GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The transactions included under “Assets sold and derecognized” are those in which the Group, while<br />

retaining most of the risk and return of the underlying receivables, nevertheless derecognized them<br />

because the transaction was prior to January 1 st , 2002. On first adoption of IFRS the option permitted by<br />

IFRS 1 that allows assets sold before January, 1 st 2004 not to be rerecognized, regardless of the amount<br />

of risk and return retained, was taken.<br />

Beside the indicated exposures, the Group has also carried out traditional transactions concerning<br />

performing loans by purchasing the liabilities issued by the SPVs (so-called self-securitizations) for a total<br />

amount of �41,522,071 thousand.<br />

In 2009 two self-securitizations were carried out, whose underlyings were leasing contracts originated in<br />

Italy concerning the use of motor vehicles, capital goods and real-estate assets for a nominal amount of<br />

�1,705,231 thousand and residential mortgages originated in Italy for a nominal amount of �3,499,601<br />

thousand.<br />

However, assessment and monitoring of risk underlying securitizations are performed with regard not to<br />

exposure to the SPV but rather to the sold receivables, which are monitored continuously by means of<br />

Interim reports showing status of the receivables and repayment performance.<br />

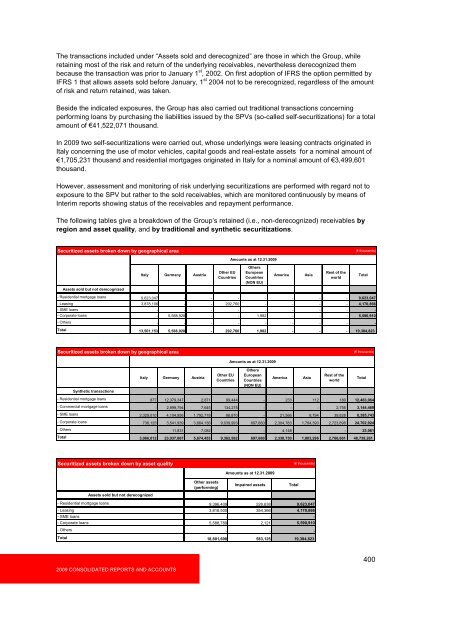

The following tables give a breakdown of the Group’s retained (i.e., non-derecognized) receivables by<br />

region and asset quality, and by traditional and synthetic securitizations.<br />

Securitized assets broken down by geographical area<br />

Italy Germany Austria<br />

2009 CONSOLIDATED REPORTS AND ACCOUNTS<br />

Other EU<br />

Countries<br />

Amounts as at 12.31.2009<br />

Others<br />

European<br />

Countries<br />

(NON EU)<br />

America Asia<br />

Rest of the<br />

world<br />

(� thousands)<br />

Assets sold but not derecognized<br />

- Residential mortgage loans 9,623,047 - - - - - - - 9,623,047<br />

- Leasing 3,878,106 - - 292,760 - - - - 4,170,866<br />

- SME loans - - - - - - - - -<br />

- Corporate loans - 5,588,928 - - 1,982 - - - 5,590,910<br />

-Others - - - - - - - - -<br />

Total 13,501,153 5,588,928 - 292,760 1,982 - - - 19,384,823<br />

Securitized assets broken down by geographical area<br />

Italy Germany Austria<br />

Other EU<br />

Countries<br />

Amounts as at 12.31.2009<br />

Others<br />

European<br />

Countries<br />

(NON EU)<br />

America Asia<br />

Rest of the<br />

world<br />

Total<br />

(� thousands)<br />

Synthetic transactions<br />

- Residential mortgage loans 877 12,379,347 2,871 99,444 - 233 112 180 12,483,064<br />

- Commercial mortgage loans - 2,999,794 7,645 134,275 - - - 2,755 3,144,469<br />

- SME loans 2,329,010 4,104,956 1,792,719 88,870 - 21,566 8,794 39,828 8,385,743<br />

- Corporate loans 736,125 3,541,939 3,864,136 9,039,993 697,660 2,304,783 1,794,390 2,723,898 24,702,924<br />

-Others - 11,831 7,082 - - 4,148 - - 23,061<br />

Total 3,066,012 23,037,867 5,674,453 9,362,582 697,660 2,330,730 1,803,296 2,766,661 48,739,261<br />

Securitized assets broken down by asset quality<br />

(� thousands)<br />

Other assets<br />

(performing)<br />

Amounts as at 12.31.2009<br />

Impaired assets Total<br />

Assets sold but not derecognized<br />

- Residential mortgage loans 9,396,409 226,638 9,623,047<br />

- Leasing 3,816,500 354,366 4,170,866<br />

- SME loans - - -<br />

- Corporate loans 5,588,789 2,121 5,590,910<br />

-Others - - -<br />

Total 18,801,698 583,125 19,384,823<br />

Total<br />

400