We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

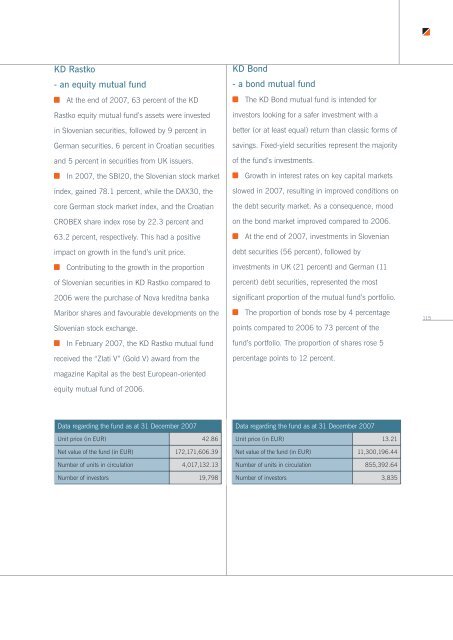

KD Rastko<br />

- an equity mutual fund<br />

At the end of 2007, 63 percent of the KD<br />

Rastko equity mutual fund’s assets were invested<br />

in Slovenian securities, followed by 9 percent in<br />

German securities, 6 percent in Croatian securities<br />

<strong>and</strong> 5 percent in securities from UK issuers.<br />

In 2007, the SBI20, the Slovenian stock market<br />

index, gained 78.1 percent, while the DAX30, the<br />

core German stock market index, <strong>and</strong> the Croatian<br />

CROBEX share index rose by 22.3 percent <strong>and</strong><br />

63.2 percent, respectively. This had a positive<br />

impact on growth in the fund’s unit price.<br />

Contributing to the growth in the proportion<br />

of Slovenian securities in KD Rastko compared to<br />

2006 were the purchase of Nova kreditna banka<br />

Maribor shares <strong>and</strong> favourable developments on the<br />

Slovenian stock exchange.<br />

In February 2007, the KD Rastko mutual fund<br />

received the “Zlati V” (Gold V) award from the<br />

magazine Kapital as the best European-oriented<br />

equity mutual fund of 2006.<br />

KD Bond<br />

- a bond mutual fund<br />

The KD Bond mutual fund is intended for<br />

investors looking for a safer investment with a<br />

better (or at least equal) return than classic forms of<br />

savings. Fixed-yield securities represent the majority<br />

of the fund’s investments.<br />

Growth in interest rates on key capital markets<br />

slowed in 2007, resulting in improved conditions on<br />

the debt security market. As a consequence, mood<br />

on the bond market improved compared to 2006.<br />

At the end of 2007, investments in Slovenian<br />

debt securities (56 percent), followed by<br />

investments in UK (21 percent) <strong>and</strong> German (11<br />

percent) debt securities, represented the most<br />

significant proportion of the mutual fund’s portfolio.<br />

The proportion of bonds rose by 4 percentage<br />

points compared to 2006 to 73 percent of the<br />

fund’s portfolio. The proportion of shares rose 5<br />

percentage points to 12 percent.<br />

115<br />

Data regarding the fund as at 31 December 2007<br />

Unit price (in EUR) 42.86<br />

Net value of the fund (in EUR) 172,171,606.39<br />

Number of units in circulation 4,017,132.13<br />

Number of investors 19,798<br />

Data regarding the fund as at 31 December 2007<br />

Unit price (in EUR) 13.21<br />

Net value of the fund (in EUR) 11,300,196.44<br />

Number of units in circulation 855,392.64<br />

Number of investors 3,835