GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

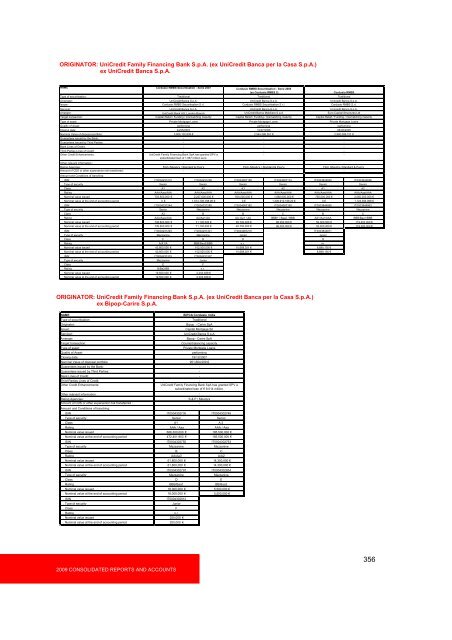

ORIGINATOR: UniCredit Family Financing Bank S.p.A. (ex UniCredit Banca per la Casa S.p.A.)<br />

ex UniCredit Banca S.p.A.<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction:<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio:<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties:<br />

Bank Lines of Credit:<br />

Third Parties Lines of Credit:<br />

Other Credit Enhancements:<br />

Other relevant information :<br />

-<br />

-<br />

-<br />

Rating Agencies:<br />

Fitch /Moody's / Standard & Poor's<br />

Fitch /Moody's / Standard & Poor's<br />

Fitch /Moody's /Standard & Poor's<br />

Amount of CDS or other supersenior risk transferred :<br />

Amount and Conditions of tranching:<br />

-<br />

-<br />

-<br />

. ISIN IT0004231210 IT0004231236 IT0004087158 IT0004087174 IT0003844930 IT0003844948<br />

. Type of security Senior Senior Senior Senior Senior Senior<br />

.Class A1 A2 A1 A2 A1 A2<br />

. Rating AAA/Aaa/AAA AAA/Aaa/AAA AAA/Aaa/AAA AAA/Aaa/AAA AAA/Aaa/AAA AAA/Aaa/AAA<br />

. Nominal value issued 703,500,000 � 2,227,600,000 � 500,000,000 � 1,892,000,000 � 750,000,000 � 2,060,000,000 �<br />

. Nominal value at the end of accounting period 0 � 1,674,708,788.96 � 0 � 1,309,912,199.20 � 0 � 1,124,394,968 �<br />

. ISIN IT0004231244 IT0004231285 IT0004087182 IT0004087190 IT0003844955 IT0003844963<br />

. Type of security Senior Mezzanine Mezzanine Mezzanine Mezzanine Mezzanine<br />

.Class A3 B B C B C<br />

. Rating AAA/Aaa/AAA AA/Aa1/AA AA /Aa1 / AA BBB+ / Baa2 / BBB AA+/Aa1/AAA BBB/Baa1/BBB<br />

. Nominal value issued 738,600,000 � 71,100,000 � 45,700,000 � 96,000,000 � 52,000,000 � 119,200,000 �<br />

. Nominal value at the end of accounting period 738,600,000 � 71,100,000 � 45,700,000 � 96,000,000 � 52,000,000 � 119,200,000 �<br />

. ISIN IT0004231293 IT0004231301 IT0004087216 IT0003844971<br />

. Type of security Mezzanine Mezzanine Junior Junior<br />

.Class C D D D<br />

.Rating A/A1/A BBB/Baa2/BBB n.r. nr<br />

. Nominal value issued 43,800,000 � 102,000,000 � 10,688,351 � 8,889,150 �<br />

. Nominal value at the end of accounting period 43,800,000 � 102,000,000 � 10,688,351 � 8,889,150 �<br />

. ISIN IT0004231319 IT0004231327<br />

. Type of security Mezzanine Junior<br />

.Class E F<br />

. Rating B/Ba2/BB n.r.<br />

. Nominal value issued 19,500,000 � 2,002,838 �<br />

. Nominal value at the end of accounting period 19,500,000 � 2,002,838 �<br />

2009 CONSOLIDATED REPORTS AND ACCOUNTS<br />

Cordusio RMBS Securitisation - Serie 2007<br />

Traditional<br />

Cordusio RMBS Securitisation - Serie 2006<br />

(ex Cordusio RMBS 2)<br />

Traditional<br />

UniCredit Banca S.p.A.<br />

UniCredit Banca S.p.A.<br />

Cordusio RMBS Securitisation S.r.l.<br />

Cordusio RMBS Securitisation S.r.l.<br />

UniCredit Banca S.p.A.<br />

UniCredit Banca S.p.A.<br />

UniCredit Bank AG, London Branch<br />

UniCredit Banca Mobiliare S.p.A<br />

Capital Relief / Funding / mismatching maturity<br />

Capital Relief / Funding / mismatching maturity<br />

Private Mortgage Loans Private Mortgage Loans<br />

performing<br />

performing<br />

24/05/2007<br />

10/07/2006<br />

3,908,102,838 �<br />

2,544,388,351 �<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

UniCredit Family Financing Bank SpA has granted SPV a<br />

subordinated loan of 1.667 million euro.<br />

-<br />

ORIGINATOR: UniCredit Family Financing Bank S.p.A. (ex UniCredit Banca per la Casa S.p.A.)<br />

ex Bipop-Carire S.p.A.<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction:<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio:<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties:<br />

Bank Lines of Credit:<br />

Third Parties Lines of Credit:<br />

Other Credit Enhancements:<br />

BIPCA Cordusio rmbs<br />

Traditional<br />

Bipop - Carire SpA<br />

Capital Mortgage Srl<br />

UniCredit Banca S.p.A<br />

Bipop - Carire SpA<br />

Counterbalancing capacity<br />

Private Mortgage Loans<br />

performing<br />

19/12/2007<br />

951,664,009 �<br />

-<br />

-<br />

-<br />

-<br />

UniCredit Family Financing Bank SpA has granted SPV a<br />

subordinated loan of � 8.014 million.<br />

Other relevant information :<br />

-<br />

Rating Agencies:<br />

S&P/Moody's<br />

Amount of CDS or other supersenior risk transferred :<br />

Amount and Conditions of tranching:<br />

-<br />

. ISIN IT0004302730 IT0004302748<br />

. Type of security Senior Senior<br />

.Class A1 A 2<br />

.Rating AAA/Aaa AAA/Aaa<br />

. Nominal value issued 666,300,000 � 185,500,000 �<br />

. Nominal value at the end of accounting period 472,401,903 � 185,500,000 �<br />

. ISIN IT0004302755 IT0004302763<br />

. Type of security Mezzanine Mezzanine<br />

.Class B C<br />

. Rating AA/Aa3 A/A2<br />

. Nominal value issued 61,800,000 � 14,300,000 �<br />

. Nominal value at the end of accounting period 61,800,000 � 14,300,000 �<br />

. ISIN IT0004302797 IT0004302854<br />

. Type of security Mezzanine Mezzanine<br />

.Class D E<br />

. Rating BBB/Baa1 BB/Baa2<br />

. Nominal value issued 18,000,000 � 5,500,000 �<br />

. Nominal value at the end of accounting period 18,000,000 � 5,500,000 �<br />

. ISIN IT0004302912<br />

.Typeofsecurity Junior<br />

.Class F<br />

.Rating n.r.<br />

. Nominal value issued 250,000 �<br />

. Nominal value at the end of accounting period 250,000 �<br />

Cordusio RMBS<br />

Traditional<br />

Unicredit Banca S.p.A.<br />

Cordusio RMBS S.r.l.<br />

Unicredit Banca S.p.A.<br />

Euro Capital Structures Ltd<br />

Capital Relief / Funding / mismatching maturity<br />

Private Mortgage Loans<br />

performing<br />

06/05/2005<br />

2,990,089,151 �<br />

-<br />

-<br />

-<br />

-<br />

-<br />

356