Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

Kuwait Corporate Fact Sheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

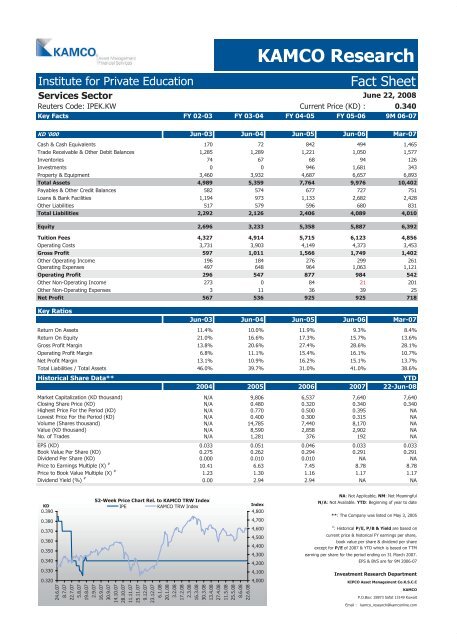

Institute for Private Education <strong>Fact</strong> <strong>Sheet</strong><br />

Services Sector<br />

Reuters Code: IPEK.KW Current Price (KD) : 0.340<br />

Key <strong>Fact</strong>s FY 02-03 FY 03-04 FY 04-05 FY 05-06 9M 06-07<br />

KD '000 Jun-03 Jun-04 Jun-05 Jun-06 Mar-07<br />

Cash & Cash Equivalents 170 72 842 494 1,465<br />

Trade Receivable & Other Debit Balances 1,285 1,289 1,221 1,050 1,577<br />

Inventories 74 67 68 94 126<br />

Investments 0 0 946 1,681 343<br />

Property & Equipment 3,460 3,932 4,687 6,657 6,893<br />

Total Assets 4,989 5,359 7,764 9,976 10,402<br />

Payables & Other Credit Balances 582 574 677 727 751<br />

Loans & Bank Facilities 1,194 973 1,133 2,682 2,428<br />

Other Liabilities 517 579 596 680 831<br />

Total Liabilities 2,292 2,126 2,406 4,089 4,010<br />

Equity 2,696 3,233 5,358 5,887 6,392<br />

Tuition Fees 4,327 4,914 5,715 6,123 4,856<br />

Operating Costs 3,731 3,903 4,149 4,373 3,453<br />

Gross Profit 597 1,011 1,566 1,749 1,402<br />

Other Operating Income 196 184 276 299 261<br />

Operating Expenses 497 648 964 1,063 1,121<br />

Operating Profit 296 547 877 984 542<br />

Other Non-Operating Income 273 0 84 21 201<br />

Other Non-Operating Expenses 3 11 36 39 25<br />

Net Profit 567 536 925 925 718<br />

Key Ratios<br />

KAMCO Research<br />

June 22, 2008<br />

Jun-03 Jun-04 Jun-05 Jun-06 Mar-07<br />

Return On Assets 11.4% 10.0% 11.9% 9.3% 8.4%<br />

Return On Equity 21.0% 16.6% 17.3% 15.7% 13.6%<br />

Gross Profit Margin 13.8% 20.6% 27.4% 28.6% 28.1%<br />

Operating Profit Margin 6.8% 11.1% 15.4% 16.1% 10.7%<br />

Net Profit Margin 13.1% 10.9% 16.2% 15.1% 13.7%<br />

Total Liabilities / Total Assets 46.0% 39.7% 31.0% 41.0% 38.6%<br />

Historical Share Data** YTD<br />

2004 2005 2006 2007 22-Jun-08<br />

Market Capitalization (KD thousand) N/A 9,806 6,537 7,640 7,640<br />

Closing Share Price (KD) N/A 0.480 0.320 0.340 0.340<br />

Highest Price For the Period (KD) N/A 0.770 0.500 0.395 NA<br />

Lowest Price For the Period (KD) N/A 0.400 0.300 0.315 NA<br />

Volume (Shares thousand) N/A 14,785 7,440 8,170 NA<br />

Value (KD thousand) N/A 8,590 2,858 2,902 NA<br />

No. of Trades N/A 1,281 376 192 NA<br />

EPS (KD) 0.033 0.051 0.046 0.033 0.033<br />

Book Value Per Share (KD) 0.275 0.262 0.294 0.291 0.291<br />

Dividend Per Share (KD) 0.000 0.010 0.010 NA NA<br />

Price to Earnings Multiple (X) #<br />

10.41 6.63 7.45 8.78 8.78<br />

Price to Book Value Multiple (X) #<br />

1.23 1.30 1.16 1.17 1.17<br />

Dividend Yield (%) #<br />

0.00 2.94 2.94 NA NA<br />

KD<br />

0.390<br />

0.380<br />

0.370<br />

0.360<br />

0.350<br />

0.340<br />

0.330<br />

0.320<br />

52-Week Price Chart Rel. to KAMCO TRW Index<br />

IPE KAMCO TRW Index<br />

24.6.07<br />

8.7.07<br />

22.7.07<br />

5.8.07<br />

19.8.07<br />

2.9.07<br />

16.9.07<br />

30.9.07<br />

14.10.07<br />

28.10.07<br />

11.11.07<br />

25.11.07<br />

9.12.07<br />

23.12.07<br />

6.1.08<br />

20.1.08<br />

3.2.08<br />

17.2.08<br />

2.3.08<br />

16.3.08<br />

30.3.08<br />

13.4.08<br />

27.4.08<br />

11.5.08<br />

25.5.08<br />

8.6.08<br />

22.6.08<br />

Index<br />

4,800<br />

4,700<br />

4,600<br />

4,500<br />

4,400<br />

4,300<br />

4,200<br />

4,100<br />

4,000<br />

NA: Not Applicable, NM: Not Meaningful<br />

N/A: Not Available. YTD: Beginning of year to date<br />

**: The Company was listed on May 3, 2005<br />

#<br />

: Historical P/E, P/B & Yield are based on<br />

current price & historical FY earnings per share,<br />

book value per share & dividend per share<br />

except for P/E of 2007 & YTD which is based on TTM<br />

earning per share for the period ending on 31 March 2007.<br />

EPS & BVS are for 9M 2006-07<br />

Investment Research Department<br />

KIPCO Asset Management Co.K.S.C.C<br />

KAMCO<br />

P.O.Box: 28873 Safat 13149 <strong>Kuwait</strong><br />

Email : kamco_research@kamconline.com