GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

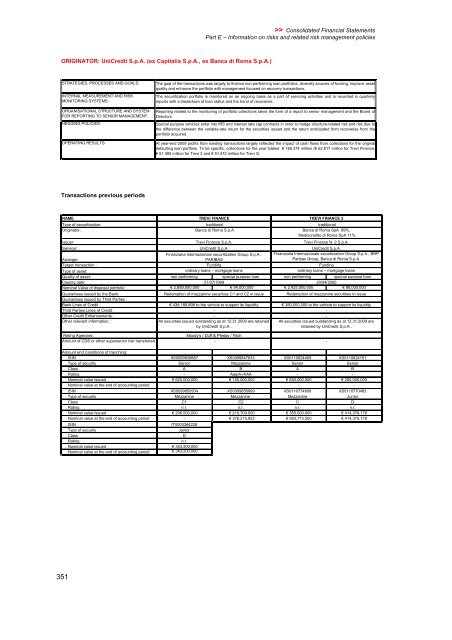

ORIGINATOR: UniCredit S.p.A. (ex Capitalia S.p.A., ex Banca di Roma S.p.A.)<br />

STRATEGIES, PROCESSES AND GOALS:<br />

INTERNAL MEASUREMENT AND RISK<br />

MONITORING SYSTEMS:<br />

ORGANISATIONAL STRUCTURE AND SYSTEM<br />

FOR REPORTING TO SENIOR MANAGEMENT:<br />

HEDGING POLICIES:<br />

OPERATING RESULTS:<br />

Transactions previous periods<br />

351<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

The goal of the transactions was largely to finance non-performing loan portfolios, diversify sources of funding, improve asset<br />

quality and enhance the portfolio with management focused on recovery transactions.<br />

The securitization portfolio is monitored on an ongoing basis as a part of servicing activities and is recorded in quarterly<br />

reports with a breakdown of loan status and the trend of recoveries.<br />

Reporting related to the monitoring of portfolio collections takes the form of a report to senior management and the Board of<br />

Directors.<br />

Special purpose vehicles enter into IRS and interest rate cap contracts in order to hedge structure-related risk and risk due to<br />

the difference between the variable-rate return for the securities issued and the return anticipated from recoveries from the<br />

portfolio acquired.<br />

At year-end 2009 profits from existing transactions largely reflected the impact of cash flows from collections for the original<br />

defaulting loan portfolio. To be specific, collections for the year totaled � 165.374 million (� 62.817 million for Trevi Finance,<br />

� 51.085 million for Trevi 2 and � 51.472 million for Trevi 3).<br />

NAME<br />

TREVI FINANCE<br />

TREVI FINANCE 2<br />

Type of securitisation:<br />

traditional<br />

traditional<br />

Originator:<br />

BancadiRomaS.p.A<br />

Banca di Roma SpA 89%,<br />

Mediocredito di Roma SpA 11%<br />

Issuer:<br />

Trevi Finance S.p.A.<br />

Trevi Finance N. 2 S.p.A.<br />

Servicer:<br />

UniCredit S.p.A.<br />

UniCredit S.p.A.<br />

Finanziaria Internazionale securitization Group S.p.A., Finanziaria Internazionale securitization Group S.p.A., BNP<br />

Arranger:<br />

PARIBAS<br />

Paribas Group, Banca di Roma S.p.A.<br />

Target transaction :<br />

Funding<br />

Funding<br />

Type of asset:<br />

ordinary loans – mortgage loans<br />

ordinary loans – mortgage loans<br />

Quality of asset: non performing special purpose loan non performing special purpose loan<br />

Closing date:<br />

21/07/1999<br />

20/04/2000<br />

Nominal Value of disposal portfolio : � 2,689,000,000 � 94,000,000 � 2,425,000,000 � 98,000,000<br />

Guarantees issued by the Bank:<br />

Redemption of mezzanine securities C1 and C2 in issue<br />

Redemption of mezzanine securities in issue<br />

Guarantees issued by Third Parties :<br />

-<br />

-<br />

Bank Lines of Credit :<br />

� 438,189,898 to the vehicle to support its liquidity<br />

� 380,000,000 to the vehicle to support its liquidity<br />

Third Parties Lines of Credit :<br />

-<br />

-<br />

Other Credit Enhancements :<br />

-<br />

-<br />

Other relevant information :<br />

All securities issued outstanding as at 12.31.2009 are retained All securities issued outstanding as at 12.31.2009 are<br />

by UniCredit S.p.A..<br />

retained by UniCredit S.p.A..<br />

Rating Agencies:<br />

Moody's / Duff & Phelps / Fitch<br />

Amount of CDS or other supersenior risk transferred<br />

:<br />

Amount and Conditions of tranching:<br />

-<br />

-<br />

. ISIN XS0099839887 XS0099847633 XS0110624409 XS0110624151<br />

. Type of security Senior Mezzanine Senior Senior<br />

. Class A B A B<br />

. Rating - Aaa/A-/AAA - -<br />

.Nominalvalueissued � 620,000,000 � 155,000,000 � 650,000,000 � 200,000,000<br />

.Nominalvalueattheendofaccountingperiod - - - -<br />

. ISIN XS0099850934 XS0099856899 XS0110774808 XS0110770483<br />

. Type of security Mezzanine Mezzanine Mezzanine Junior<br />

.Class C1 C2 C D<br />

. Rating n.r. n.r. n.r. n.r.<br />

.Nominalvalueissued � 206,500,000 � 210,700,000 � 355,000,000 � 414,378,178<br />

.Nominalvalueattheendofaccountingperiod - � 378,215,922 � 683,773,500 � 414,378,178<br />

. ISIN IT0003364228<br />

.Typeofsecurity Junior<br />

.Class D<br />

.Rating n.r.<br />

.Nominalvalueissued � 343,200,000<br />

.Nominalvalueattheendofaccountingperiod<br />

� 343,200,000