GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

321<br />

>> Consolidated Financial Statements<br />

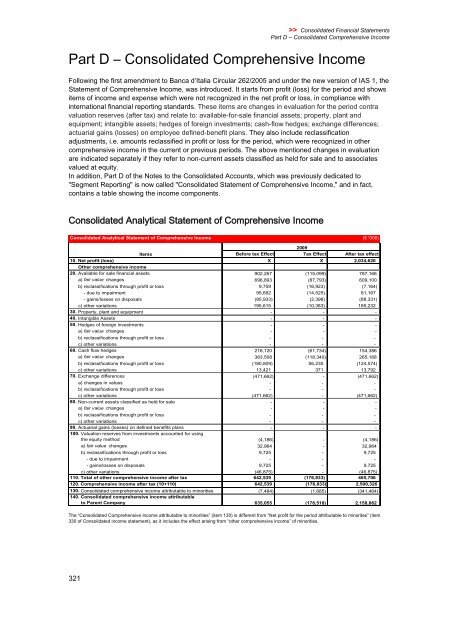

Part D – Consolidated Comprehensive Income<br />

���� � � ������������ ������������� ������<br />

Following the first amendment to Banca d’Italia Circular 262/2005 and under the new version of IAS 1, the<br />

Statement of Comprehensive Income, was introduced. It starts from profit (loss) for the period and shows<br />

items of income and expense which were not recognized in the net profit or loss, in com<strong>pl</strong>iance with<br />

international financial reporting standards. These items are changes in evaluation for the period contra<br />

valuation reserves (after tax) and relate to: available-for-sale financial assets; property, <strong>pl</strong>ant and<br />

equipment; intangible assets; hedges of foreign investments; cash-flow hedges; exchange differences;<br />

actuarial gains (losses) on em<strong>pl</strong>oyee defined-benefit <strong>pl</strong>ans. They also include reclassification<br />

adjustments, i.e. amounts reclassified in profit or loss for the period, which were recognized in other<br />

comprehensive income in the current or previous periods. The above mentioned changes in evaluation<br />

are indicated separately if they refer to non-current assets classified as held for sale and to associates<br />

valued at equity.<br />

In addition, Part D of the Notes to the Consolidated Accounts, which was previously dedicated to<br />

"Segment Reporting" is now called "Consolidated Statement of Comprehensive Income," and in fact,<br />

contains a table showing the income components.<br />

������������� ���������� ��������� �� ������������� ������<br />

Consolidated Analytical Statement of Comprehensive Income (� '000)<br />

Items Before tax Effect<br />

2009<br />

Tax Effect After tax effect<br />

10. Net profit (loss)<br />

Other comprehensive income<br />

X X 2,034,620<br />

20. Available for sale financial assets 902,267 (115,099) 787,168<br />

a) fair value changes 696,893 (87,793) 609,100<br />

b) reclassifications through profit or loss 9,759 (16,923) (7,164)<br />

- due to impairment 95,692 (14,525) 81,167<br />

- gains/losses on disposals (85,933) (2,398) (88,331)<br />

c) other variations 195,615 (10,383) 185,232<br />

30. Property, <strong>pl</strong>ant and equipment - - -<br />

40. Intangible Assets - - -<br />

50. Hedges of foreign investments - - -<br />

a) fair value changes - - -<br />

b) reclassifications through profit or loss - - -<br />

c) other variations - - -<br />

60. Cash flow hedges 216,120 (61,734) 154,386<br />

a) fair value changes 383,508 (118,340) 265,168<br />

b) reclassifications through profit or loss (180,809) 56,235 (124,574)<br />

c) other variations 13,421 371 13,792<br />

70. Exchange differences (471,662) - (471,662)<br />

a) changes in values - - -<br />

b) reclassifications through profit or loss - - -<br />

c) other variations (471,662) - (471,662)<br />

80. Non-current assets classified as held for sale - - -<br />

a) fair value changes - - -<br />

b) reclassifications through profit or loss - - -<br />

c) other variations - - -<br />

90. Actuarial gains (losses) on defined benefits <strong>pl</strong>ans<br />

100. Valuation reserves from investments accounted for using<br />

- - -<br />

the equity method (4,186) - (4,186)<br />

a) fair value changes 32,964 - 32,964<br />

b) reclassifications through profit or loss 9,725 - 9,725<br />

- due to impairment - - -<br />

- gains/losses on disposals 9,725 - 9,725<br />

c) other variations (46,875) - (46,875)<br />

110. Total of other comprehensive income after tax 642,539 (176,833) 465,706<br />

120. Comprehensive income after tax (10+110) 642,539 (176,833) 2,500,326<br />

130. Consolidated comprehensive income attributable to minorities<br />

140. Consolidated comprehensive income attributable<br />

(7,484) (1,685) (341,464)<br />

to Parent Company 635,055 (178,518) 2,158,862<br />

The “Consolidated Comprehensive Income attributable to minorities” (item 130) is different from “Net profit for the period attributable to minorites” (item<br />

330 of Consolidated income statement), as it includes the effect arising from “other comprehensive income” of minorities.