GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1.3 Other non-consolidated SPVs<br />

405<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

The Group is also an investor in structured credit instruments issued by vehicles which are not<br />

consolidated, as these instruments do not bear most of the risk and do not receive most of the return on<br />

the operations carried out by SPVs.<br />

These exposures are mainly held on the books of the Corporate and Investment Banking Division (CIB)<br />

and Unicredit Bank Ireland.<br />

This business was particularly affected by the difficult situation on the financial markets, which began in<br />

2007 and determined a transformation of the structured credit product market into an illiquid market.<br />

Against this background, in 2008 the Group ring-fenced these products in a specific Global ABS Portfolio<br />

managed with the aim of maintaining the holdings, also in view of the fact that the underlyings have good<br />

fundamentals. This portfolio is subject to monitoring and reporting of both credit risk and market risk.<br />

This new strategy has been reflected in the accounts through the reclassification of most of these<br />

positions in the item “loans and receivables to customers” occurred for the most part in the second half of<br />

2008 and, for the remaining, in the first half 2009. See Section 1.4 for information about the effects of this<br />

reclassification.<br />

This portfolio shows the following characteristics:<br />

- high seniority with an insignificant percentage of junior positions;<br />

- predominance of residential mortgage-backed securities and commercial mortgage-backed<br />

securities;<br />

- an insignificant portion of products has US Subprime or Alt-A mortgages as underlyings;<br />

- high rating (over 95% of the positions is classified as “investment grade”)<br />

- mainly concentrated in EU Countries.<br />

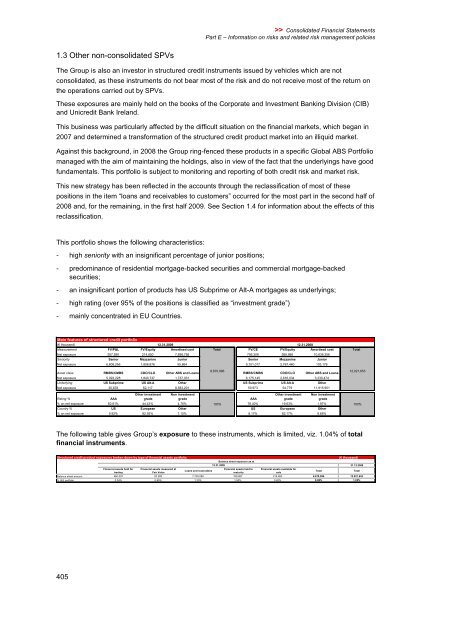

Main features of structured credit portfolio<br />

(� thousand)<br />

12.31.2009 12.31.2008<br />

Measurement FV/P&L FV/Equity Amortised cost Total FV/CE FV/Equity Amortised cost Total<br />

Net exposure 557,590 214,650 7,898,756 795,309 589,988 10,636,356<br />

Seniority Senior Mezzanine Junior Senior Mezzanine Junior<br />

Net exposure 6,808,256 1,806,876 55,864 9,151,017 2,767,460 103,176<br />

Asset class RMBS/CMBS CDO/CLO Other ABS and Loans<br />

8,670,996<br />

RMBS/CMBS CDO/CLO Other ABS and Loans<br />

12,021,653<br />

Net exposure 5,093,228 1,840,737 1,737,031 6,175,145 2,616,034 3,230,474<br />

Underlying US Subprime US Alt-A Other US Subprime US Alt-A Other<br />

Net exposure 35,678 52,117 8,583,201 50,973 54,779 11,915,901<br />

Other investment Non investment<br />

Other investment Non investment<br />

Rating % AAA<br />

grade<br />

grade AAA<br />

grade<br />

grade<br />

% on net exposure 50.81% 44.43% 4.76% 100%<br />

78.40% 19.63% 1.97%<br />

100%<br />

Country % US European Other US European Other<br />

% on net exposure 9.92% 82.93% 7.15% 8.17% 82.17% 9.66%<br />

The following table gives Group’s exposure to these instruments, which is limited, viz. 1.04% of total<br />

financial instruments.<br />

Structured credit product exposures broken down by type of financial assets portfolio (� thousand)<br />

Balance sheet exposure as at<br />

12.31.2009<br />

31.12.2008<br />

Financial assets held for<br />

trading<br />

Financial assets measured at<br />

Fair Value<br />

Loans and receivables<br />

Financial assets held to<br />

maturity<br />

Financial assets available for<br />

sale<br />

Total Total<br />

Balance sheet amount 460,307 97,283 7,739,099 159,657 214,650 8,670,996 12,021,653<br />

% IAS portfolio 0.34% 0.65% 1.20% 1.50% 0.62% 0.98% 1.25%