GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

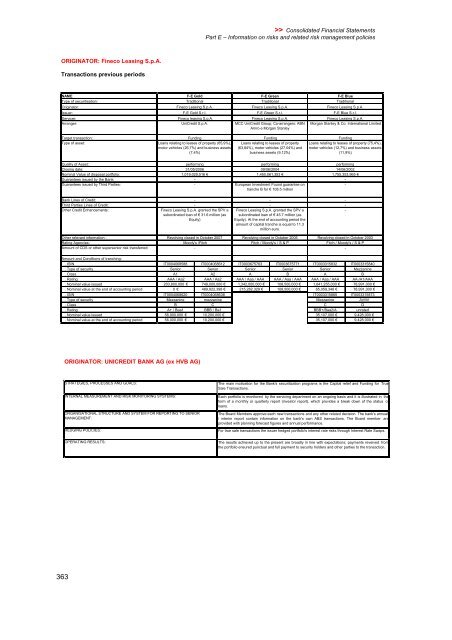

ORIGINATOR: Fineco Leasing S.p.A.<br />

Transactions previous periods<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction:<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio:<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties:<br />

Bank Lines of Credit:<br />

Third Parties Lines of Credit:<br />

Other Credit Enhancements:<br />

Other relevant information :<br />

Rating Agencies:<br />

Amount of CDS or other supersenior risk transferred:<br />

363<br />

performing<br />

31/05/2006<br />

1,019,029,516 �<br />

-<br />

-<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

F-E Gold<br />

F-E Green<br />

F-E Blue<br />

Traditional<br />

Traditional<br />

Traditional<br />

Fineco Leasing S.p.A.<br />

Fineco Leasing S.p.A.<br />

Fineco Leasing S.p.A.<br />

F-E Gold S.r.l.<br />

F-E Green S.r.l.<br />

F-E Blue S.r.l.<br />

Fineco leasing S.p.A.<br />

Fineco Leasing S.p.A.<br />

Fineco Leasing S.p.A.<br />

UniCredit S.p.A.<br />

MCC UniCredit Group; Co-arrangers: ABN<br />

Amro e Morgan Stanley<br />

Morgan Stanley & Co. International Limited<br />

Funding<br />

Funding<br />

Funding<br />

Loans relating to leases of property (65,9%), Loans relating to leases of property Loans relating to leases of property (75,4%),<br />

motor vehicles (26,7%) and business assets (63,84%), motor vehicles (27,04%) and motor vehicles (12,7%) and business assets<br />

(7,4%)<br />

business assets (9,12%)<br />

(11,9%)<br />

performing<br />

09/06/2004<br />

1,450,061,353 �<br />

-<br />

European Investment Found guarantee on<br />

tranche B for � 108.5 million<br />

-<br />

-<br />

-<br />

-<br />

Fineco Leasing S.p.A. granted the SPV a Fineco Leasing S.p.A. granted the SPV a<br />

subordinated loan of � 31.6 million (as subordinated loan of � 45.7 million (as<br />

Equity)<br />

Equity). At the end of accounting period the<br />

amount of capital tranche is equal to 11.3<br />

million euro.<br />

Revolving closed in October 2007<br />

Moody's /Fitch<br />

-<br />

Revolving closed in October 2005<br />

Fitch/Moody's/S&P<br />

-<br />

performing<br />

14/06/2002<br />

1,755,353,965 �<br />

-<br />

-<br />

Amount and Conditions of tranching:<br />

. ISIN IT0004068588 IT0004068612 IT0003675763 IT0003675771 IT0003315832 IT0003315840<br />

. Type of security Senior Senior Senior Senior Senior Mezzanine<br />

. Class A1 A2 A B A B<br />

. Rating AAA / Aa2 AAA / Aa2 AAA / Aaa / AAA AAA / Aaa / AAA AAA / Aaa / AAA AA-/A1/AAA<br />

. Nominal value issued 203,800,000 � 749,000,000 � 1,342,000,000 � 108,500,000 � 1,641,255,000 � 78,991,000 �<br />

. Nominal value at the end of accounting period 0 � 489,922,398 � 215,262,329 � 108,500,000 � 65,059,348 � 78,991,000 �<br />

. ISIN IT0004068620 IT0004068638 IT0003315865 IT0003315873<br />

. Type of security Mezzanine mezzanine Mezzanine Junior<br />

.Class B C C D<br />

. Rating A+ / Baa1 BBB / Ba1 BBB+/Baa2/A unrated<br />

. Nominal value issued 56,000,000 � 10,200,000 � 35,107,000 � 9,428,000 �<br />

. Nominal value at the end of accounting period 56,000,000 � 10,200,000 � 35,107,000 � 9,428,000 �<br />

ORIGINATOR: UNICREDIT BANK AG (ex HVB AG)<br />

STRATEGIES, PROCESSES AND GOALS:<br />

INTERNAL MEASUREMENT AND RISK MONITORING SYSTEMS:<br />

ORGANISATIONAL STRUCTURE AND SYSTEM FOR REPORTING TO SENIOR<br />

MANAGEMENT:<br />

HEDGING POLICIES:<br />

OPERATING RESULTS:<br />

-<br />

-<br />

-<br />

Revolving closed in October 2003<br />

Fitch / Moody's / S & P<br />

-<br />

The main motivation for the Bank's securitization programs is the Capital relief and Funding for True<br />

Sale Transactions.<br />

Each portfolio is monitored by the servicing department on an ongoing basis and it is illustrated in the<br />

form of a monthly or quarterly report (investor report), which provides a break down of the status of<br />

loans.<br />

The Board Members approve each new transactions and any other related decision. The bank's annual<br />

/ interim report contain information on the bank's own ABS transactions. The Board member are<br />

provided with <strong>pl</strong>anning forecast figures and annual performance.<br />

For true sale transactions the issuer hedged portfolio's interest rate risks through Interest Rate Swaps.<br />

The results achieved up to the present are broadly in line with expectations; payments reveived from<br />

the portfolio ensured punctual and full payment to security holders and other parties to the transaction.