Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

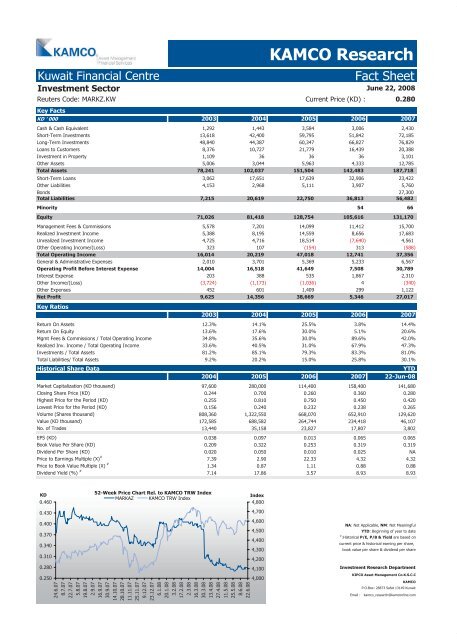

<strong>Kuwait</strong> Financial Centre <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: MARKZ.KW Current Price (KD) : 0.280<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

June 22, 2008<br />

KD ' 000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalent 1,292 1,443 3,584 3,006 2,430<br />

Short-Term Investments 13,618 42,400 59,795 51,842 72,185<br />

Long-Term Investments 48,840 44,387 60,347 66,827 76,829<br />

Loans to Customers 8,376 10,727 21,779 16,439 20,388<br />

Investment in Property 1,109 36 36 36 3,101<br />

Other Assets 5,006 3,044 5,963 4,333 12,785<br />

Total Assets 78,241 102,037 151,504 142,483 187,718<br />

Short-Term Loans 3,062 17,651 17,639 32,906 23,422<br />

Other Liabilities 4,153 2,968 5,111 3,907 5,760<br />

Bonds 27,300<br />

Total Liabilities 7,215 20,619 22,750 36,813 56,482<br />

Minority 54 66<br />

Equity 71,026 81,418 128,754 105,616 131,170<br />

Management Fees & Commissions 5,578 7,201 14,099 11,412 15,700<br />

Realized Investment Income 5,388 8,195 14,559 8,656 17,683<br />

Unrealized Investment Income 4,725 4,716 18,514 (7,640) 4,561<br />

Other Operating Income/(Loss) 323 107 (154) 313 (588)<br />

Total Operating Income 16,014 20,219 47,018 12,741 37,356<br />

General & Administrative Expenses 2,010 3,701 5,369 5,233 6,567<br />

Operating Profit Before Interest Expense 14,004 16,518 41,649 7,508 30,789<br />

Interest Expense 203 388 535 1,867 2,310<br />

Other Income/(Loss) (3,724) (1,173) (1,036) 4 (340)<br />

Other Expenses 452 601 1,409 299 1,122<br />

Net Profit<br />

Key Ratios<br />

9,625 14,356 38,669 5,346 27,017<br />

2003 2004 2005 2006 2007<br />

Return On Assets 12.3% 14.1% 25.5% 3.8% 14.4%<br />

Return On Equity 13.6% 17.6% 30.0% 5.1% 20.6%<br />

Mgmt Fees & Commissions / Total Operating Income 34.8% 35.6% 30.0% 89.6% 42.0%<br />

Realized Inv. Income / Total Operating Income 33.6% 40.5% 31.0% 67.9% 47.3%<br />

Investments / Total Assets 81.2% 85.1% 79.3% 83.3% 81.0%<br />

Total Liabilities/ Total Assets 9.2% 20.2% 15.0% 25.8% 30.1%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 97,600 280,000 114,400 158,400 141,680<br />

Closing Share Price (KD) 0.244 0.700 0.260 0.360 0.280<br />

Highest Price for the Period (KD) 0.255 0.810 0.750 0.450 0.420<br />

Lowest Price for the Period (KD) 0.156 0.240 0.232 0.238 0.265<br />

Volume (Shares thousand) 808,360 1,322,550 668,070 652,910 129,620<br />

Value (KD thousand) 172,585 688,582 264,744 234,418 46,107<br />

No. of Trades 13,440 35,158 23,827 17,807 3,802<br />

EPS (KD) 0.038 0.097 0.013 0.065 0.065<br />

Book Value Per Share (KD) 0.209 0.322 0.253 0.319 0.319<br />

Dividend Per Share (KD) 0.020 0.050 0.010 0.025 NA<br />

Price to Earnings Multiple (X) #<br />

7.39 2.90 22.33 4.32 4.32<br />

Price to Book Value Multiple (X) #<br />

1.34 0.87 1.11 0.88 0.88<br />

Dividend Yield (%) #<br />

7.14 17.86 3.57 8.93 8.93<br />

KD<br />

0.460<br />

0.430<br />

0.400<br />

0.370<br />

0.340<br />

0.310<br />

0.280<br />

0.250<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

MARKAZ KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com