Kerala 2005 - of Planning Commission

Kerala 2005 - of Planning Commission

Kerala 2005 - of Planning Commission

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56<br />

However, let us look at another measure. Guhan (1994)<br />

has stated that it is possible to have resources for<br />

social security at the national level by cutting military<br />

expenditure and subsidies for non-poor, and argued that<br />

doubling the proportion <strong>of</strong> social security expenditure<br />

from 1.5 per cent <strong>of</strong> the GDP to 3 per cent is feasible.<br />

In the regional context, if the State can tap more tax<br />

revenue by checking the alarming proportions <strong>of</strong> sales<br />

tax evasion and mobilise more non-tax revenue from<br />

education, 19 health and for several economic services<br />

from sections <strong>of</strong> population who can afford to pay, it is<br />

quite feasible that vulnerable sections can be extended<br />

benefits that will provide the critical minimum to rise<br />

above the poverty level.<br />

There are also multiple Centrally-sponsored schemes,<br />

whose structure is inflexible with regard to specific<br />

problems <strong>of</strong> the State and at the same time impose a fiscal<br />

burden on the State by way <strong>of</strong> requirement <strong>of</strong> matching<br />

contributions. There have already been suggestions at<br />

the <strong>of</strong>ficial level to transfer these existing schemes along<br />

with the funds to the State Governments. If these are<br />

translated into reality, a modest target <strong>of</strong> pension schemes<br />

at 1 or even 1.5 per cent <strong>of</strong> the State domestic product<br />

will not hinder the <strong>of</strong>ficially laid down targets <strong>of</strong> fiscal<br />

consolidation.<br />

In an inter-State comparison <strong>of</strong> per capita social security<br />

and welfare expenditure (SSW) 20 for the population below<br />

poverty line, <strong>Kerala</strong> ranks third below Haryana and Punjab,<br />

and only marginally ahead <strong>of</strong> Tamil Nadu (Table 3.12).<br />

When the per capita SSW is computed for the whole<br />

population, it shows that <strong>Kerala</strong> ranks third below Haryana<br />

and Tamil Nadu. Bihar is at the bottom <strong>of</strong> per capita SSW<br />

expenditure. 21<br />

As a measure <strong>of</strong> sustainability <strong>of</strong> this component <strong>of</strong><br />

expenditure, ratio <strong>of</strong> non-Plan to Plan expenditure is taken.<br />

It is very high for Maharashtra, Rajasthan and Tamil Nadu.<br />

It is 2.02 for <strong>Kerala</strong>. The deficit targeting approach to fiscal<br />

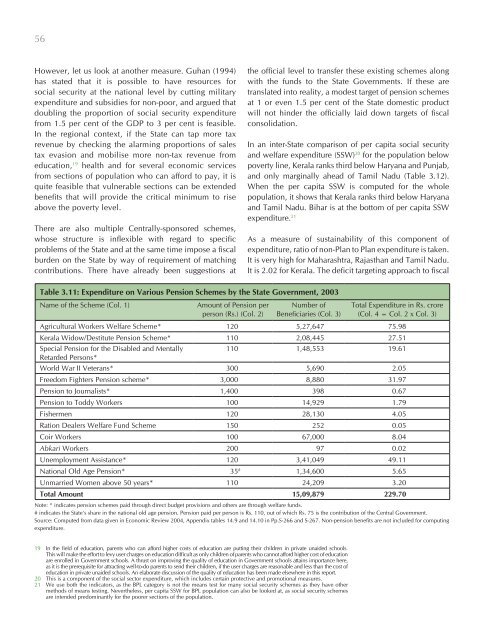

Table 3.11: Expenditure on Various Pension Schemes by the State Government, 2003<br />

Name <strong>of</strong> the Scheme (Col. 1)<br />

Amount <strong>of</strong> Pension per<br />

person (Rs.) (Col. 2)<br />

Number <strong>of</strong><br />

Beneficiaries (Col. 3)<br />

Total Expenditure in Rs. crore<br />

(Col. 4 = Col. 2 x Col. 3)<br />

Agricultural Workers Welfare Scheme* 120 5,27,647 75.98<br />

<strong>Kerala</strong> Widow/Destitute Pension Scheme* 110 2,08,445 27.51<br />

Special Pension for the Disabled and Mentally<br />

110 1,48,553 19.61<br />

Retarded Persons*<br />

World War II Veterans* 300 5,690 2.05<br />

Freedom Fighters Pension scheme* 3,000 8,880 31.97<br />

Pension to Journalists* 1,400 398 0.67<br />

Pension to Toddy Workers 100 14,929 1.79<br />

Fishermen 120 28,130 4.05<br />

Ration Dealers Welfare Fund Scheme 150 252 0.05<br />

Coir Workers 100 67,000 8.04<br />

Abkari Workers 200 97 0.02<br />

Unemployment Assistance* 120 3,41,049 49.11<br />

National Old Age Pension* 35 # 1,34,600 5.65<br />

Unmarried Women above 50 years* 110 24,209 3.20<br />

Total Amount 15,09,879 229.70<br />

Note: * indicates pension schemes paid through direct budget provisions and others are through welfare funds.<br />

# indicates the State’s share in the national old age pension. Pension paid per person is Rs. 110, out <strong>of</strong> which Rs. 75 is the contribution <strong>of</strong> the Central Government.<br />

Source: Computed from data given in Economic Review 2004, Appendix tables 14.9 and 14.10 in Pp.S-266 and S-267. Non-pension benefits are not included for computing<br />

expenditure.<br />

19 In the field <strong>of</strong> education, parents who can afford higher costs <strong>of</strong> education are putting their children in private unaided schools.<br />

This will make the effort to levy user charges on education difficult as only children <strong>of</strong> parents who cannot afford higher cost <strong>of</strong> education<br />

are enrolled in Government schools. A thrust on improving the quality <strong>of</strong> education in Government schools attains importance here,<br />

as it is the prerequisite for attracting well-to-do parents to send their children, if the user charges are reasonable and less than the cost <strong>of</strong><br />

education in private unaided schools. An elaborate discussion <strong>of</strong> the quality <strong>of</strong> education has been made elsewhere in this report.<br />

20 This is a component <strong>of</strong> the social sector expenditure, which includes certain protective and promotional measures.<br />

21 We use both the indicators, as the BPL category is not the means test for many social security schemes as they have other<br />

methods <strong>of</strong> means testing. Nevertheless, per capita SSW for BPL population can also be looked at, as social security schemes<br />

are intended predominantly for the poorer sections <strong>of</strong> the population.