GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

355<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

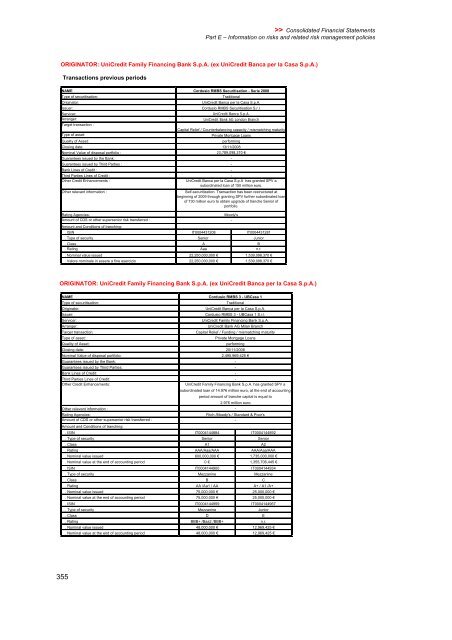

ORIGINATOR: UniCredit Family Financing Bank S.p.A. (ex UniCredit Banca per la Casa S.p.A.)<br />

Transactions previous periods<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction :<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio :<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties :<br />

Bank Lines of Credit :<br />

Third Parties Lines of Credit :<br />

Other Credit Enhancements :<br />

Other relevant information :<br />

Rating Agencies:<br />

Amount of CDS or other supersenior risk transferred :<br />

Amount and Conditions of tranching:<br />

Cordusio RMBS Securitisation - Serie 2008<br />

Traditional<br />

UniCredit Banca per la Casa S.p.A.<br />

Cordusio RMBS Securitisation S.r.l.<br />

UniCredit Banca S.p.A.<br />

UniCredit Bank AG London Branch<br />

Capital Relief / Counterbalancing capacity / mismatching maturity<br />

Private Mortgage Loans<br />

performing<br />

13/11/2008<br />

23,789,098,370 �<br />

-<br />

-<br />

-<br />

-<br />

UniCredit Banca per la Casa S.p.A has granted SPV a<br />

subordinated loan of 150 million euro.<br />

Self-securitization. Transaction has been restructured at<br />

beginning of 2009 through granting SPV further subordinated loan<br />

of 730 million euro to obtain upgrade of tranche Senior of<br />

portfolio.<br />

Moody's<br />

-<br />

. ISIN IT0004431208 IT0004431281<br />

. Type of security Senior Junior<br />

.Class A B<br />

.Rating Aaa n.r.<br />

. Nominal value issued 22,250,000,000 � 1,539,098,370 �<br />

. Valore nominale in essere a fine esercizio 22,250,000,000 � 1,539,098,370 �<br />

ORIGINATOR: UniCredit Family Financing Bank S.p.A. (ex UniCredit Banca per la Casa S.p.A.)<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction:<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio:<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties:<br />

Bank Lines of Credit:<br />

Third Parties Lines of Credit:<br />

Other Credit Enhancements:<br />

Cordusio RMBS 3 - UBCasa 1<br />

Traditional<br />

UniCredit Banca per la Casa S.p.A.<br />

Cordusio RMBS 3 - UBCasa 1 S.r.l.<br />

UniCredit Family Financing Bank S.p.A.<br />

UniCredit Bank AG Milan Branch<br />

Capital Relief / Funding / mismatching maturity<br />

Private Mortgage Loans<br />

performing<br />

20/11/2006<br />

2,495,969,425 �<br />

-<br />

-<br />

-<br />

-<br />

UniCredit Family Financing Bank S.p.A. has granted SPV a<br />

subordinated loan of 14.976 million euro, at the end of accounting<br />

period amount of tranche capital is equal to<br />

Other relevant information :<br />

2.976 million euro.<br />

-<br />

Rating Agencies:<br />

Fitch /Moody's / Standard & Poor's<br />

Amount of CDS or other supersenior risk transferred :<br />

Amount and Conditions of tranching:<br />

-<br />

. ISIN IT0004144884 IT0004144892<br />

. Type of security Senior Senior<br />

.Class A1 A2<br />

. Rating AAA/Aaa/AAA AAA/Aaa/AAA<br />

. Nominal value issued 600,000,000 � 1,735,000,000 �<br />

. Nominal value at the end of accounting period 0 � 1,355,706,445 �<br />

. ISIN IT0004144900 IT0004144934<br />

. Type of security Mezzanine Mezzanine<br />

.Class B C<br />

. Rating AA /Aa1 / AA A+ / A1 /A+<br />

. Nominal value issued 75,000,000 � 25,000,000 �<br />

. Nominal value at the end of accounting period 75,000,000 � 25,000,000 �<br />

. ISIN IT0004144959 IT0004144967<br />

. Type of security Mezzanine Junior<br />

.Class D E<br />

. Rating BBB+ /Baa2 /BBB+ n.r.<br />

. Nominal value issued 48,000,000 � 12,969,425 �<br />

. Nominal value at the end of accounting period 48,000,000 � 12,969,425 �