Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

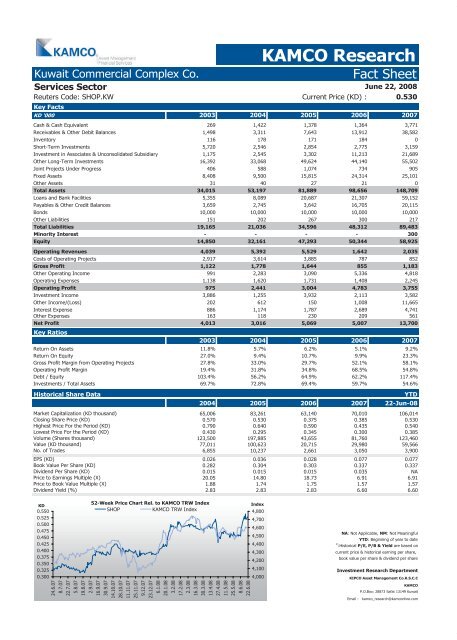

<strong>Kuwait</strong> Commercial Complex Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: SHOP.KW Current Price (KD) : 0.530<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalent 269 1,422 1,378 1,364 3,771<br />

Receivables & Other Debit Balances 1,498 3,311 7,643 13,912 38,582<br />

Inventory 116 178 171 184 0<br />

Short-Term Investments 5,720 2,546 2,854 2,775 3,159<br />

Investment in Associates & Unconsolidated Subsidiary 1,175 2,545 3,302 11,213 21,689<br />

Other Long-Term Investments 16,392 33,068 49,624 44,140 55,502<br />

Joint Projects Under Progress 406 588 1,074 734 905<br />

Fixed Assets 8,408 9,500 15,815 24,314 25,101<br />

Other Assets 31 40 27 21 0<br />

Total Assets 34,015 53,197 81,889 98,656 148,709<br />

Loans and Bank Facilities 5,355 8,089 20,687 21,307 59,152<br />

Payables & Other Credit Balances 3,659 2,745 3,642 16,705 20,115<br />

Bonds 10,000 10,000 10,000 10,000 10,000<br />

Other Liabilities 151 202 267 300 217<br />

Total Liabilities 19,165 21,036 34,596 48,312 89,483<br />

Minority Interest -<br />

-<br />

-<br />

-<br />

300<br />

Equity 14,850 32,161 47,293 50,344 58,925<br />

Operating Revenues 4,039 5,392 5,529 1,642 2,035<br />

Costs of Operating Projects 2,917 3,614 3,885 787 852<br />

Gross Profit 1,122 1,778 1,644 855 1,183<br />

Other Operating Income 991 2,283 3,090 5,336 4,818<br />

Operating Expenses 1,138 1,620 1,731 1,408 2,245<br />

Operating Profit 975 2,441 3,004 4,783 3,755<br />

Investment Income 3,886 1,255 3,932 2,113 3,582<br />

Other Income/(Loss) 202 612 150 1,008 11,665<br />

Interest Expense 886 1,174 1,787 2,689 4,741<br />

Other Expenses 163 118 230 209 561<br />

Net Profit<br />

Key Ratios<br />

4,013 3,016 5,069 5,007 13,700<br />

2003 2004 2005 2006 2007<br />

Return On Assets 11.8% 5.7% 6.2% 5.1% 9.2%<br />

Return On Equity 27.0% 9.4% 10.7% 9.9% 23.3%<br />

Gross Profit Margin from Operating Projects 27.8% 33.0% 29.7% 52.1% 58.1%<br />

Operating Profit Margin 19.4% 31.8% 34.8% 68.5% 54.8%<br />

Debt / Equity 103.4% 56.2% 64.9% 62.2% 117.4%<br />

Investments / Total Assets 69.7% 72.8% 69.4% 59.7% 54.6%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 65,006 83,261 63,140 70,010 106,014<br />

Closing Share Price (KD) 0.570 0.530 0.375 0.385 0.530<br />

Highest Price For the Period (KD) 0.790 0.640 0.590 0.435 0.540<br />

Lowest Price For the Period (KD) 0.430 0.295 0.345 0.300 0.385<br />

Volume (Shares thousand) 123,500 197,885 43,655 81,760 123,460<br />

Value (KD thousand) 77,011 100,623 20,715 29,980 59,566<br />

No. of Trades 6,855 10,237 2,661 3,050 3,900<br />

EPS (KD) 0.026 0.036 0.028 0.077 0.077<br />

Book Value Per Share (KD) 0.282 0.304 0.303 0.337 0.337<br />

Dividend Per Share (KD) 0.015 0.015 0.015 0.035 NA<br />

Price to Earnings Multiple (X) 20.05 14.80 18.73 6.91 6.91<br />

Price to Book Value Multiple (X) 1.88 1.74 1.75 1.57 1.57<br />

Dividend Yield (%) 2.83 2.83 2.83 6.60 6.60<br />

KD<br />

0.550<br />

0.525<br />

0.500<br />

0.475<br />

0.450<br />

0.425<br />

0.400<br />

0.375<br />

0.350<br />

0.325<br />

0.300<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

SHOP KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com