Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

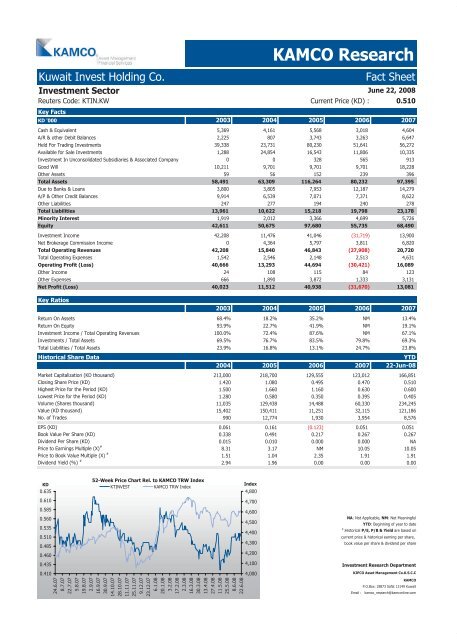

<strong>Kuwait</strong> Invest Holding Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: KTIN.KW Current Price (KD) : 0.510<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 5,369 4,161 5,568 3,018 4,604<br />

A/R & other Debit Balances 2,225 807 3,743 3,263 6,647<br />

Held For Trading Investments 39,338 23,731 80,230 51,641 56,272<br />

Available for Sale Investments 1,288 24,854 16,543 11,806 10,335<br />

Investment In Unconsolidated Subsidiaries & Associated Company 0 0 328 565 913<br />

Good Will 10,211 9,701 9,701 9,701 18,228<br />

Other Assets 59 56 152 239 396<br />

Total Assets 58,491 63,309 116,264 80,232 97,395<br />

Due to Banks & Loans 3,800 3,805 7,953 12,187 14,279<br />

A/P & Other Credit Balances 9,914 6,539 7,071 7,371 8,622<br />

Other Liabilities 247 277 194 240 278<br />

Total Liabilities 13,961 10,622 15,218 19,798 23,178<br />

Minority Interest 1,919 2,012 3,366 4,699 5,726<br />

Equity 42,611 50,675 97,680 55,735 68,490<br />

Investment Income 42,208 11,476 41,046 (31,719) 13,900<br />

Net Brokerage Commission Income 0 4,364 5,797 3,811 6,820<br />

Total Operating Revenues 42,208 15,840 46,843 (27,908) 20,720<br />

Total Operating Expenses 1,542 2,546 2,148 2,513 4,631<br />

Operating Profit (Loss) 40,666 13,293 44,694 (30,421) 16,089<br />

Other Income 24 108 115 84 123<br />

Other Expenses 666 1,890 3,872 1,333 3,131<br />

Net Profit (Loss) 40,023 11,512 40,938 (31,670) 13,081<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 68.4% 18.2% 35.2% NM 13.4%<br />

Return On Equity 93.9% 22.7% 41.9% NM 19.1%<br />

Investment Income / Total Operating Revenues 100.0% 72.4% 87.6% NM 67.1%<br />

Investments / Total Assets 69.5% 76.7% 83.5% 79.8% 69.3%<br />

Total Liabilities / Total Assets 23.9% 16.8% 13.1% 24.7% 23.8%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 213,000 218,700 129,555 123,012 166,851<br />

Closing Share Price (KD) 1.420 1.080 0.495 0.470 0.510<br />

Highest Price for the Period (KD) 1.500 1.660 1.160 0.630 0.600<br />

Lowest Price for the Period (KD) 1.280 0.580 0.350 0.395 0.405<br />

Volume (Shares thousand) 11,035 129,438 14,488 60,330 234,245<br />

Value (KD thousand) 15,402 150,411 11,251 32,115 121,186<br />

No. of Trades 990 12,774 1,930 3,954 8,576<br />

EPS (KD) 0.061 0.161 (0.123) 0.051 0.051<br />

Book Value Per Share (KD) 0.338 0.491 0.217 0.267 0.267<br />

Dividend Per Share (KD) 0.015 0.010 0.000 0.000 NA<br />

Price to Earnings Multiple (X) #<br />

8.31 3.17 NM 10.05 10.05<br />

Price to Book Value Multiple (X) #<br />

1.51 1.04 2.35 1.91 1.91<br />

Dividend Yield (%) #<br />

2.94 1.96 0.00 0.00 0.00<br />

KD<br />

0.635<br />

0.610<br />

0.585<br />

0.560<br />

0.535<br />

0.510<br />

0.485<br />

0.460<br />

0.435<br />

0.410<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

KTINVEST KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com