Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

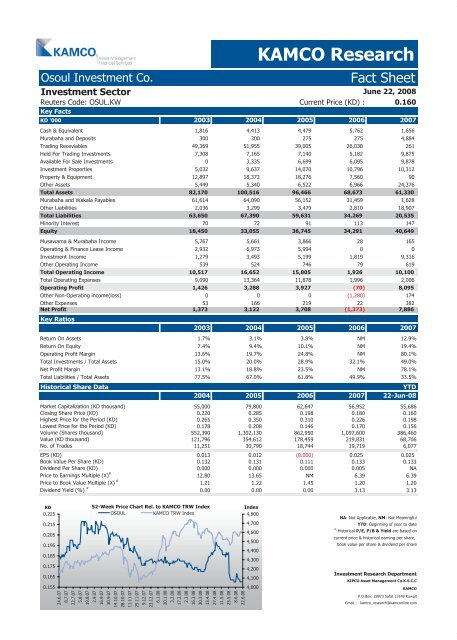

Osoul Investment Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

KAMCO Research<br />

June 22, 2008<br />

Reuters Code: OSUL.KW Current Price (KD) : 0.160<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalent 1,816 4,413 4,479 5,762 1,656<br />

Murabaha and Deposits 300 300 275 275 4,884<br />

Trading Receviables 49,369 51,955 39,005 26,038 261<br />

Held For Trading Investments 7,308 7,165 7,140 5,182 9,875<br />

Available For Sale Investments 0 3,335 6,699 6,095 9,878<br />

Investment Properties 5,032 9,637 14,070 10,796 10,312<br />

Property & Equipment 12,897 18,372 18,276 7,560 90<br />

Other Assets 5,449 5,340 6,522 6,966 24,376<br />

Total Assets 82,170 100,516 96,466 68,673 61,330<br />

Murabaha and Wakala Payables 61,614 64,090 56,152 31,459 1,628<br />

Other Liabilities 2,036 3,299 3,479 2,810 18,907<br />

Total Liabilities 63,650 67,390 59,631 34,269 20,535<br />

Minority Interest 70 72 91 113 147<br />

Equity 18,450 33,055 36,745 34,291 40,649<br />

Musawama & Murabaha Income 5,767 5,661 3,866 28 165<br />

Operating & Finance Lease Income 2,932 6,973 5,994 0 0<br />

Investment Income 1,279 3,493 5,199 1,819 9,316<br />

Other Operating Income 539 524 746 79 619<br />

Total Operating Income 10,517 16,652 15,805 1,926 10,100<br />

Total Operating Expenses 9,090 13,364 11,878 1,996 2,006<br />

Operating Profit 1,426 3,288 3,927 (70) 8,095<br />

Other Non-Operating income(loss) 0 0 0 (1,280) 174<br />

Other Expenses 53 166 219 22 382<br />

Net Profit<br />

Key Ratios<br />

1,373 3,122 3,708 (1,373) 7,886<br />

2003 2004 2005 2006 2007<br />

Return On Assets 1.7% 3.1% 3.8% NM 12.9%<br />

Return On Equity 7.4% 9.4% 10.1% NM 19.4%<br />

Operating Profit Margin 13.6% 19.7% 24.8% NM 80.1%<br />

Total Investments / Total Assets 15.0% 20.0% 28.9% 32.1% 49.0%<br />

Net Profit Margin 13.1% 18.8% 23.5% NM 78.1%<br />

Total Liabilities / Total Assets 77.5% 67.0% 61.8% 49.9% 33.5%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 55,000 79,800 62,647 56,952 55,686<br />

Closing Share Price (KD) 0.220 0.285 0.198 0.180 0.160<br />

Highest Price for the Period (KD) 0.265 0.350 0.310 0.226 0.198<br />

Lowest Price for the Period (KD) 0.178 0.208 0.146 0.170 0.156<br />

Volume (Shares thousand) 552,390 1,302,130 862,950 1,097,600 386,460<br />

Value (KD thousand) 121,796 354,612 178,459 219,831 68,706<br />

No. of Trades 11,251 30,790 18,744 19,719 6,077<br />

EPS (KD) 0.013 0.012 (0.000) 0.025 0.025<br />

Book Value Per Share (KD) 0.132 0.131 0.111 0.133 0.133<br />

Dividend Per Share (KD) 0.000 0.000 0.000 0.005 NA<br />

Price to Earnings Multiple (X) #<br />

12.80 13.65 NM 6.39 6.39<br />

Price to Book Value Multiple (X) #<br />

1.21 1.22 1.45 1.20 1.20<br />

Dividend Yield (%) #<br />

0.00 0.00 0.00 3.13 3.13<br />

KD<br />

0.225<br />

0.215<br />

0.205<br />

0.195<br />

0.185<br />

0.175<br />

0.165<br />

0.155<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

OSOUL KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com