NAVFAC P-300 Management of Transportation Equipment

NAVFAC P-300 Management of Transportation Equipment

NAVFAC P-300 Management of Transportation Equipment

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

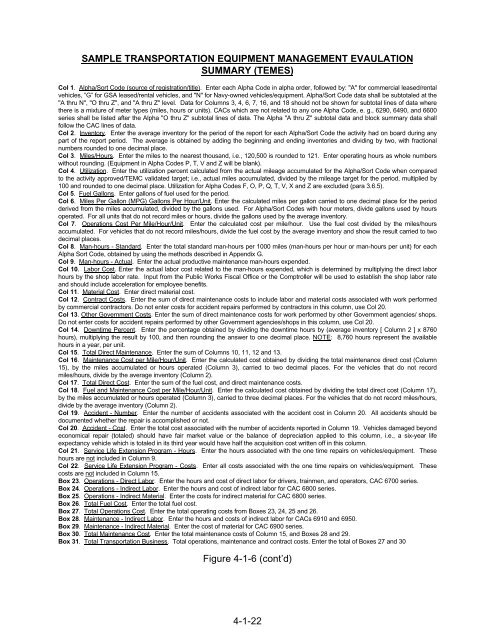

SAMPLE TRANSPORTATION EQUIPMENT MANAGEMENT EVAULATION<br />

SUMMARY (TEMES)<br />

Col 1. Alpha/Sort Code (source <strong>of</strong> registration/title). Enter each Alpha Code in alpha order, followed by: "A" for commercial leased/rental<br />

vehicles, ”G” for GSA leased/rental vehicles, and "N" for Navy-owned vehicles/equipment. Alpha/Sort Code data shall be subtotaled at the<br />

"A thru N", "O thru Z", and "A thru Z" level. Data for Columns 3, 4, 6, 7, 16, and 18 should not be shown for subtotal lines <strong>of</strong> data where<br />

there is a mixture <strong>of</strong> meter types (miles, hours or units). CACs which are not related to any one Alpha Code, e. g., 6290, 6490, and 6600<br />

series shall be listed after the Alpha "O thru Z" subtotal lines <strong>of</strong> data. The Alpha "A thru Z" subtotal data and block summary data shall<br />

follow the CAC lines <strong>of</strong> data.<br />

Col 2. Inventory. Enter the average inventory for the period <strong>of</strong> the report for each Alpha/Sort Code the activity had on board during any<br />

part <strong>of</strong> the report period. The average is obtained by adding the beginning and ending inventories and dividing by two, with fractional<br />

numbers rounded to one decimal place.<br />

Col 3. Miles/Hours. Enter the miles to the nearest thousand, i.e., 120,500 is rounded to 121. Enter operating hours as whole numbers<br />

without rounding. (<strong>Equipment</strong> in Alpha Codes P, T, V and Z will be blank).<br />

Col 4. Utilization. Enter the utilization percent calculated from the actual mileage accumulated for the Alpha/Sort Code when compared<br />

to the activity approved/TEMC validated target; i.e., actual miles accumulated, divided by the mileage target for the period, multiplied by<br />

100 and rounded to one decimal place. Utilization for Alpha Codes F, O, P, Q, T, V, X and Z are excluded (para 3.6.5).<br />

Col 5. Fuel Gallons. Enter gallons <strong>of</strong> fuel used for the period.<br />

Col 6. Miles Per Gallon (MPG) Gallons Per Hour/Unit. Enter the calculated miles per gallon carried to one decimal place for the period<br />

derived from the miles accumulated, divided by the gallons used. For Alpha/Sort Codes with hour meters, divide gallons used by hours<br />

operated. For all units that do not record miles or hours, divide the gallons used by the average inventory.<br />

Col 7. Operations Cost Per Mile/Hour/Unit. Enter the calculated cost per mile/hour. Use the fuel cost divided by the miles/hours<br />

accumulated. For vehicles that do not record miles/hours, divide the fuel cost by the average inventory and show the result carried to two<br />

decimal places.<br />

Col 8. Man-hours - Standard. Enter the total standard man-hours per 1000 miles (man-hours per hour or man-hours per unit) for each<br />

Alpha Sort Code, obtained by using the methods described in Appendix G.<br />

Col 9. Man-hours - Actual. Enter the actual productive maintenance man-hours expended.<br />

Col 10. Labor Cost. Enter the actual labor cost related to the man-hours expended, which is determined by multiplying the direct labor<br />

hours by the shop labor rate. Input from the Public Works Fiscal Office or the Comptroller will be used to establish the shop labor rate<br />

and should include acceleration for employee benefits.<br />

Col 11. Material Cost. Enter direct material cost.<br />

Col 12. Contract Costs. Enter the sum <strong>of</strong> direct maintenance costs to include labor and material costs associated with work performed<br />

by commercial contractors. Do not enter costs for accident repairs performed by contractors in this column, use Col 20.<br />

Col 13. Other Government Costs. Enter the sum <strong>of</strong> direct maintenance costs for work performed by other Government agencies/ shops.<br />

Do not enter costs for accident repairs performed by other Government agencies/shops in this column, use Col 20.<br />

Col 14. Downtime Percent. Enter the percentage obtained by dividing the downtime hours by (average inventory [ Column 2 ] x 8760<br />

hours), multiplying the result by 100, and then rounding the answer to one decimal place. NOTE: 8,760 hours represent the available<br />

hours in a year, per unit.<br />

Col 15. Total Direct Maintenance. Enter the sum <strong>of</strong> Columns 10, 11, 12 and 13.<br />

Col 16. Maintenance Cost per Mile/Hour/Unit. Enter the calculated cost obtained by dividing the total maintenance direct cost (Column<br />

15), by the miles accumulated or hours operated (Column 3), carried to two decimal places. For the vehicles that do not record<br />

miles/hours, divide by the average inventory (Column 2).<br />

Col 17. Total Direct Cost. Enter the sum <strong>of</strong> the fuel cost, and direct maintenance costs.<br />

Col 18. Fuel and Maintenance Cost per Mile/Hour/Unit. Enter the calculated cost obtained by dividing the total direct cost (Column 17),<br />

by the miles accumulated or hours operated (Column 3), carried to three decimal places. For the vehicles that do not record miles/hours,<br />

divide by the average inventory (Column 2).<br />

Col 19. Accident - Number. Enter the number <strong>of</strong> accidents associated with the accident cost in Column 20. All accidents should be<br />

documented whether the repair is accomplished or not.<br />

Col 20. Accident - Cost. Enter the total cost associated with the number <strong>of</strong> accidents reported in Column 19. Vehicles damaged beyond<br />

economical repair (totaled) should have fair market value or the balance <strong>of</strong> depreciation applied to this column, i.e., a six-year life<br />

expectancy vehicle which is totaled in its third year would have half the acquisition cost written <strong>of</strong>f in this column.<br />

Col 21. Service Life Extension Program - Hours. Enter the hours associated with the one time repairs on vehicles/equipment. These<br />

hours are not included in Column 9.<br />

Col 22. Service Life Extension Program - Costs. Enter all costs associated with the one time repairs on vehicles/equipment. These<br />

costs are not included in Column 15.<br />

Box 23. Operations - Direct Labor. Enter the hours and cost <strong>of</strong> direct labor for drivers, trainmen, and operators, CAC 6700 series.<br />

Box 24. Operations - Indirect Labor. Enter the hours and cost <strong>of</strong> indirect labor for CAC 6800 series.<br />

Box 25. Operations - Indirect Material. Enter the costs for indirect material for CAC 6800 series.<br />

Box 26. Total Fuel Cost. Enter the total fuel cost.<br />

Box 27. Total Operations Cost. Enter the total operating costs from Boxes 23, 24, 25 and 26.<br />

Box 28. Maintenance - Indirect Labor. Enter the hours and costs <strong>of</strong> indirect labor for CACs 6910 and 6950.<br />

Box 29. Maintenance - Indirect Material. Enter the cost <strong>of</strong> material for CAC 6900 series.<br />

Box 30. Total Maintenance Cost. Enter the total maintenance costs <strong>of</strong> Column 15, and Boxes 28 and 29.<br />

Box 31. Total <strong>Transportation</strong> Business. Total operations, maintenance and contract costs. Enter the total <strong>of</strong> Boxes 27 and 30<br />

Figure 4-1-6 (cont’d)<br />

4-1-22