Pulacayo Project Feasibility Study - Apogee Silver

Pulacayo Project Feasibility Study - Apogee Silver

Pulacayo Project Feasibility Study - Apogee Silver

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Pulacayo</strong> 1 000 t/d Phase I <strong>Feasibility</strong> <strong>Study</strong> - NI 43-101 Technical Report<br />

090644-3-0000-20-IFI-100<br />

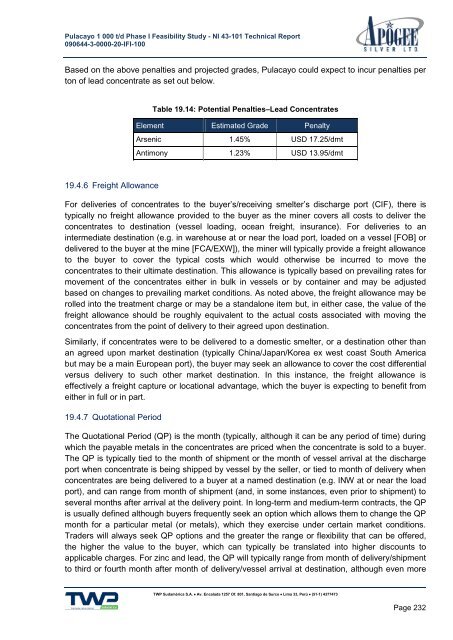

Based on the above penalties and projected grades, <strong>Pulacayo</strong> could expect to incur penalties per<br />

ton of lead concentrate as set out below.<br />

Table 19.14: Potential Penalties–Lead Concentrates<br />

Element Estimated Grade Penalty<br />

Arsenic 1.45% USD 17.25/dmt<br />

Antimony 1.23% USD 13.95/dmt<br />

19.4.6 Freight Allowance<br />

For deliveries of concentrates to the buyer’s/receiving smelter’s discharge port (CIF), there is<br />

typically no freight allowance provided to the buyer as the miner covers all costs to deliver the<br />

concentrates to destination (vessel loading, ocean freight, insurance). For deliveries to an<br />

intermediate destination (e.g. in warehouse at or near the load port, loaded on a vessel [FOB] or<br />

delivered to the buyer at the mine [FCA/EXW]), the miner will typically provide a freight allowance<br />

to the buyer to cover the typical costs which would otherwise be incurred to move the<br />

concentrates to their ultimate destination. This allowance is typically based on prevailing rates for<br />

movement of the concentrates either in bulk in vessels or by container and may be adjusted<br />

based on changes to prevailing market conditions. As noted above, the freight allowance may be<br />

rolled into the treatment charge or may be a standalone item but, in either case, the value of the<br />

freight allowance should be roughly equivalent to the actual costs associated with moving the<br />

concentrates from the point of delivery to their agreed upon destination.<br />

Similarly, if concentrates were to be delivered to a domestic smelter, or a destination other than<br />

an agreed upon market destination (typically China/Japan/Korea ex west coast South America<br />

but may be a main European port), the buyer may seek an allowance to cover the cost differential<br />

versus delivery to such other market destination. In this instance, the freight allowance is<br />

effectively a freight capture or locational advantage, which the buyer is expecting to benefit from<br />

either in full or in part.<br />

19.4.7 Quotational Period<br />

The Quotational Period (QP) is the month (typically, although it can be any period of time) during<br />

which the payable metals in the concentrates are priced when the concentrate is sold to a buyer.<br />

The QP is typically tied to the month of shipment or the month of vessel arrival at the discharge<br />

port when concentrate is being shipped by vessel by the seller, or tied to month of delivery when<br />

concentrates are being delivered to a buyer at a named destination (e.g. INW at or near the load<br />

port), and can range from month of shipment (and, in some instances, even prior to shipment) to<br />

several months after arrival at the delivery point. In long-term and medium-term contracts, the QP<br />

is usually defined although buyers frequently seek an option which allows them to change the QP<br />

month for a particular metal (or metals), which they exercise under certain market conditions.<br />

Traders will always seek QP options and the greater the range or flexibility that can be offered,<br />

the higher the value to the buyer, which can typically be translated into higher discounts to<br />

applicable charges. For zinc and lead, the QP will typically range from month of delivery/shipment<br />

to third or fourth month after month of delivery/vessel arrival at destination, although even more<br />

TWP Sudamérica S.A. Av. Encalada 1257 Of. 801, Santiago de Surco Lima 33, Perú (51-1) 4377473<br />

Page 232