GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

GENERAL MEETING DRAFT - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

359<br />

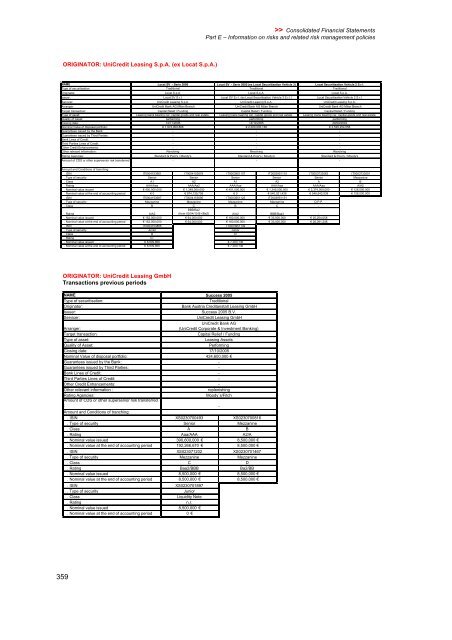

ORIGINATOR: UniCredit Leasing S.p.A. (ex Locat S.p.A.)<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction:<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio:<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties:<br />

Bank Lines of Credit:<br />

Third Parties Lines of Credit:<br />

Other Credit Enhancements:<br />

Other relevant information :<br />

Rating Agencies:<br />

Amount of CDS or other supersenior risk transferred<br />

:<br />

>> Consolidated Financial Statements<br />

Part E – Information on risks and related risk management policies<br />

Locat SV - Serie 2006<br />

Locat SV - Serie 2005 (ex Locat Securitisation Vehicle 3)<br />

Traditional<br />

Traditional<br />

Locat S.p.A.<br />

Locat S.p.A.<br />

Locat SV S.r.l.<br />

Locat SV S.r.l. (ex Locat Securitisation Vehicle 3 S.r.l.)<br />

UniCredit Leasing S.p.A.<br />

UniCredit Leasing S.p.A.<br />

UniCredit Bank AG Milan Branch<br />

UniCredit Bank AG Milan Branch<br />

Capital Relief / Funding<br />

Capital Relief / Funding<br />

Leasing loans bearing car, capital goods and real estate. Leasing loans bearing car, capital goods and real estate.<br />

performing performing<br />

14/11/2006<br />

14/10/2005<br />

� 1,972,909,866<br />

� 2,000,000,136<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Revolving<br />

Revolving<br />

Standard & Poor's / Moody's<br />

Standard & Poor's / Moody's<br />

-<br />

-<br />

Locat Securitisation Vehicle 2 S.r.l.<br />

Traditional<br />

Locat S.p.A.<br />

Locat Securitisation Vehicle 2 S.r.l.<br />

UniCredit Leasing S.p.A.<br />

UniCredit Bank AG Milan Branch<br />

Capital Relief / Funding<br />

Leasing loans bearing car, capital goods and real estate.<br />

performing<br />

29/09/2004<br />

� 2,525,254,058<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Revolving<br />

Standard & Poor's / Moody's<br />

-<br />

Amount and Conditions of tranching:<br />

. ISIN IT0004153661 IT0004153679 IT0003951107 IT0003951115 IT0003733083 IT0003733091<br />

. Type of security Senior Senior Senior Senior Senior Mezzanine<br />

. Class A1 A2 A1 A2 A B<br />

. Rating AAA/Aaa AAA/Aa2 AAA/Aaa AAA/Aaa AAA/Aaa A/A2<br />

. Nominal value issued � 400,000,000 � 1,348,000,000 � 451,000,000 � 1,349,000,000 � 2,374,000,000 � 126,000,000<br />

. Nominal value at the end of accounting period � 0 � 974,135,705 � 0 � 540,021,428 � 546,642,938 � 126,000,000<br />

. ISIN IT0004153687 IT0004153695 IT0003951123 IT0003951131 -<br />

. Type of security Mezzanine Mezzanine Mezzanine Mezzanine D.P.P.<br />

. Class B C<br />

BBB/Ba2<br />

B C -<br />

.Rating A/A3<br />

(from 03/04/10 B+/Ba2) A/A2 BBB/Baa3 -<br />

. Nominal value issued � 152,000,000 � 64,000,000 � 160,000,000 � 33,000,000 � 25,254,058<br />

. Nominal value at the end of accounting period � 152,000,000 � 64,000,000 � 160,000,000 � 33,000,000 � 26,091,248<br />

. ISIN IT0004153885 IT0003951149<br />

. Type of security Junior Junior<br />

.Class D D<br />

.Rating n.r. -<br />

. Nominal value issued � 8,909,866 � 7,000,136<br />

. Nominal value at the end of accounting period � 8,909,866 � 7,000,136<br />

ORIGINATOR: UniCredit Leasing GmbH<br />

Transactions previous periods<br />

NAME<br />

Type of securitisation:<br />

Originator:<br />

Issuer:<br />

Servicer:<br />

Arranger:<br />

Target transaction:<br />

Type of asset:<br />

Quality of Asset:<br />

Closing date:<br />

Nominal Value of disposal portfolio:<br />

Guarantees issued by the Bank:<br />

Guarantees issued by Third Parties:<br />

Bank Lines of Credit:<br />

Third Parties Lines of Credit:<br />

Other Credit Enhancements:<br />

Other relevant information :<br />

Rating Agencies:<br />

Amount of CDS or other supersenior risk transferred<br />

:<br />

Success 2005<br />

Traditional<br />

Bank Austria Creditanstalt Leasing GmbH<br />

Success 2005 B.V.<br />

UniCredit Leasing GmbH<br />

UniCredit Bank AG<br />

(UniCredit Corporate & Investment Banking)<br />

Capital Relief / Funding<br />

Leasing Assets<br />

Performing<br />

17/10/2005<br />

424,600,000 �<br />

-<br />

-<br />

-<br />

-<br />

-<br />

re<strong>pl</strong>enishing<br />

Moody´s/Fitch<br />

Amount and Conditions of tranching:<br />

. ISIN XS0230700493 XS0230700816<br />

. Type of security Senior Mezzanine<br />

. Class A B<br />

. Rating Aaa/AAA A2/A<br />

. Nominal value issued 390,600,000 � 8,500,000 �<br />

. Nominal value at the end of accounting period 192,266,670 � 8,500,000 �<br />

. ISIN XS023071202 XS0230701467<br />

. Type of security Mezzanine Mezzanine<br />

. Class C D<br />

. Rating Baa2/BBB Ba2/BB<br />

. Nominal value issued 8,500,000 � 8,500,000 �<br />

. Nominal value at the end of accounting period 8,500,000 � 8,500,000 �<br />

. ISIN XS0230701897<br />

. Type of security Junior<br />

. Class Liquidity Note<br />

. Rating n.r.<br />

. Nominal value issued 8,500,000 �<br />

. Nominal value at the end of accounting period 0 �<br />

-