GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

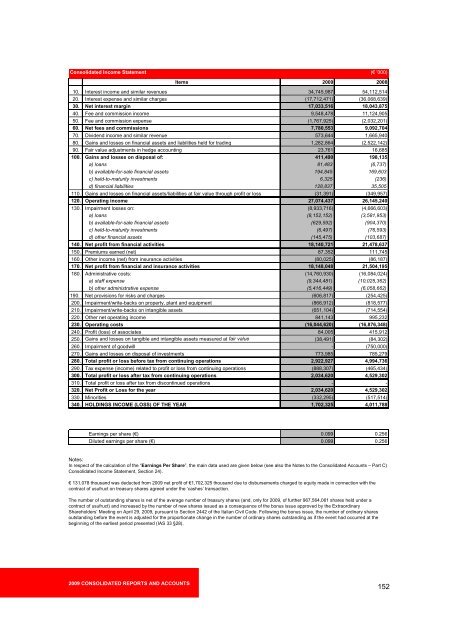

Consolidated Income Statement (� '000)<br />

Items<br />

2009 CONSOLIDATED REPORTS AND ACCOUNTS<br />

2009 2008<br />

10. Interest income and similar revenues 34,745,987 54,112,514<br />

20. Interest expense and similar charges (17,712,471) (36,068,639)<br />

30. Net interest margin 17,033,516 18,043,875<br />

40. Fee and commission income 9,548,478 11,124,905<br />

50. Fee and commission expense (1,767,925) (2,032,201)<br />

60. Net fees and commissions 7,780,553 9,092,704<br />

70. Dividend income and similar revenue 573,644 1,665,940<br />

80. Gains and losses on financial assets and liabilities held for trading 1,282,864 (2,522,142)<br />

90. Fair value adjustments in hedge accounting 23,761 16,685<br />

100. Gains and losses on disposal of: 411,490 198,135<br />

a) loans 81,483 (6,737)<br />

b) available-for-sale financial assets 194,845 169,603<br />

c) held-to-maturity investments 6,325 (236)<br />

d) financial liabilities 128,837 35,505<br />

110. Gains and losses on financial assets/liabilities at fair value through profit or loss (31,391) (349,957)<br />

120. Operating income 27,074,437 26,145,240<br />

130. Impairment losses on: (8,933,716) (4,666,603)<br />

a) loans (8,152,152) (3,581,953)<br />

b) available-for-sale financial assets (629,592) (904,370)<br />

c) held-to-maturity investments (6,497) (76,593)<br />

d) other financial assets (145,475) (103,687)<br />

140. Net profit from financial activities 18,140,721 21,478,637<br />

150. Premiums earned (net) 87,352 111,745<br />

160. Other income (net) from insurance activities (80,025) (86,187)<br />

170. Net profit from financial and insurance activities 18,148,048 21,504,195<br />

180. Administrative costs: (14,760,930) (16,084,024)<br />

a) staff expense (9,344,481) (10,025,362)<br />

b) other administrative expense (5,416,449) (6,058,662)<br />

190. Net provisions for risks and charges (606,817) (254,425)<br />

200. Impairment/write-backs on property, <strong>pl</strong>ant and equipment (866,912) (818,577)<br />

210. Impairment/write-backs on intangible assets (651,104) (714,554)<br />

220. Other net operating income 841,143 995,232<br />

230. Operating costs (16,044,620) (16,876,348)<br />

240. Profit (loss) of associates 84,005 415,912<br />

250. Gains and losses on tangible and intangible assets measured at fair value (38,491) (84,302)<br />

260. Impairment of goodwill - (750,000)<br />

270. Gains and losses on disposal of investments 773,985 785,279<br />

280. Total profit or loss before tax from continuing operations 2,922,927 4,994,736<br />

290. Tax expense (income) related to profit or loss from continuing operations (888,307) (465,434)<br />

300. Total profit or loss after tax from continuing operations 2,034,620 4,529,302<br />

310. Total profit or loss after tax from discontinued operations - -<br />

320. Net Profit or Loss for the year 2,034,620 4,529,302<br />

330. Minorities (332,295) (517,514)<br />

340. HOLDINGS INCOME (LOSS) OF THE YEAR 1,702,325 4,011,788<br />

Earnings per share (�) 0.099 0.256<br />

Diluted earnings per share (�) 0.099 0.256<br />

Notes:<br />

In respect of the calculation of the “Earnings Per Share”, the main data used are given below (see also the Notes to the Consolidated Accounts – Part C)<br />

Consolidated Income Statement, Section 24).<br />

� 131,078 thousand was deducted from 2009 net profit of �1,702,325 thousand due to disbursements charged to equity made in connection with the<br />

contract of usufruct on treasury shares agreed under the ‘cashes’ transaction.<br />

The number of outstanding shares is net of the average number of treasury shares (and, only for 2009, of further 967,564,061 shares held under a<br />

contract of usufruct) and increased by the number of new shares issued as a consequence of the bonus issue approved by the Extraordinary<br />

Shareholders’ Meeting on April 29, 2009, pursuant to Section 2442 of the Italian Civil Code. Following the bonus issue, the number of ordinary shares<br />

outstanding before the event is adjusted for the proportionate change in the number of ordinary shares outstanding as if the event had occurred at the<br />

beginning of the earliest period presented (IAS 33 §28).<br />

152