GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

������� � � ���� ����� ����������� �� ����� ���������� � ���� ��<br />

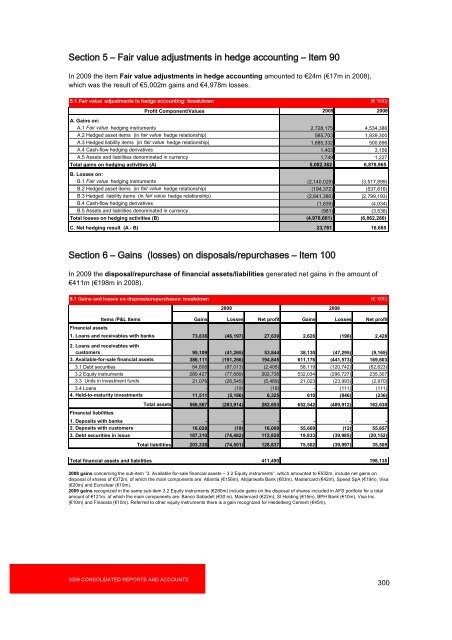

In 2009 the item Fair value adjustments in hedge accounting amounted to �24m (�17m in 2008),<br />

whichwastheresultof�5,002m gains and �4,978m losses.<br />

5.1 Fair value adjustments in hedge accounting: breakdown (� '000)<br />

2009 CONSOLIDATED REPORTS AND ACCOUNTS<br />

Profit Component/Values 2009 2008<br />

A. Gains on:<br />

A.1 Fair value hedging instruments 2,728,175 4,534,386<br />

A.2 Hedged asset items (in fair value hedge relationship) 585,703 1,839,300<br />

A.3 Hedged liability items (in fair value hedge relationship) 1,685,332 500,896<br />

A.4 Cash-flow hedging derivatives 1,403 3,156<br />

A.5 Assets and liabilities denominated in currency 1,749 1,227<br />

Total gains on hedging activities (A) 5,002,362 6,878,965<br />

B. Losses on:<br />

B.1 Fair value hedging instruments (2,140,029) (3,517,899)<br />

B.2 Hedged asset items (in fair value hedge relationship) (194,372) (537,616)<br />

B.3 Hedged liability items (in fair value hedge relationship) (2,641,380) (2,799,193)<br />

B.4 Cash-flow hedging derivatives (1,839) (4,034)<br />

B.5 Assets and liabilities denominated in currency (981) (3,538)<br />

Total losses on hedging activities (B) (4,978,601) (6,862,280)<br />

C. Net hedging result (A - B) 23,761 16,685<br />

������� � � ����� �������� �� ��������������������� � ���� ���<br />

In 2009 the disposal/repurchase of financial assets/liabilities generated net gains in the amount of<br />

�411m (�198m in 2008).<br />

6.1 Gains and losses on disposals/repurchases: breakdown (� '000)<br />

2009 2008<br />

Items /P&L Items Gains Losses Net profit Gains Losses Net profit<br />

Financial assets<br />

1. Loans and receivables with banks 73,836 (46,197) 27,639 2,626 (198) 2,428<br />

2. Loans and receivables with<br />

customers 95,109 (41,265) 53,844 38,130 (47,295) (9,165)<br />

3. Available-for-sale financial assets 386,111 (191,266) 194,845 611,176 (441,573) 169,603<br />

3.1 Debt securities 84,608 (87,013) (2,405) 58,119 (120,742) (62,623)<br />

3.2 Equity instruments 280,427 (77,689) 202,738 532,034 (296,727) 235,307<br />

3.3 Units in investment funds 21,076 (26,545) (5,469) 21,023 (23,993) (2,970)<br />

3.4 Loans - (19) (19) - (111) (111)<br />

4. Held-to-maturity investments 11,511 (5,186) 6,325 610 (846) (236)<br />

Total assets<br />

Financial liabilities<br />

566,567 (283,914) 282,653 652,542 (489,912) 162,630<br />

1. Deposits with banks - - - - - -<br />

2. Deposits with customers 16,028 (19) 16,009 55,669 (12) 55,657<br />

3. Debt securities in issue 187,310 (74,482) 112,828 19,833 (39,985) (20,152)<br />

Total liabilities 203,338 (74,501) 128,837 75,502 (39,997) 35,505<br />

Total financial assets and liabilities 411,490 198,135<br />

2008 gains concerning the sub-item ”3. Available-for-sale financial assets – 3.2 Equity instruments”, which amounted to �532m, include net gains on<br />

disposal of shares of �372m, of which the main components are: Atlantia (�156m), Attijariwafa Bank (�83m), Mastercard (�42m), Speed SpA (�19m), Visa<br />

(�20m) and Euroclear (�19m).<br />

2009 gains recognized in the same sub-item 3.2 Equity instruments (�280m) include gains on the disposal of shares included in AFS portfolio for a total<br />

amount of �121m, of which the main components are: Banco Sabadell (�30 m), Mastercard (�22m), SI Holding (�15m), BPH Bank (�10m), Visa Inc.<br />

(�10m) and Finaosta (�10m). Referred to other equity instruments there is a gain recognized for Heidelberg Cement (�45m).<br />

300