.115 0.268 0.268<br />

Dividend Per Share (KD) 0.000 0.000 0.000 0.005 NA<br />

Price to Earnings Multiple (X) #<br />

7.50 4.63 59.59 6.72 6.72<br />

Price to Book Value Multiple (X) #<br />

1.32 0.84 2.00 0.86 0.86<br />

Dividend Yield (%) #<br />

0.00 0.00 0.00 2.17 2.17<br />

KD<br />

0.345<br />

0.330<br />

0.315<br />

0.300<br />

0.285<br />

0.270<br />

0.255<br />

0.240<br />

0.225<br />

0.210<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

EKTTITAB KAMCO TRW Index<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

KAMCO Research<br />

June 22, 2008<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The Company was listed on the KSE on 19-Dec-05<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com