GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

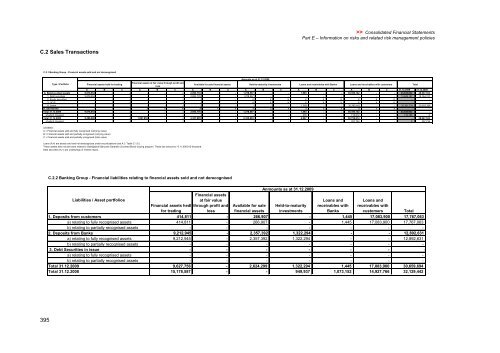

C.2 Sales Transactions<br />

C.2.1 Banking Group - Financial assets sold and not derecognised<br />

395<br />

Type / Portfolio<br />

Financial assets held for trading<br />

Financial assets at fair value through profit and<br />

loss<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

A B C A B C A B C A B C A B C A B C 31.12.2009 31.12.2008<br />

A. Balance-sheet assets 9,676,854 - - - - - 2,693,776 - - 1,278,567 - - 1,593 - - 30,390,142 - - 44,040,932 48,047,523<br />

1. Debt securities 9,676,854 - - - - - 2,693,776 - - 1,278,567 - - - - - - - - 13,649,197 18,764,157<br />

2. Equity securities - - - - - - - - - X X X X X X X X X - -<br />

3. UCIS - - - - - - - - - X X X X X X X X X - -<br />

4. Loans - - - - - - - - - - - - 1,593 - - 30,390,142 - - 30,391,735 29,283,366<br />

B. Derivatives - - - X X X X X X X X X X X X X X X - -<br />

Total 31.12.2009 9,676,854 - - - - - 2,693,776 - - 1,278,567 - - 1,593 - - 30,390,142 - - 44,040,932 -<br />

of which impaired - - - - - - - - - - - - 276 - - 718,912 - - 719,188 X<br />

Total 31.12.2008 9,496,908 - - 1,997,852 - - 3,337,695 - - 2,335,803 - - 2,047 - - 30,756,614 - - - 48,047,523<br />

of which impaired - - - - - - - - - - - - - - - 257,734 - - X 257,734<br />

LEGEND:<br />

A = Financial assets sold and fully recognised (carrying value)<br />

B = Financial assets sold and partially recognised (carrying value)<br />

C = Financial assets sold and partially recognised (total value)<br />

Loans (A.4) are assets sold and not derecognized under securitizations (see A.3. Table C.1.5.).<br />

These assets also include loans related to Obbligazioni Bancarie Garantite (Covered Bond) issuing program. These last amount to � 11,006,912 thousand.<br />

Debt securities (A.1) are underlyings of reverse repos.<br />

C.2.2 Banking Group - Financial liabilities relating to financial assets sold and not derecognised<br />

Liabilities / Asset portfolios<br />

Financial assets hedl<br />

for trading<br />

Amounts as at 31.12.2009<br />

Available for sale financial assets Held-to-maturity investments Loans and receivables with Banks Loans and receivables with customers<br />

Financial assets<br />

at fair value<br />

through profit and<br />

loss<br />

Available for sale<br />

financial assets<br />

Anmounts as at 31.12.2009<br />

Held-to-maturity<br />

investments<br />

Loans and<br />

receivables with<br />

Banks<br />

Loans and<br />

receivables with<br />

customers Total<br />

1. Deposits from customers<br />

414,811 - 266,907 - 1,445 17,083,900 17,767,063<br />

a) relating to fully recognised assets 414,811 - 266,907 - 1,445 17,083,900 17,767,063<br />

b) relating to partially recognised assets - - - - - - -<br />

2. Deposits from Banks<br />

9,212,945 - 2,357,392 1,322,294 - - 12,892,631<br />

a) relating to fully recognised assets 9,212,945 - 2,357,392 1,322,294 - - 12,892,631<br />

b) relating to partially recognised assets - - - - - - -<br />

3. Debt Securities in issue - - - - - - -<br />

a) relating to fully recognised assets - - - - - - -<br />

b) relating to partially recognised assets - - - - - - -<br />

Total 31.12.2009 9,627,756 - 2,624,299 1,322,294 1,445 17,083,900 30,659,694<br />

Total 31.12.2008 15,178,587 - - 949,937 1,073,152 14,927,766 32,129,442<br />

Total