2004-2005 COLLEGE CATALOG - Luzerne County Community ...

2004-2005 COLLEGE CATALOG - Luzerne County Community ...

2004-2005 COLLEGE CATALOG - Luzerne County Community ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

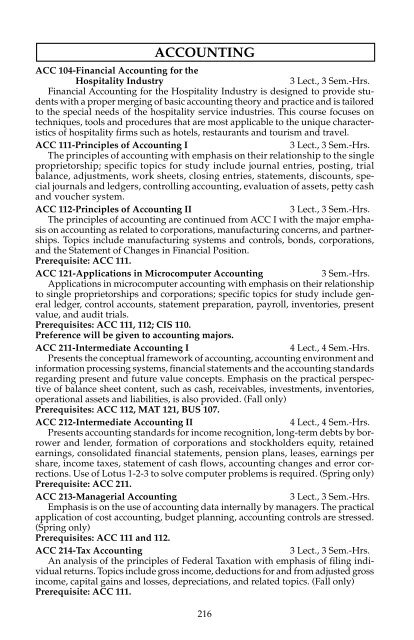

ACCOUNTING<br />

ACC 104-Financial Accounting for the<br />

Hospitality Industry 3 Lect., 3 Sem.-Hrs.<br />

Financial Accounting for the Hospitality Industry is designed to provide students<br />

with a proper merging of basic accounting theory and practice and is tailored<br />

to the special needs of the hospitality service industries. This course focuses on<br />

techniques, tools and procedures that are most applicable to the unique characteristics<br />

of hospitality firms such as hotels, restaurants and tourism and travel.<br />

ACC 111-Principles of Accounting I 3 Lect., 3 Sem.-Hrs.<br />

The principles of accounting with emphasis on their relationship to the single<br />

proprietorship; specific topics for study include journal entries, posting, trial<br />

balance, adjustments, work sheets, closing entries, statements, discounts, special<br />

journals and ledgers, controlling accounting, evaluation of assets, petty cash<br />

and voucher system.<br />

ACC 112-Principles of Accounting II 3 Lect., 3 Sem.-Hrs.<br />

The principles of accounting are continued from ACC I with the major emphasis<br />

on accounting as related to corporations, manufacturing concerns, and partnerships.<br />

Topics include manufacturing systems and controls, bonds, corporations,<br />

and the Statement of Changes in Financial Position.<br />

Prerequisite: ACC 111.<br />

ACC 121-Applications in Microcomputer Accounting 3 Sem.-Hrs.<br />

Applications in microcomputer accounting with emphasis on their relationship<br />

to single proprietorships and corporations; specific topics for study include general<br />

ledger, control accounts, statement preparation, payroll, inventories, present<br />

value, and audit trials.<br />

Prerequisites: ACC 111, 112; CIS 110.<br />

Preference will be given to accounting majors.<br />

ACC 211-Intermediate Accounting I 4 Lect., 4 Sem.-Hrs.<br />

Presents the conceptual framework of accounting, accounting environment and<br />

information processing systems, financial statements and the accounting standards<br />

regarding present and future value concepts. Emphasis on the practical perspective<br />

of balance sheet content, such as cash, receivables, investments, inventories,<br />

operational assets and liabilities, is also provided. (Fall only)<br />

Prerequisites: ACC 112, MAT 121, BUS 107.<br />

ACC 212-Intermediate Accounting II 4 Lect., 4 Sem.-Hrs.<br />

Presents accounting standards for income recognition, long-term debts by borrower<br />

and lender, formation of corporations and stockholders equity, retained<br />

earnings, consolidated financial statements, pension plans, leases, earnings per<br />

share, income taxes, statement of cash flows, accounting changes and error corrections.<br />

Use of Lotus 1-2-3 to solve computer problems is required. (Spring only)<br />

Prerequisite: ACC 211.<br />

ACC 213-Managerial Accounting 3 Lect., 3 Sem.-Hrs.<br />

Emphasis is on the use of accounting data internally by managers. The practical<br />

application of cost accounting, budget planning, accounting controls are stressed.<br />

(Spring only)<br />

Prerequisites: ACC 111 and 112.<br />

ACC 214-Tax Accounting 3 Lect., 3 Sem.-Hrs.<br />

An analysis of the principles of Federal Taxation with emphasis of filing individual<br />

returns. Topics include gross income, deductions for and from adjusted gross<br />

income, capital gains and losses, depreciations, and related topics. (Fall only)<br />

Prerequisite: ACC 111.<br />

216