GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

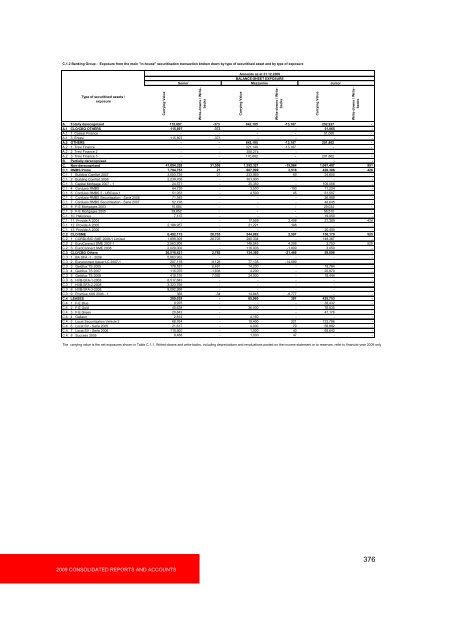

C.1.2 Banking Group - Exposure from the main "in-house" securitisation transaction broken down by type of securitised asset and by type of exposure<br />

Type of securitised assets /<br />

exposure<br />

A. Totally derecognised 115,897 -373 842,105 -13,187 252,927 -<br />

A.1 CLO/CBO OTHERS 115,897 -373 - - 51,065 -<br />

A.1 1 Caesar Finance - - - - 51,065 -<br />

A.1 3 Entasi 115,897 -373 - - - -<br />

A.2 OTHERS - - 842,105 -13,187 201,862 -<br />

A.2 1 Trevi Finance - - 321,149 -13,187 - -<br />

A.2 2 Trevi Finance 2 - - 350,274 - - -<br />

A.2 3 Trevi Finance 3 - - 170,682 - 201,862 -<br />

B. Partially derecognised - - - - - -<br />

C. Non-derecognised 41,094,328 31,506 1,352,321 -15,964 1,067,407 951<br />

C.1 RMBS Prime 7,794,753 21 607,999 2,518 426,386 426<br />

C.1. 1 Building Comfort 2007 3,053,735 21 233,969 69 24,600 -<br />

C.1. 2 Building Comfort 2008 2,239,708 - 301,900 - - -<br />

C.1. 3 Capital Mortgage 2007 - 1 24,571 - 25,350 - 109,058 -<br />

C.1. 4 Cordusio RMBS 64,735 - 3,500 -190 11,224 -<br />

C.1. 5 Cordusio RMBS 3 - UBCasa 1 51,053 - 4,500 45 61,507 -<br />

C.1. 6 Cordusio RMBS Securitisation - Serie 2006 71,545 - - - 26,989 -<br />

C.1. 7 Cordusio RMBS Securitisation - Serie 2007 52,776 - - - 46,645 -<br />

C.1. 8 F-E Mortgages 2003 10,684 - - - 29,034 -<br />

C.1. 9 F-E Mortgages 2005 29,852 - - - 56,510 -<br />

C.1. 10 Heliconus 7,137 - - - 19,050 -<br />

C.1. 11 Provide A 2004 - - 17,559 2,406 21,369 426<br />

C.1. 12 Provide A 2005 2,188,957 - 21,221 188 - -<br />

C.1. 13 Provide A 2006 - - - - 20,400 -<br />

C.2 CLO/SME 6,492,115 28,703 544,882 2,597 156,170 525<br />

C.2. 1 CORDUSIO SME 2008-1 Limited 1,899,309 28,703 280,334 - 149,367 -<br />

C.2. 2 EuroConnect SME 2007-1 2,563,806 - 148,545 4,206 3,753 525<br />

C.2. 3 EuroConnect SME 2008 2,029,000 - 116,003 -1,609 3,050 -<br />

C.3 CLO/CBO Others 26,518,421 2,782 134,380 -21,466 59,098 -<br />

C.3. 1 BA SFA -1 - 2008 5,663,932 - - - - -<br />

C.3. 2 Euroconnect Issuer LC 2007-1 207,118 -9,128 77,135 -14,689 - -<br />

C.3. 3 Geldilux TS 2005 178,181 6,491 14,200 - 19,784 -<br />

C.3. 4 Geldilux TS 2007 115,075 -1,638 4,200 - 20,870 -<br />

C.3. 5 Geldilux TS 2008 419,155 7,092 24,000 - 18,444 -<br />

C.3. 6 HVB-SFA-1-2008 8,517,843 - - - - -<br />

C.3. 7 HVB-SFA-2-2008 3,323,795 - - - - -<br />

C.3. 8 HVB-SFA-3-2008 8,092,956 - - - - -<br />

C.3. 9 Promise XXS 2006 - 1 366 -34 14,845 -6,777 - -<br />

C.4 LEASES 289,039 - 65,060 387 425,753 -<br />

C.4. 1 F-E Blue 9,975 - - - 38,432 -<br />

C.4. 2 F-E Gold 40,638 - 36,000 - 78,835 -<br />

C.4. 3 F-E Green 20,843 - - - 47,176 -<br />

C.4. 4 Galleon 2,814 - 4,160 - - -<br />

C.4. 5 Locat Securitization Vehicle 2 68,764 - 18,400 221 133,786 -<br />

C.4. 6 Locat SV - Serie 2005 21,617 - 4,000 79 58,882 -<br />

C.4. 7 Locat SV - Serie 2006 115,900 - 1,500 40 68,642 -<br />

C.4. 8 Success 2005 8,488 - 1,000 47 - -<br />

The carrying value is the net exposures shown in Table C.1.1. Writed-downs and write-backs, including depreciations and revaluations posted on the income statement or to reserves, refer to financial year 2009 only<br />

2009 CONSOLIDATED REPORTS AND ACCOUNTS<br />

Carrying Value<br />

Senior<br />

Amounts as at 31.12.2009<br />

BALANCE-SHEET EXPOSURE<br />

Mezzanine Junior<br />

Write-downs / Writebacks<br />

Carrying Value<br />

Write-downs / Writebacks<br />

Carrying Value<br />

Write-downs / Writebacks<br />

376