- Page 1 and 2:

Naval Facilities Engineering Comman

- Page 3 and 4:

21A(1) 22A(1) 23(1) 24(1) 39(2) 41A

- Page 5 and 6:

ABSTRACT This publication provides

- Page 7 and 8:

CHAPTER 2. ADMINISTRATION CONTENTS

- Page 9 and 10:

CONTENTS PAGE NO. 2.14.16 REMOVAL O

- Page 11 and 12:

CONTENTS PAGE NO. 3.8.13 ACCIDENT R

- Page 13 and 14:

CHAPTER 4. MAINTENANCE CONTENTS PAG

- Page 15 and 16:

CHAPTER 5. EQUIPMENT SUPPORT FOR TH

- Page 17 and 18:

H-14 H-15 H-16 H-17 H-18 H-19 H-20

- Page 19 and 20:

augmented in depth and detail for N

- Page 21 and 22:

COMSECONDNCB and COMTHIRDNCB perfor

- Page 23 and 24:

1.7.5 Shore Activities a. Review an

- Page 25 and 26:

Commands/Major Claimants Holding CE

- Page 27 and 28:

duties. Persons who report to a reg

- Page 29 and 30:

1.13.5 Transportation Between Resid

- Page 31 and 32:

2.1 Assignment CHAPTER 2. ADMINISTR

- Page 33 and 34:

Commanding Officers can restrict th

- Page 35 and 36:

vehicles and equipment inventory ob

- Page 37 and 38:

2.1.9 Assignment to Commissaries, E

- Page 39 and 40:

General Policy of Vehicle Assignmen

- Page 41 and 42:

2.2.3 COMNAVFACENGCOM IO Review/App

- Page 43 and 44:

2.4.3 Transfers of Equipment by NCF

- Page 45 and 46:

2.5 Foreign Purchases. The Federal

- Page 47 and 48:

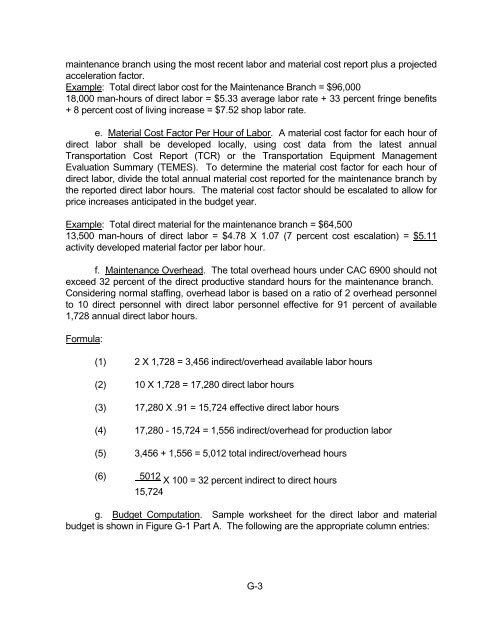

d. Direct Materials (1) Cost to rep

- Page 49 and 50:

2.8.2 Transportation Equipment P-1

- Page 51 and 52:

P1 LINE/LINE ITEM REFERENCE NUMBER

- Page 53 and 54:

2.8.4 DBOF Requirements Procedures.

- Page 55 and 56:

control. COMNAVFACENGCOM is also th

- Page 57 and 58:

c. Funding. The criteria for expens

- Page 59 and 60:

(6) Name and telephone number (comm

- Page 61:

LEASED VEHICLE REPORT FROM: (Activi

- Page 64 and 65:

2.9.10.2 Authority. Activity Comman

- Page 66 and 67:

equipment. Vehicles leased from the

- Page 68 and 69:

Classification of CESE by Assignmen

- Page 70 and 71:

2.10.3 Nonappropriated Fund Vehicle

- Page 72 and 73:

follows: (1) Disposal Process. A si

- Page 74 and 75:

o. Block 15 - Reimbursement Require

- Page 76 and 77:

2.13 Warranties and Deficiencies 2.

- Page 78 and 79:

2.13.8 Assistance with CESE Deficie

- Page 80 and 81:

e. Camouflage Painting of CESE (NCF

- Page 82 and 83:

(2) Location of Markings. (a) Side

- Page 84 and 85:

(4) Marking Colors. Painted and ela

- Page 86 and 87:

2.14.8 Warning Stripes for Vehicles

- Page 88 and 89:

cross on a 4-inch square white fiel

- Page 90 and 91:

h. Tie Down Markings. It is recomme

- Page 92 and 93:

(4) Provides equipment with operato

- Page 94 and 95:

(c) Keys. The Dispatcher controls t

- Page 96 and 97:

vehicles involved. Applicants for l

- Page 98 and 99:

d. Seabee Automated Mobile Manageme

- Page 100 and 101:

(3) Implement revised dispatching p

- Page 102 and 103:

CHAPTER 3. OPERATIONS This chapter

- Page 104 and 105:

a. Application of the various types

- Page 106 and 107:

(3) Public Law 100-180 amended 10 U

- Page 108 and 109:

tickets. In considering the type of

- Page 110 and 111:

3.3.4 Transportation for Morale, We

- Page 112 and 113:

the use of the siren or red light i

- Page 114 and 115:

activity assignments, annual utiliz

- Page 116 and 117:

h. Column 8 - Ending Inventory. Ent

- Page 118 and 119:

3.7 Guidelines for Achieving Motor

- Page 120 and 121:

3.9. (See Appendix H Figures H-18 a

- Page 122 and 123:

. Vehicles over 10,000 pounds GVW;

- Page 124 and 125:

applicants knowledge and operationa

- Page 126 and 127:

demonstrate competence in driving t

- Page 128 and 129:

(1) Has a manufacturer's gross vehi

- Page 130 and 131:

Construction Equipment Requiring Li

- Page 132 and 133:

3.9.5 Use and Limitations of Licens

- Page 134 and 135:

States Civil Service Commission Cer

- Page 136 and 137:

d. Notation on Failures. A short li

- Page 138 and 139:

(1) Date Revoked, NAVFAC 11260/3. A

- Page 140 and 141:

3.15.2 Equipment Not Replaced by th

- Page 142 and 143:

3.20.1 Exceptions. Fire extinguishe

- Page 144 and 145:

(1) The sides and the end must be e

- Page 146:

(3) Origin and destination of the m

- Page 149 and 150:

3.25.5 Work Requests. Requests for

- Page 151 and 152:

permit. This on-the-scene level of

- Page 153 and 154:

CHAPTER 4. MAINTENANCE SECTION 1. S

- Page 155 and 156:

where specialized skills, tooling,

- Page 157 and 158:

4-1.7 Maintenance Coordination a. C

- Page 159:

the direct labor necessary to maint

- Page 163 and 164:

4-1.8.5 Inventory Objective (IO) Co

- Page 165 and 166:

4-1.8.8 Direct Labor Productivity.

- Page 167 and 168:

g. Copies of any applicable quality

- Page 169 and 170:

a. Average inventory levels; b. Mil

- Page 171:

23.3

- Page 175:

c. Vehicles/equipment in process by

- Page 178 and 179:

(8) Assume responsibility for stagi

- Page 180 and 181:

(2) Furnish basic information for m

- Page 182 and 183:

eturned. (3) A copy shall be retain

- Page 184 and 185:

Sample Vehicle Safety Inspection St

- Page 186 and 187:

(1) Date of inspection (2) Name and

- Page 188 and 189:

(5) On air brake systems, inspect a

- Page 190 and 191:

4-1.10.7 Tire Maintenance. Tire and

- Page 192 and 193:

4-1.11.2 Operator's Daily Inspectio

- Page 194 and 195:

load test. A permanent tram point b

- Page 196 and 197:

Device; (2) ANSI A92.2-1979, Vehicl

- Page 198 and 199:

protective coatings and adequate ma

- Page 200 and 201:

support areas to production bays, c

- Page 202 and 203:

epair work that pertains to inspect

- Page 204 and 205:

NOTE: Amphibious Construction Batta

- Page 206 and 207:

PREVENTIVE MAINTENANCE INSPECTION S

- Page 208 and 209:

frequent intervals, shall be the de

- Page 210 and 211:

, f. Equipment Downtime. Blocks 27

- Page 212 and 213:

42.5 Maintenance Program Evaluation

- Page 214 and 215:

(3) CESE Maintenance Cost Check. Th

- Page 216 and 217:

The following is a complete list of

- Page 218 and 219:

should designate one person, normal

- Page 220 and 221:

. Justification. Justification for

- Page 222 and 223:

G Major detachments with an interme

- Page 224 and 225:

FIGURE 5-1 Allowance Change Request

- Page 226 and 227:

NOTE: Manufacturers identify vehicl

- Page 228 and 229:

NAVSUP Form 1250-1 5.6.2 Completion

- Page 230 and 231: determined, Block 21 and the first

- Page 232 and 233: When the part is issued, line throu

- Page 234 and 235: Date Dept. No. Req. No. UND Nomencl

- Page 236 and 237: APPENDIX A. DEFINITIONS AND TERMS N

- Page 238 and 239: Incidental Driver. A person, other

- Page 240 and 241: and wreckers. The term includes veh

- Page 242 and 243: CFE CONTRACTOR FURNISHED EQUIPMENT

- Page 244 and 245: JAG JUDGE ADVOCATE GENERAL JCCO JOI

- Page 246 and 247: RFI READY FOR ISSUE RIC REPAIRABLE

- Page 248 and 249: APPENDIX C PREPARATION INSTRUCTIONS

- Page 250 and 251: (10) Excess/Remarks. Completed by C

- Page 252 and 253: APPENDIX D. ATTACHMENT MANAGEMENT F

- Page 254 and 255: First Segment List of Attachment Id

- Page 256 and 257: Equipment Attachment Registration R

- Page 258 and 259: . Transfer to Another Activity. Unl

- Page 260 and 261: (1) The Bulk type is open and used

- Page 262 and 263: . Surveillance. In all instances wh

- Page 264 and 265: 17. Technical Manuals. Technical ma

- Page 266 and 267: National Stock Number/Navy Item Con

- Page 268 and 269: 3. Claimants requiring specialized

- Page 270 and 271: APPENDIX F. REPLACEMENT AND REPAIR

- Page 272 and 273: NAVFAC Life Expectancy Equip. Alpha

- Page 274 and 275: NAVFAC Life Expectancy Equip. Alpha

- Page 276 and 277: NAVFAC Life Expectancy Equip. Alpha

- Page 278 and 279: 8252 Y CRANE CARRIER TORPEDO HANDLI

- Page 282 and 283: COLUMN (1) EQUIP. CODE. List NAVFAC

- Page 284 and 285: NAVFAC Equip. Code Alpha Code Man-h

- Page 286 and 287: NAVFAC Equip. Code Alpha Code Man-h

- Page 288 and 289: NAVFAC Equip. Code Alpha Code Man-h

- Page 290 and 291: NAVFAC Equip. Code Alpha Code Man-h

- Page 292 and 293: NAVFAC Equip. Code Alpha Code Man-h

- Page 294 and 295: APPENDIX H (FORMS)

- Page 296 and 297: ACTIVITY NAME NAVSTA ADAK CLAIMANT

- Page 298 and 299: CRANE REQUIREMENTS DATA SHEET (Cont

- Page 300 and 301: CRANE REQUIREMENTS DATA SHEET (Samp

- Page 302 and 303: ACCESSORIES: TRUCK TRACTOR DATA SHE

- Page 304 and 305: TRUCK TRACTOR DATA SHEET (USER REQU

- Page 306 and 307: ECONOMIC ANALYSIS Cost Factors (Con

- Page 308 and 309: Report of Excess Personal Property

- Page 310 and 311: Quality Deficiency Report (SF-3681

- Page 312 and 313: Quality Deficiency Report (Sample)

- Page 314 and 315: Motor Equipment Utilization Record

- Page 316 and 317: Dispatcher’s Log: (NAVFAC Form 11

- Page 319 and 320: Alpha Code Description Figure H-15

- Page 321 and 322: Construction Equipment Operator’s

- Page 323: Application for Construction Equipm

- Page 326: Operator’s Inspection Guide and T

- Page 329 and 330: Maintenance Inspection/Service Reco

- Page 331 and 332:

DoD PROPERTY RECORD (DD 1342) H-37

- Page 333 and 334:

Figure H-26 (cont’d) 16 Manufactu

- Page 335 and 336:

(2) Cylinders make, model, Mfr. par

- Page 337 and 338:

54. Remarks. Block Entry A. Transac

- Page 341 and 342:

STEP 1 Equipment Repair Order Flow

- Page 343 and 344:

NOTE: If repair parts required are

- Page 345 and 346:

APPENDIX I. TRANSPORTATION EQUIPMEN

- Page 347 and 348:

TRANSACTION CODES Transaction Codes

- Page 349 and 350:

Code Title Definition STATUS CODES

- Page 351 and 352:

(1) Primer (wash) pretreatment TABL

- Page 353 and 354:

TABLE J-1. Paint National Stock Num

- Page 355 and 356:

1 Wash with liquid detergent, NSN 7

- Page 357 and 358:

R = REFERENCE DISTANCE B = BAND WID

- Page 359 and 360:

Vehicle and Equipment Colors and Ma

- Page 361 and 362:

3. Corrosion Control a. Corrosion C

- Page 363 and 364:

DOT Placard for Flammables Figure J

- Page 365 and 366:

Locations of Markings Figure J-6 J-

- Page 367 and 368:

Locations of Markings Figure J-6 (c

- Page 369 and 370:

Locations of Markings Figure J-6 (c

- Page 371 and 372:

Locations of Markings Figure J-6 (c

- Page 373 and 374:

Locations of Markings Figure J-6 (c

- Page 375 and 376:

Locations of Markings Figure J-6 (c

- Page 377 and 378:

APPENDIX K. NAVAL CONSTRUCTION FORC

- Page 379 and 380:

Item Service Item Description A B C

- Page 381 and 382:

Item Service Item Description A B C

- Page 383 and 384:

Item Service Item Description A B C

- Page 385 and 386:

Item Service Item Description A B C

- Page 387 and 388:

Item Service Item Description A B C

- Page 389 and 390:

Item Service Item Description A B C

- Page 391 and 392:

d. CF4 - High-Speed Four-Stroke-Cyc

- Page 393 and 394:

COMMERCIAL HD ENGINE OILS Military

- Page 395 and 396:

GEAR LUBRICANTS Military Military S

- Page 397 and 398:

police cars, etc.) or under severe

- Page 399 and 400:

6. Miscellaneous Lubricants PTL Lub

- Page 401 and 402:

Section 2. APPROVED FUELS FOR USE B

- Page 403 and 404:

Military Symbol Quantity NSN DFA (U

- Page 405 and 406:

d. If cost effective, use an antifr

- Page 407 and 408:

. MIL-C-16173. Extended under cover

- Page 409 and 410:

h. MIL-G-10924. For the lubrication

- Page 411 and 412:

APPENDIX N. LIVE STORAGE FOR CIVIL

- Page 413 and 414:

FIGURE N-2. Live Storage Service Sh

- Page 415 and 416:

(c) Batteries are fully charged and

- Page 417 and 418:

(5) Any Direct Turnover (DTO) parts

- Page 419 and 420:

Department of Transportation, 400 S

- Page 421 and 422:

Occupational Safety and Health Act

- Page 423 and 424:

PARAGRAPH TOPIC PAGE 2.3 BUDGETING

- Page 425 and 426:

PARAGRAPH TOPIC PAGE 2.1.2.a(4) EXE

- Page 427 and 428:

PARAGRAPH TOPIC PAGE 5.1 LOGISTIC S

- Page 429 and 430:

PARAGRAPH TOPIC PAGE 3.19 PAYMENT O

- Page 431 and 432:

PARAGRAPH TOPIC PAGE 4-1.9.4 SUPPLY