Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

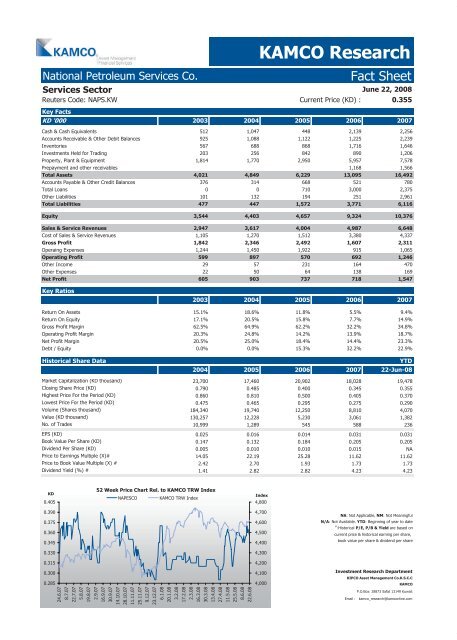

National Petroleum Services Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: NAPS.KW Current Price (KD) : 0.355<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalents 512 1,047 448 2,139 2,256<br />

Accounts Receivable & Other Debit Balances 925 1,088 1,122 1,225 2,239<br />

Inventories 567 688 868 1,716 1,646<br />

Investments Held for Trading 203 256 842 890 1,206<br />

Property, Plant & Equipment 1,814 1,770 2,950 5,957 7,578<br />

Prepayment and other receivables 1,168 1,566<br />

Total Assets 4,021 4,849 6,229 13,095 16,492<br />

Accounts Payable & Other Credit Balances 376 314 668 521 780<br />

Total Loans 0 0 710 3,000 2,375<br />

Other Liabilities 101 132 194 251 2,961<br />

Total Liabilities 477 447 1,572 3,771 6,116<br />

Equity 3,544 4,403 4,657 9,324 10,376<br />

Sales & Service Revenues 2,947 3,617 4,004 4,987 6,648<br />

Cost of Sales & Service Revenues 1,105 1,270 1,512 3,380 4,337<br />

Gross Profit 1,842 2,346 2,492 1,607 2,311<br />

Operaing Expenses 1,244 1,450 1,922 915 1,065<br />

Operating Profit 599 897 570 692 1,246<br />

Other Income 29 57 231 164 470<br />

Other Expenses 22 50 64 138 169<br />

Net Profit 605 903 737 718 1,547<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 15.1% 18.6% 11.8% 5.5% 9.4%<br />

Return On Equity 17.1% 20.5% 15.8% 7.7% 14.9%<br />

Gross Profit Margin 62.5% 64.9% 62.2% 32.2% 34.8%<br />

Operating Profit Margin 20.3% 24.8% 14.2% 13.9% 18.7%<br />

Net Profit Margin 20.5% 25.0% 18.4% 14.4% 23.3%<br />

Debt / Equity 0.0% 0.0% 15.3% 32.2% 22.9%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 23,700 17,460 20,902 18,028 19,478<br />

Closing Share Price (KD) 0.790 0.485 0.400 0.345 0.355<br />

Highest Price For the Period (KD) 0.860 0.810 0.500 0.405 0.370<br />

Lowest Price For the Period (KD) 0.475 0.465 0.295 0.275 0.290<br />

Volume (Shares thousand) 184,340 19,740 12,250 8,810 4,070<br />

Value (KD thousand) 130,257 12,228 5,230 3,061 1,382<br />

No. of Trades 10,999 1,289 545 588 236<br />

EPS (KD) 0.025 0.016 0.014 0.031 0.031<br />

Book Value Per Share (KD) 0.147 0.132 0.184 0.205 0.205<br />

Dividend Per Share (KD) 0.005 0.010 0.010 0.015 NA<br />

Price to Earnings Multiple (X)# 14.05 22.19 25.28 11.62 11.62<br />

Price to Book Value Multiple (X) # 2.42 2.70 1.93 1.73 1.73<br />

Dividend Yield (%) # 1.41 2.82 2.82 4.23 4.23<br />

KD<br />

0.405<br />

0.390<br />

0.375<br />

0.360<br />

0.345<br />

0.330<br />

0.315<br />

0.300<br />

0.285<br />

52 Week Price Chart Rel. to KAMCO TRW Index<br />

NAPESCO KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com