Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

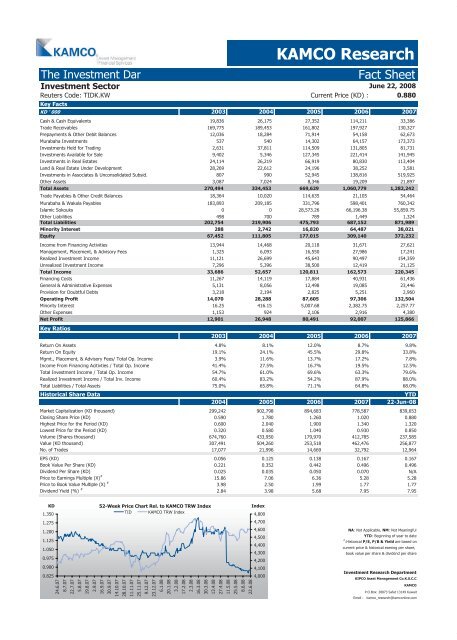

The Investment Dar <strong>Fact</strong> <strong>Sheet</strong><br />

Investment Sector<br />

Reuters Code: TIDK.KW Current Price (KD) :<br />

June 22, 2008<br />

0.880<br />

Key <strong>Fact</strong>s<br />

KAMCO Research<br />

KD ' 000 2003 2004 2005 2006 2007<br />

Cash & Cash Equivalents 19,836 26,175 27,352 114,211 33,386<br />

Trade Receivables 169,775 189,453 161,802 197,927 130,327<br />

Prepayments & Other Debit Balances 12,036 18,284 71,914 54,158 62,673<br />

Murabaha Investments 537 540 14,302 64,157 173,373<br />

Investments Held for Trading 2,631<br />

37,811<br />

114,509<br />

131,805<br />

81,731<br />

Investments Available for Sale 9,402 5,346 127,345 221,414 141,945<br />

Investments in Real Estates 24,114 26,219 66,919 80,830 113,404<br />

Land & Real Estate Under Development 28,269 22,612 24,196 38,252 3,581<br />

Investments in Associates & Unconsolidated Subsid. 807 990 52,945 138,816 519,925<br />

Other Assets 3,087 7,024 8,346 19,209 21,897<br />

Total Assets 270,494 334,453 669,629 1,060,779 1,282,242<br />

Trade Payables & Other Credit Balances 18,364 10,020 114,635 21,105 54,464<br />

Murabaha & Wakala Payables 183,893 209,185 331,796 598,401 760,342<br />

Islamic Sokouks 0 0 28,573.26<br />

66,196.38<br />

55,859.75<br />

Other Liabilities 498 700 789 1,449 1,324<br />

Total Liabilities 202,754 219,906 475,793 687,152 871,989<br />

Minority Interest 288<br />

2,742<br />

16,820<br />

64,487<br />

38,021<br />

Equity 67,452 111,805 177,015 309,140 372,232<br />

Income from Financing Activities 13,944 14,468 20,118 31,671 27,621<br />

Management, Placement, & Advisory Fees 1,325 6,093 16,550 27,986 17,241<br />

Realized Investment Income 11,121 26,699 45,643 90,497 154,359<br />

Unrealized Investment Income 7,296 5,396 38,500 12,419 21,125<br />

Total Income 33,686 52,657 120,811 162,573 220,345<br />

Financing Costs 11,267 14,119 17,884 40,931 61,436<br />

General & Administrative Expenses 5,131 8,056 12,498 19,085 23,446<br />

Provision for Doubtful Debts 3,218 2,194 2,825 5,251 2,960<br />

Operating Profit 14,070 28,288 87,605 97,306 132,504<br />

Minority Interest 16.25<br />

416.15<br />

5,007.68<br />

2,382.75<br />

2,257.77<br />

Other Expenses 1,153 924 2,106 2,916 4,380<br />

Net Profit<br />

Key Ratios<br />

12,901 26,948 80,491 92,007 125,866<br />

2003 2004 2005 2006 2007<br />

Return On Assets 4.8% 8.1% 12.0% 8.7% 9.8%<br />

Return On Equity 19.1% 24.1% 45.5% 29.8% 33.8%<br />

Mgmt., Placement, & Advisory Fees/ Total Op. Income 3.9% 11.6% 13.7% 17.2% 7.8%<br />

Income From Financing Acitivties / Total Op. Income 41.4% 27.5% 16.7% 19.5% 12.5%<br />

Total Investment Income / Total Op. Income 54.7% 61.0% 69.6% 63.3% 79.6%<br />

Realized Investment Income / Total Inv. Income 60.4% 83.2% 54.2% 87.9% 88.0%<br />

Total Liabilities / Total Assets 75.0% 65.8% 71.1% 64.8% 68.0%<br />

Historical Share Data YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) 299,242 902,798 894,683 778,587 839,653<br />

Closing Share Price (KD) 0.590 1.780 1.260 1.020 0.880<br />

Highest Price for the Period (KD) 0.600 2.040 1.900 1.340 1.320<br />

Lowest Price for the Period (KD) 0.320 0.580 1.040 0.930 0.850<br />

Volume (Shares thousand) 674,760 433,950 179,970 412,785 237,585<br />

Value (KD thousand) 307,491 504,260 253,518 462,476 256,877<br />

No. of Trades 17,077 21,996 14,669 32,792 12,964<br />

EPS (KD) 0.056 0.125 0.138 0.167 0.167<br />

Book Value Per Share (KD) 0.221 0.352 0.442 0.496 0.496<br />

Dividend Per Share (KD) 0.025 0.035 0.050 0.070 N/A<br />

Price to Earnings Multiple (X) #<br />

15.86 7.06 6.36 5.28 5.28<br />

Price to Book Value Multiple (X) #<br />

3.98 2.50 1.99 1.77 1.77<br />

Dividend Yield (%) #<br />

2.84 3.98 5.68 7.95 7.95<br />

KD<br />

1.350<br />

1.275<br />

1.200<br />

1.125<br />

1.050<br />

0.975<br />

0.900<br />

0.825<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

TID KAMCO TRW Index<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

YTD: Beginning of year to date<br />

#<br />

:Historical P/E, P/B & Yield are based on<br />

current price & historical earning per share,<br />

book value per share & dividend per share<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com