Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

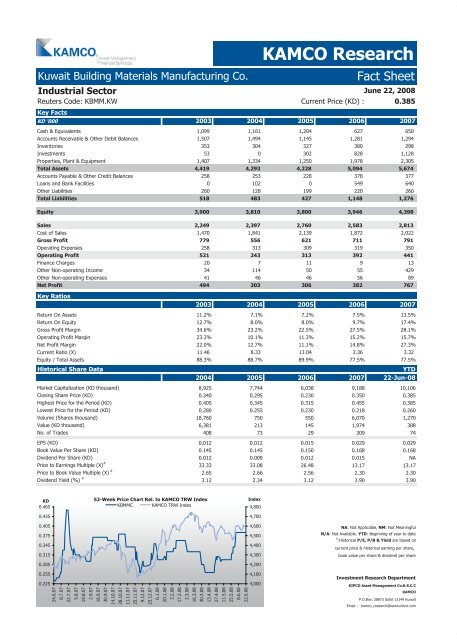

<strong>Kuwait</strong> Building Materials Manufacturing Co. <strong>Fact</strong> <strong>Sheet</strong><br />

Industrial Sector<br />

Reuters Code: KBMM.KW Current Price (KD) : 0.385<br />

Key <strong>Fact</strong>s<br />

KD '000 2003 2004 2005 2006 2007<br />

Cash & Equivalents 1,099 1,161 1,204 627 650<br />

Accounts Receivable & Other Debit Balances 1,507 1,494 1,145 1,281 1,294<br />

Inventories 353 304 327 380 298<br />

Investments 53 0 302 828 1,128<br />

Properties, Plant & Equipment 1,407 1,334 1,250 1,978 2,305<br />

Total Assets 4,419 4,293 4,228 5,094 5,674<br />

Accounts Payable & Other Credit Balances 258 253 228 378 377<br />

Loans and Bank Facilities 0 102 0 549 640<br />

Other Liabilities 260 128 199 220 260<br />

Total Liabilities 518 483 427 1,148 1,276<br />

Equity 3,900 3,810 3,800 3,946 4,398<br />

Sales 2,249 2,397 2,760 2,583 2,813<br />

Cost of Sales 1,470 1,841 2,139 1,872 2,022<br />

Gross Profit 779 556 621 711 791<br />

Operating Expenses 258 313 309 319 350<br />

Operating Profit 521 243 313 392 441<br />

Finance Charges 20 7 11 9 13<br />

Other Non-operating Income 34 114 50 55 429<br />

Other Non-operating Expenses 41 46 46 56 89<br />

Net Profit 494 303 306 382 767<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

2003 2004 2005 2006 2007<br />

Return On Assets 11.2% 7.1% 7.2% 7.5% 13.5%<br />

Return On Equity 12.7% 8.0% 8.0% 9.7% 17.4%<br />

Gross Profit Margin 34.6% 23.2% 22.5% 27.5% 28.1%<br />

Operating Profit Margin 23.2% 10.1% 11.3% 15.2% 15.7%<br />

Net Profit Margin 22.0% 12.7% 11.1% 14.8% 27.3%<br />

Current Ratio (X) 11.46<br />

8.33<br />

13.04<br />

3.36<br />

3.32<br />

Equity / Total Assets 88.3% 88.7% 89.9% 77.5% 77.5%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 8,925 7,744 6,038 9,188 10,106<br />

Closing Share Price (KD) 0.340 0.295 0.230 0.350 0.385<br />

Highest Price for the Period (KD) 0.405 0.345 0.315 0.455 0.385<br />

Lowest Price for the Period (KD) 0.280 0.255 0.230 0.218 0.260<br />

Volume (Shares thousand) 18,760 750 550 6,070 1,270<br />

Value (KD thousand) 6,381 213 145 1,974 388<br />

No. of Trades 408 73 29 309 74<br />

EPS (KD) 0.012 0.012 0.015 0.029 0.029<br />

Book Value Per Share (KD) 0.145 0.145 0.150 0.168 0.168<br />

Dividend Per Share (KD) 0.012 0.009 0.012 0.015 NA<br />

Price to Earnings Multiple (X) #<br />

33.33 33.08 26.48 13.17 13.17<br />

Price to Book Value Multiple (X) #<br />

2.65 2.66 2.56 2.30 2.30<br />

Dividend Yield (%) #<br />

3.12 2.34 3.12 3.90 3.90<br />

KD<br />

0.465<br />

0.435<br />

0.405<br />

0.375<br />

0.345<br />

0.315<br />

0.285<br />

0.255<br />

0.225<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

KBMMC KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com