Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

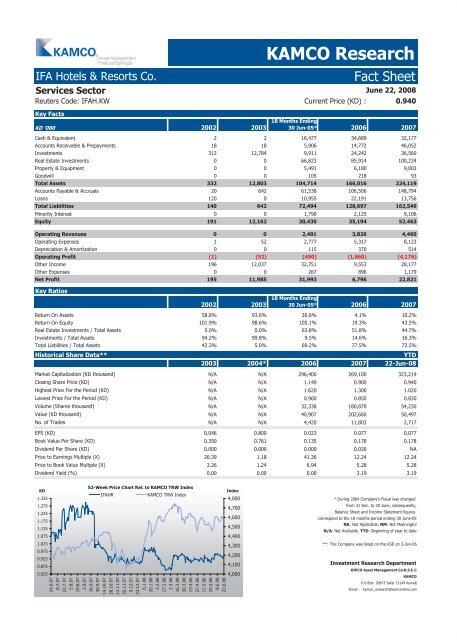

IFA Hotels & Resorts Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: IFAH.KW Current Price (KD) : 0.940<br />

Key <strong>Fact</strong>s<br />

KD '000 2002 2003<br />

18 Months Ending<br />

30 Jun-05* 2006 2007<br />

Cash & Equivalent 2 2 16,477 34,689 32,177<br />

Accounts Receivable & Prepayments 18 18 5,906 14,772 46,052<br />

Investments 312 12,784 9,911 24,242 36,560<br />

Real Estate Investments 0 0 66,823 85,914 100,234<br />

Property & Equipment 0 0 5,491 6,180 9,003<br />

Goodwill 0 0 105 218 93<br />

Total Assets 332 12,803 104,714 166,016 224,119<br />

Accounts Payable & Accruals 20 642 61,538 106,506 148,794<br />

Loans 120 0 10,955 22,191 13,756<br />

Total Liabilities 140 642 72,494 128,697 162,549<br />

Minority Interest 0 0 1,790 2,125 9,106<br />

Equity 191 12,162 30,430 35,194 52,463<br />

Operating Revenues 0 0 2,401 3,826 4,460<br />

Operating Expenses 1 52 2,777 5,317 8,123<br />

Depreciation & Amortization 0 0 115 370 514<br />

Operating Profit (1) (52) (490) (1,860) (4,176)<br />

Other Income 196 12,037 32,751 9,553 28,177<br />

Other Expenses 0 0 267 896 1,179<br />

Net Profit 195 11,985 31,993 6,796 22,821<br />

Key Ratios<br />

2002 2003<br />

KAMCO Research<br />

June 22, 2008<br />

18 Months Ending<br />

30 Jun-05* 2006 2007<br />

Return On Assets 58.8% 93.6% 30.6% 4.1% 10.2%<br />

Return On Equity 101.9% 98.6% 105.1% 19.3% 43.5%<br />

Real Estate Investments / Total Assets 0.0% 0.0% 63.8% 51.8% 44.7%<br />

Investments / Total Assets 94.2% 99.8% 9.5% 14.6% 16.3%<br />

Total Liabilities / Total Assets 42.3% 5.0% 69.2% 77.5% 72.5%<br />

Historical Share Data** YTD<br />

2003 2004* 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A N/A 296,400 269,100 323,219<br />

Closing Share Price (KD) N/A N/A 1.140 0.900 0.940<br />

Highest Price For the Period (KD) N/A N/A 1.620 1.300 1.020<br />

Lowest Price For the Period (KD) N/A N/A 0.960 0.850 0.830<br />

Volume (Shares thousand) N/A N/A 32,338 180,870 54,230<br />

Value (KD thousand) N/A N/A 40,907 202,660 50,497<br />

No. of Trades N/A N/A 4,420 11,803 2,717<br />

EPS (KD) 0.046 0.800 0.023 0.077 0.077<br />

Book Value Per Share (KD) 0.350 0.761 0.135 0.178 0.178<br />

Dividend Per Share (KD) 0.000 0.000 0.000 0.030 NA<br />

Price to Earnings Multiple (X) 20.39 1.18 41.36 12.24 12.24<br />

Price to Book Value Multiple (X) 3.26 1.24 6.94 5.28 5.28<br />

Dividend Yield (%) 0.00 0.00 0.00 3.19 3.19<br />

KD<br />

1.325<br />

1.275<br />

1.225<br />

1.175<br />

1.125<br />

1.075<br />

1.025<br />

0.975<br />

0.925<br />

0.875<br />

0.825<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

IFAHR KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

* During 2004 Company's Fiscal was changed<br />

from 31 Dec. to 30 June, consequently,<br />

Balance <strong>Sheet</strong> and Income Statement figures<br />

correspond to the 18 months period ending 30 June-05<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

**: The Company was listed on the KSE on 3-Jan-06<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com