Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

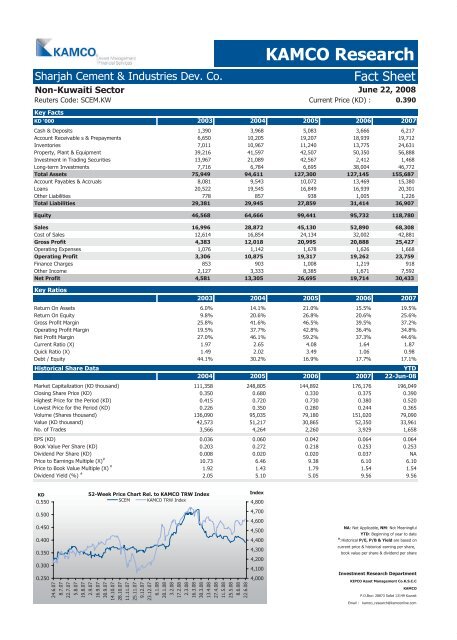

Sharjah Cement & Industries Dev. Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Non-<strong>Kuwait</strong>i Sector<br />

June 22, 2008<br />

Reuters Code: SCEM.KW Current Price (KD) : 0.390<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Deposits 1,390 3,968 5,083 3,666 6,217<br />

Account Receivable s & Prepayments 6,650 10,205 19,207 18,939 19,712<br />

Inventories 7,011 10,967 11,240 13,775 24,631<br />

Property, Plant & Equipment 39,216 41,597 42,507 50,350 56,888<br />

Investment in Trading Securities 13,967 21,089 42,567 2,412 1,468<br />

Long-term Investments 7,716 6,784 6,695 38,004 46,772<br />

Total Assets 75,949 94,611 127,300 127,145 155,687<br />

Account Payables & Accruals 8,081 9,543 10,072 13,469 15,380<br />

Loans 20,522 19,545 16,849 16,939 20,301<br />

Other Liabilities 778 857 938 1,005 1,226<br />

Total Liabilities 29,381 29,945 27,859 31,414 36,907<br />

Equity 46,568 64,666 99,441 95,732 118,780<br />

Sales 16,996 28,872 45,130 52,890 68,308<br />

Cost of Sales 12,614 16,854 24,134 32,002 42,881<br />

Gross Profit 4,383 12,018 20,995 20,888 25,427<br />

Operating Expenses 1,076 1,142 1,678 1,626 1,668<br />

Operating Profit 3,306 10,875 19,317 19,262 23,759<br />

Finance Charges 853 903 1,008 1,219 918<br />

Other Income 2,127 3,333 8,385 1,671 7,592<br />

Net Profit 4,581 13,305 26,695 19,714 30,433<br />

Key Ratios<br />

2003 2004 2005 2006 2007<br />

Return On Assets 6.0% 14.1% 21.0% 15.5% 19.5%<br />

Return On Equity 9.8% 20.6% 26.8% 20.6% 25.6%<br />

Gross Profit Margin 25.8% 41.6% 46.5% 39.5% 37.2%<br />

Operating Profit Margin 19.5% 37.7% 42.8% 36.4% 34.8%<br />

Net Profit Margin 27.0% 46.1% 59.2% 37.3% 44.6%<br />

Current Ratio (X) 1.97<br />

2.65<br />

4.08<br />

1.64<br />

1.87<br />

Quick Ratio (X) 1.49<br />

2.02<br />

3.49<br />

1.06<br />

0.98<br />

Debt / Equity 44.1% 30.2% 16.9% 17.7% 17.1%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 111,358 248,805 144,892 176,176 196,049<br />

Closing Share Price (KD) 0.350 0.680 0.330 0.375 0.390<br />

Highest Price for the Period (KD) 0.415 0.720 0.730 0.380 0.520<br />

Lowest Price for the Period (KD) 0.226 0.350 0.280 0.244 0.365<br />

Volume (Shares thousand) 136,090 95,035 79,180 151,020 79,090<br />

Value (KD thousand) 42,573 51,217 30,865 52,350 33,961<br />

No. of Trades 3,566 4,264 2,260 3,929 1,658<br />

EPS (KD) 0.036 0.060 0.042 0.064 0.064<br />

Book Value Per Share (KD) 0.203 0.272 0.218 0.253 0.253<br />

Dividend Per Share (KD) 0.008 0.020 0.020 0.037 NA<br />

Price to Earnings Multiple (X) #<br />

10.73 6.46 9.38 6.10 6.10<br />

Price to Book Value Multiple (X) #<br />

1.92 1.43 1.79 1.54 1.54<br />

Dividend Yield (%) #<br />

2.05 5.10 5.05 9.56 9.56<br />

KD<br />

0.550<br />

0.500<br />

0.450<br />

0.400<br />

0.350<br />

0.300<br />

0.250<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

SCEM KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com