GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

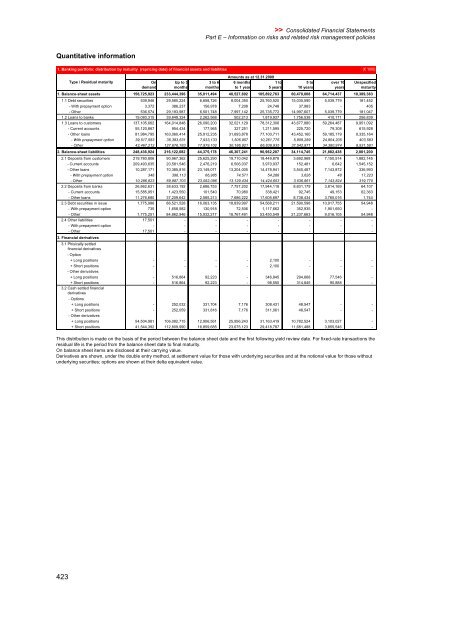

Quantitative information<br />

423<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

1. Banking portfolio: distribution by maturity (repricing date) of financial assets and liabilities (� '000)<br />

Type / Residual maturity<br />

On<br />

demand<br />

Up to 3<br />

months<br />

3to6<br />

months<br />

6 months<br />

to 1 year<br />

1to<br />

5years<br />

5to<br />

10 years<br />

over 10<br />

years<br />

Unspecified<br />

maturity<br />

1. Balance-sheet assets 156,725,923 233,444,396 35,011,494 40,527,692 105,892,763 60,470,008 64,714,437 10,389,383<br />

1.1 Debt securities 539,946 29,580,224 6,658,726 8,004,350 25,760,520 15,035,590 5,039,779 181,452<br />

- With prepayment option 3,372 386,237 156,978 7,208 24,748 37,983 - 405<br />

- Other 536,574 29,193,987 6,501,748 7,997,142 25,735,772 14,997,607 5,039,779 181,047<br />

1.2 Loans to banks 19,080,315 39,849,324 2,262,568 502,213 1,819,937 1,756,538 410,171 256,839<br />

1.3 Loans to customers 137,105,662 164,014,848 26,090,200 32,021,129 78,312,306 43,677,880 59,264,487 9,951,092<br />

- Current accounts 55,120,867 954,434 177,965 327,251 1,211,595 225,720 79,308 615,928<br />

- Other loans 81,984,795 163,060,414 25,912,235 31,693,878 77,100,711 43,452,160 59,185,179 9,335,164<br />

- With prepayment option 39,517,583 35,383,631 7,933,133 1,506,957 10,261,776 5,909,289 24,804,205 403,583<br />

- Other 42,467,212 127,676,783 17,979,102 30,186,921 66,838,935 37,542,871 34,380,974 8,931,581<br />

2. Balance-sheet liabilities 248,436,924 216,122,082 44,375,178 46,307,241 90,962,207 34,114,745 21,882,438 2,001,200<br />

2.1 Deposits from customers 219,780,806 90,967,362 25,625,290 19,710,042 18,449,878 3,692,968 7,150,514 1,882,145<br />

- Current accounts 209,493,635 20,581,546 2,476,219 6,506,037 3,970,937 152,481 6,642 1,545,152<br />

- Other loans 10,287,171 70,385,816 23,149,071 13,204,005 14,478,941 3,540,487 7,143,872 336,993<br />

- With prepayment option 348 398,113 66,985 74,571 54,288 3,626 48 17,223<br />

- Other 10,286,823 69,987,703 23,082,086 13,129,434 14,424,653 3,536,861 7,143,824 319,770<br />

2.2 Deposits from banks 26,862,631 38,633,192 2,686,753 7,757,202 17,944,118 8,831,179 3,814,169 64,107<br />

- Current accounts 15,585,951 1,423,550 101,540 70,980 338,421 92,745 49,153 62,363<br />

- Other loans 11,276,680 37,209,642 2,585,213 7,686,222 17,605,697 8,738,434 3,765,016 1,744<br />

2.3 Debt securities in issue 1,775,986 86,521,528 16,063,135 18,839,997 54,568,211 21,590,598 10,917,755 54,948<br />

- With prepayment option 735 1,658,582 130,918 72,506 1,117,662 352,935 1,901,650 -<br />

- Other 1,775,251 84,862,946 15,932,217 18,767,491 53,450,549 21,237,663 9,016,105 54,948<br />

2.4 Other liabilities 17,501 - - - - - - -<br />

- With prepayment option - - - - - - - -<br />

- Other 17,501 - - - - - - -<br />

3. Financial derivatives<br />

3.1 Phisically settled<br />

financial derivatives<br />

Amounts as at 12.31.2009<br />

-Option<br />

+ Long positions - - - - 2,100 - - -<br />

+ Short positions - - - - 2,100 - - -<br />

- Other derivatives<br />

+ Long positions - 516,864 92,223 - 346,845 294,668 77,546 -<br />

+ Short positions - 516,864 92,223 - 98,550 314,845 90,888 -<br />

3.2 Cash settled financial<br />

derivatives<br />

- Options<br />

+ Long positions - 252,032 331,704 7,176 308,431 48,547 - -<br />

+ Short positions - 252,059 331,816 7,176 311,061 48,547 - -<br />

- Other derivatives<br />

+ Long positions 54,504,981 106,082,715 12,906,561 25,956,243 31,163,419 10,782,524 3,103,027 -<br />

+ Short positions 41,544,392 112,809,990 16,859,685 23,675,123 29,418,787 11,681,488 3,855,546 -<br />

This distribution is made on the basis of the period between the balance sheet date and the first following yield review date. For fixed-rate transactions the<br />

residual life is the period from the balance sheet date to final maturity.<br />

On balance sheet items are disclosed at their carrying value.<br />

Derivatives are shown, under the double entry method, at settlement value for those with underlying securities and at the notional value for those without<br />

underlying securities; options are shown at their delta equivalent value.