Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

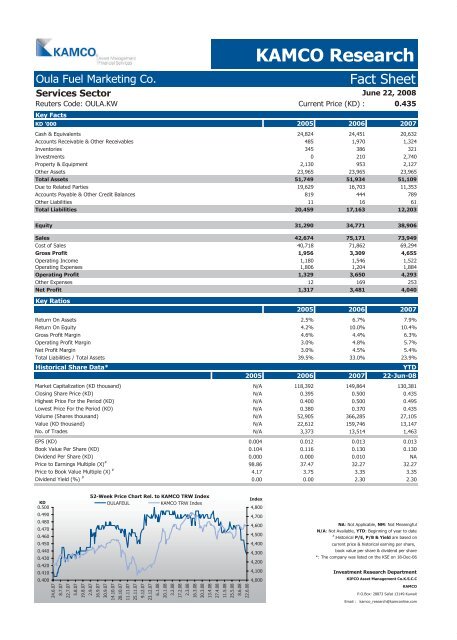

Oula Fuel Marketing Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: OULA.KW Current Price (KD) : 0.435<br />

Key <strong>Fact</strong>s<br />

KD '000 2005 2006 2007<br />

Cash & Equivalents 24,824 24,451 20,632<br />

Accounts Receivable & Other Receivables 485 1,970 1,324<br />

Inventories 345 386 321<br />

Investments 0 210 2,740<br />

Property & Equipment 2,130 953 2,127<br />

Other Assets 23,965 23,965 23,965<br />

Total Assets 51,749 51,934 51,109<br />

Due to Related Parties 19,629 16,703 11,353<br />

Accounts Payable & Other Credit Balances 819 444 789<br />

Other Liabilities 11 16 61<br />

Total Liabilities 20,459 17,163 12,203<br />

Equity 31,290 34,771 38,906<br />

Sales 42,674 75,171 73,949<br />

Cost of Sales 40,718 71,862 69,294<br />

Gross Profit 1,956 3,309 4,655<br />

Operating Income 1,180 1,546 1,522<br />

Operating Expenses 1,806 1,204 1,884<br />

Operating Profit 1,329 3,650 4,293<br />

Other Expenses 12 169 253<br />

Net Profit 1,317 3,481 4,040<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2005 2006 2007<br />

Return On Assets 2.5% 6.7% 7.9%<br />

Return On Equity 4.2% 10.0% 10.4%<br />

Gross Profit Margin 4.6% 4.4% 6.3%<br />

Operating Profit Margin 3.0% 4.8% 5.7%<br />

Net Profit Margin 3.0% 4.5% 5.4%<br />

Total Liabilities / Total Assets 39.5% 33.0% 23.9%<br />

Historical Share Data* YTD<br />

2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 118,392 149,864 130,381<br />

Closing Share Price (KD) N/A 0.395 0.500 0.435<br />

Highest Price For the Period (KD) N/A 0.400 0.500 0.495<br />

Lowest Price For the Period (KD) N/A 0.380 0.370 0.435<br />

Volume (Shares thousand) N/A 52,905 366,285 27,105<br />

Value (KD thousand) N/A 22,612 159,746 13,147<br />

No. of Trades N/A 3,373 13,514 1,463<br />

EPS (KD) 0.004 0.012 0.013 0.013<br />

Book Value Per Share (KD) 0.104 0.116 0.130 0.130<br />

Dividend Per Share (KD) 0.000 0.000 0.010 NA<br />

Price to Earnings Multiple (X) #<br />

98.86 37.47 32.27 32.27<br />

Price to Book Value Multiple (X) #<br />

4.17 3.75 3.35 3.35<br />

Dividend Yield (%) #<br />

0.00 0.00 2.30 2.30<br />

KD<br />

0.500<br />

0.490<br />

0.480<br />

0.470<br />

0.460<br />

0.450<br />

0.440<br />

0.430<br />

0.420<br />

0.410<br />

0.400<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

OULAFEUL KAMCO TRW Index<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available, YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

*: The company was listed on the KSE on 18-Dec-06<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com