Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

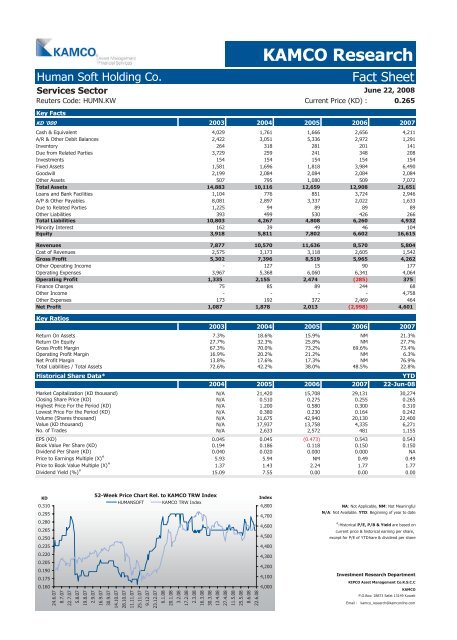

Human Soft Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: HUMN.KW Current Price (KD) : 0.265<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 4,029 1,761 1,666 2,656 4,211<br />

A/R & Other Debit Balances 2,422 3,051 5,336 2,972 1,291<br />

Inventory 264 318 281 201 141<br />

Due from Related Parties 3,729 259 241 348 208<br />

Investments 154 154 154 154 154<br />

Fixed Assets 1,581 1,696 1,818 3,984 6,490<br />

Goodwill 2,199 2,084 2,084 2,084 2,084<br />

Other Assets 507 795 1,080 509 7,072<br />

Total Assets 14,883 10,116 12,659 12,908 21,651<br />

Loans and Bank Facilities 1,104 776 851 3,724 2,946<br />

A/P & Other Payables 8,081 2,897 3,337 2,022 1,633<br />

Due to Related Parties 1,225 94 89 89 89<br />

Other Liabilities 393 499 530 426 266<br />

Total Liabilities 10,803 4,267 4,808 6,260 4,932<br />

Minority Interest 162 39 49 46 104<br />

Equity 3,918 5,811 7,802 6,602 16,615<br />

Revenues 7,877 10,570 11,636 8,570 5,804<br />

Cost of Revenues 2,575 3,173 3,118 2,605 1,542<br />

Gross Profit 5,302 7,396 8,519 5,965 4,262<br />

Other Operating Income - 127 15 90 177<br />

Operating Expenses 3,967 5,368 6,060 6,341 4,064<br />

Operating Profit 1,335 2,155 2,474 (285) 375<br />

Finance Charges 75 85 89 244 68<br />

Other Income - - - - 4,758<br />

Other Expenses 173 192 372 2,469 464<br />

Net Profit 1,087 1,878 2,013 (2,998) 4,601<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 7.3% 18.6% 15.9% NM 21.3%<br />

Return On Equity 27.7% 32.3% 25.8% NM 27.7%<br />

Gross Profit Margin 67.3% 70.0% 73.2% 69.6% 73.4%<br />

Operating Profit Margin 16.9% 20.2% 21.2% NM 6.3%<br />

Net Profit Margin 13.8% 17.6% 17.3% NM 76.9%<br />

Total Liabilities / Total Assets 72.6% 42.2% 38.0% 48.5% 22.8%<br />

Historical Share Data* YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 21,420 15,708 29,131 30,274<br />

Closing Share Price (KD) N/A 0.510 0.275 0.255 0.265<br />

Highest Price For the Period (KD) N/A 1.200 0.580 0.300 0.310<br />

Lowest Price For the Period (KD) N/A 0.380 0.230 0.164 0.242<br />

Volume (Shares thousand) N/A 31,675 42,940 20,130 22,400<br />

Value (KD thousand) N/A 17,937 13,758 4,335 6,271<br />

No. of Trades N/A 2,633 2,572 481 1,155<br />

EPS (KD) 0.045 0.045 (0.473) 0.543 0.543<br />

Book Value Per Share (KD) 0.194 0.186 0.118 0.150 0.150<br />

Dividend Per Share (KD) 0.040 0.020 0.000 0.000 NA<br />

Price to Earnings Multiple (X) #<br />

5.93 5.94 NM 0.49 0.49<br />

Price to Book Value Multiple (X) #<br />

1.37 1.43 2.24 1.77 1.77<br />

Dividend Yield (%) #<br />

15.09 7.55 0.00 0.00 0.00<br />

KD<br />

0.310<br />

0.295<br />

0.280<br />

0.265<br />

0.250<br />

0.235<br />

0.220<br />

0.205<br />

0.190<br />

0.175<br />

0.160<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

16.9.07<br />

30.9.07<br />

HUMANSOFT KAMCO TRW Index<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

except for P/E of YTDhare & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com