Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

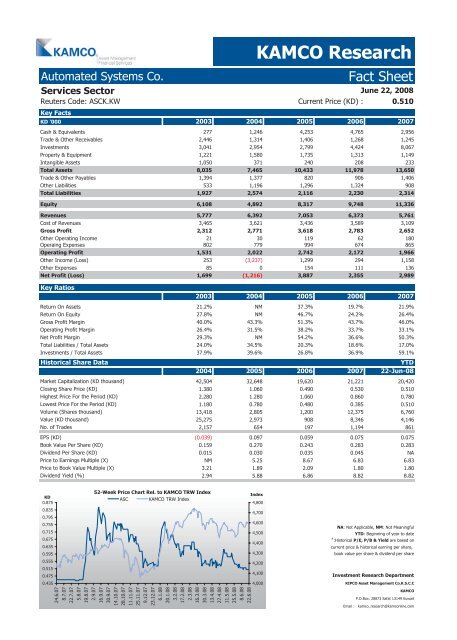

Automated Systems Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: ASCK.KW Current Price (KD) : 0.510<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalents 277 1,246 4,253 4,765 2,956<br />

Trade & Other Receivables 2,446 1,314 1,406 1,268 1,245<br />

Investments 3,041 2,954 2,799 4,424 8,067<br />

Property & Equipment 1,221 1,580 1,735 1,313 1,149<br />

Intangible Assets 1,050 371 240 208 233<br />

Total Assets 8,035 7,465 10,433 11,978 13,650<br />

Trade & Other Payables 1,394 1,377 820 906 1,406<br />

Other Liabilities 533 1,196 1,296 1,324 908<br />

Total Liabilities 1,927 2,574 2,116 2,230 2,314<br />

Equity 6,108 4,892 8,317 9,748 11,336<br />

Revenues 5,777 6,392 7,053 6,373 5,761<br />

Cost of Revenues 3,465 3,621 3,436 3,589 3,109<br />

Gross Profit 2,312 2,771 3,618 2,783 2,652<br />

Other Operating Income 21 30 119 62 180<br />

Operaing Expenses 802 779 994 674 865<br />

Operating Profit 1,531 2,022 2,742 2,172 1,966<br />

Other Income (Loss) 253 (3,237)<br />

1,299 294 1,158<br />

Other Expenses 85 0 154 111 136<br />

Net Profit (Loss) 1,699 (1,216) 3,887 2,355 2,989<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 21.2% NM 37.3% 19.7% 21.9%<br />

Return On Equity 27.8% NM 46.7% 24.2% 26.4%<br />

Gross Profit Margin 40.0% 43.3% 51.3% 43.7% 46.0%<br />

Operating Profit Margin 26.4% 31.5% 38.2% 33.7% 33.1%<br />

Net Profit Margin 29.3% NM 54.2% 36.6% 50.3%<br />

Total Liabilities / Total Assets 24.0% 34.5% 20.3% 18.6% 17.0%<br />

Investments / Total Assets 37.9% 39.6% 26.8% 36.9% 59.1%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 42,504 32,648 19,620 21,221 20,420<br />

Closing Share Price (KD) 1.380 1.060 0.490 0.530 0.510<br />

Highest Price For the Period (KD) 2.280 1.280 1.060 0.860 0.780<br />

Lowest Price For the Period (KD) 1.180 0.780 0.480 0.385 0.510<br />

Volume (Shares thousand) 13,418 2,805 1,200 12,375 6,760<br />

Value (KD thousand) 25,275 2,973 908 8,346 4,146<br />

No. of Trades 2,157 654 197 1,194 861<br />

EPS (KD) (0.039) 0.097 0.059 0.075 0.075<br />

Book Value Per Share (KD) 0.159 0.270 0.243 0.283 0.283<br />

Dividend Per Share (KD) 0.015 0.030 0.035 0.045 NA<br />

Price to Earnings Multiple (X) NM 5.25 8.67 6.83 6.83<br />

Price to Book Value Multiple (X) 3.21 1.89 2.09 1.80 1.80<br />

Dividend Yield (%) 2.94 5.88 6.86 8.82 8.82<br />

KD<br />

0.875<br />

0.835<br />

0.795<br />

0.755<br />

0.715<br />

0.675<br />

0.635<br />

0.595<br />

0.555<br />

0.515<br />

0.475<br />

0.435<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

ASC KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com