GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Transactions previous periods<br />

NAME<br />

HVB SFA-1-2008<br />

HVB SFA-2-2008<br />

HVB SFA-3-2008<br />

Type of securitisation:<br />

Synthetic/Private<br />

Synthetic/Private<br />

Synthetic/Private<br />

Originator:<br />

Bayerische Hypo- und Vereinsbank AG<br />

Bayerische Hypo- und Vereinsbank AG<br />

Bayerische Hypo- und Vereinsbank AG<br />

Issuer:<br />

Bayerische Hypo- und Vereinsbank AG<br />

Bayerische Hypo- und Vereinsbank AG Bayerische Hypo- und Vereinsbank AG<br />

Servicer:<br />

UniCredit Bank AG<br />

UniCredit Bank AG<br />

UniCredit Bank AG<br />

Arranger:<br />

UniCredit Bank AG<br />

UniCredit Bank AG<br />

UniCredit Bank AG<br />

(UniCredit Corporate & Investment Banking)<br />

(UniCredit Corporate & Investment Banking)<br />

(UniCredit Corporate & Investment Banking)<br />

Target transaction :<br />

Capital Relief and risk transfer for concentration risks<br />

Capital Relief and risk transfer for concentration risks<br />

Capital Relief and risk transfer for concentration risks<br />

Type of asset:<br />

Large Corporate Loans SME<br />

Large Corporate Loans and Mortgages<br />

Corporate loans and Mortgages<br />

Quality of Asset:<br />

Performing<br />

Performing<br />

Performing<br />

Closing date:<br />

30/09/2008<br />

30/12/2008<br />

30/12/2008<br />

Nominal Value of disposal portfolio :<br />

9,965,235,219 �<br />

3,982,760,904 �<br />

10,054,299,881 �<br />

Guarantees issued by the Bank:<br />

-<br />

-<br />

-<br />

Guarantees issued by Third Parties :<br />

-<br />

-<br />

-<br />

Bank Lines of Credit :<br />

-<br />

-<br />

-<br />

Third Parties Lines of Credit :<br />

-<br />

-<br />

-<br />

Other Credit Enhancements :<br />

-<br />

-<br />

-<br />

Other relevant information :<br />

Re<strong>pl</strong>enishing<br />

Re<strong>pl</strong>enishing<br />

Re<strong>pl</strong>enishing<br />

Rating Agencies:<br />

No rating agency, use of Supervisory Formula Approach (*) No rating agency, use of Supervisory Formula Approach (*) No rating agency, use of Supervisory Formula Approach (*)<br />

Amount of CDS or other supersenior risk transferred :<br />

Amount and Conditions of tranching:<br />

700,000,000 �<br />

420,000,000 �<br />

1,157,000,000 �<br />

.ISIN n.a n.a n.a n.a n.a n.a<br />

. Type of security Senior Junior Senior Junior Senior Junior<br />

.Class A B A B A B<br />

.Rating n.r. n.r. n.r. n.r. n.r. n.r.<br />

. Reference position at closing date 9,265,235,219 � 700,000,000 � 3,562,760,904 � 420,000,000 � 8,897,299,881 � 1,157,000,000 �<br />

. Reference position at the end of accounting period 8,517,842,578 � 700,000,000 � 3,323,795,250 � 420,000,000 � 8,092,955,891 � 1,157,000,000 �<br />

(*) Synthetic securitizations carried out used the Supervisory Formula Approach as required under Basel II.<br />

Where there is no eligible external rating, this approach requires the calculation of the regulatory capital requirement for each tranche of a securitization should use the following five elements:<br />

1. The capital requirement on the securitized assets calculated using the IRB approach (kIRB); 2. The level of credit support of the tranche in question; 3. The thickness of the tranche; 4. The number of securitized assets; 5. Average LGD.<br />

Using the Supervisory Formula Approach it is possible to calculate the amount of risk equivalent to the rating of a senior tranche, the remainder being subordinated and classified as junior.<br />

Following a number of reviews currently underway, we decided not to recognize the associated benefits on regulatory capital in the consolidated accounts.<br />

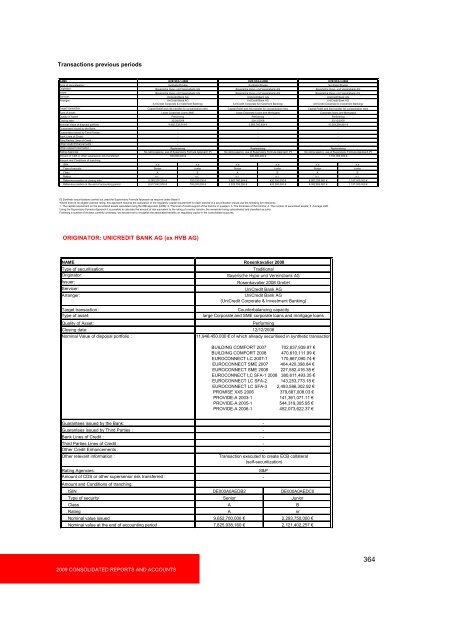

ORIGINATOR: UNICREDIT BANK AG (ex HVB AG)<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction :<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio :<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties :<br />

Bank Lines of Credit :<br />

Third Parties Lines of Credit :<br />

Other Credit Enhancements :<br />

Other relevant information :<br />

Rating Agencies:<br />

S&P<br />

Amount of CDS or other supersenior risk transferred :<br />

Amount and Conditions of tranching:<br />

-<br />

. ISIN DE000A0AEDB2 DE000A0AEDC0<br />

. Type of security Senior Junior<br />

.Class A B<br />

.Rating A nr<br />

. Nominal value issued 9,652,700,000 � 2,293,750,000 �<br />

. Nominal value at the end of accounting period 7,825,938,160 � 2,121,402,257 �<br />

2009 CONSOLIDATED REPORTS AND ACCOUNTS<br />

Rosenkavalier 2008<br />

Traditional<br />

Bayerische Hypo-und Vereinsbank AG<br />

Rosenkavalier 2008 GmbH<br />

UniCredit Bank AG<br />

UniCredit Bank AG<br />

(UniCredit Corporate & Investment Banking)<br />

Counterbalancing capacity<br />

large Corporate and SME corporate loans and mortgage loans<br />

Performing<br />

12/12/2008<br />

11,946,450,000 � of which already securitised in synthetic transaction<br />

:<br />

BUILDING COMFORT 2007 702,837,939.97 �<br />

BUILDING COMFORT 2008 470,610,111.99 �<br />

EUROCONNECT LC 2007-1 170,867,090.74 �<br />

EUROCONNECT SME 2007 404,420,398.84 �<br />

EUROCONNECT SME 2008 227,582,416.38 �<br />

EUROCONNECT LC SFA-1 2008 380,611,493.35 �<br />

EUROCONNECT LC SFA-2 143,253,773.18 �<br />

EUROCONNECT LC SFA-3 2,493,586,302.92 �<br />

PROMISE XXS 2006 379,687,008.03 �<br />

PROVIDE-A 2003-1 141,361,071.11 �<br />

PROVIDE-A 2005-1 544,319,305.95 �<br />

PROVIDE-A 2006-1 452,073,622.37 �<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Transaction executed to create ECB collateral<br />

(self-securitization)<br />

364