Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

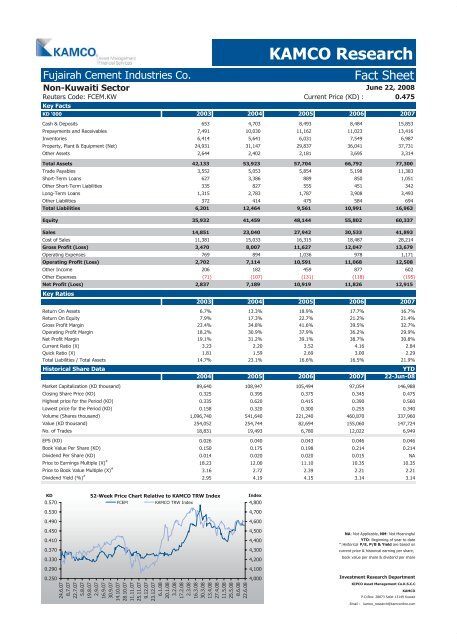

Fujairah Cement Industries Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Non-<strong>Kuwait</strong>i Sector<br />

Reuters Code: FCEM.KW Current Price (KD) :<br />

June 22, 2008<br />

0.475<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Deposits 653 4,703 8,493 8,484 15,853<br />

Prepayments and Receivables 7,491 10,030 11,162 11,023 13,416<br />

Inventories 6,414 5,641 6,031 7,549 6,987<br />

Property, Plant & Equipment (Net) 24,931 31,147 29,837 36,041 37,731<br />

Other Assets 2,644 2,402 2,181 3,695 3,314<br />

Total Assets 42,133 53,923 57,704 66,792 77,300<br />

Trade Payables 3,552 5,053 5,854 5,198 11,383<br />

Short-Term Loans 627 3,386 889 850 1,051<br />

Other Short-Term Liabilities 335 827 555 451 342<br />

Long-Term Loans 1,315 2,783 1,787 3,908 3,493<br />

Other Liabilities 372 414 475 584 694<br />

Total Liabilities 6,201 12,464 9,561 10,991 16,963<br />

Equity 35,932 41,459 48,144 55,802 60,337<br />

Sales 14,851 23,040 27,942 30,533 41,893<br />

Cost of Sales 11,381 15,033 16,315 18,487 28,214<br />

Gross Profit (Loss) 3,470 8,007 11,627 12,047 13,679<br />

Operating Expenses 769 894 1,036 978 1,171<br />

Operating Profit (Loss) 2,702 7,114 10,591 11,068 12,508<br />

Other Income 206 182 459 877 602<br />

Other Expenses (71) (107) (131) (118) (195)<br />

Net Profit (Loss)<br />

Key Ratios<br />

2,837 7,189 10,919 11,826 12,915<br />

2003 2004 2005 2006 2007<br />

Return On Assets 6.7% 13.3% 18.9% 17.7% 16.7%<br />

Return On Equity 7.9% 17.3% 22.7% 21.2% 21.4%<br />

Gross Profit Margin 23.4% 34.8% 41.6% 39.5% 32.7%<br />

Operating Profit Margin 18.2% 30.9% 37.9% 36.2% 29.9%<br />

Net Profit Margin 19.1% 31.2% 39.1% 38.7% 30.8%<br />

Current Ratio (X) 3.23 2.20 3.52 4.16 2.84<br />

Quick Ratio (X) 1.81 1.59 2.69 3.00 2.29<br />

Total Liabilities / Total Assets 14.7% 23.1% 16.6% 16.5% 21.9%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 89,640 108,947 105,494 97,054 146,988<br />

Closing Share Price (KD) 0.325 0.395 0.375 0.345 0.475<br />

Highest price for the Period (KD) 0.335 0.620 0.415 0.390 0.560<br />

Lowest price for the Period (KD) 0.158 0.320 0.300 0.255 0.340<br />

Volume (Shares thousand) 1,096,740 541,640 221,240 460,870 337,960<br />

Value (KD thousand) 254,052 254,744 82,694 155,060 147,724<br />

No. of Trades 18,831 19,493 6,780 12,022 6,949<br />

EPS (KD) 0.026 0.040 0.043 0.046 0.046<br />

Book Value Per Share (KD) 0.150 0.175 0.198 0.214 0.214<br />

Dividend Per Share (KD) 0.014 0.020 0.020 0.015 NA<br />

Price to Earnings Multiple (X) #<br />

18.23 12.00 11.10 10.35 10.35<br />

Price to Book Value Multiple (X) #<br />

3.16 2.72 2.39 2.21 2.21<br />

Dividend Yield (%) #<br />

2.95 4.19 4.15 3.14 3.14<br />

KD<br />

0.570<br />

0.530<br />

0.490<br />

0.450<br />

0.410<br />

0.370<br />

0.330<br />

0.290<br />

0.250<br />

52-Week Price Chart Relative to KAMCO TRW Index<br />

FCEM KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B&Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com