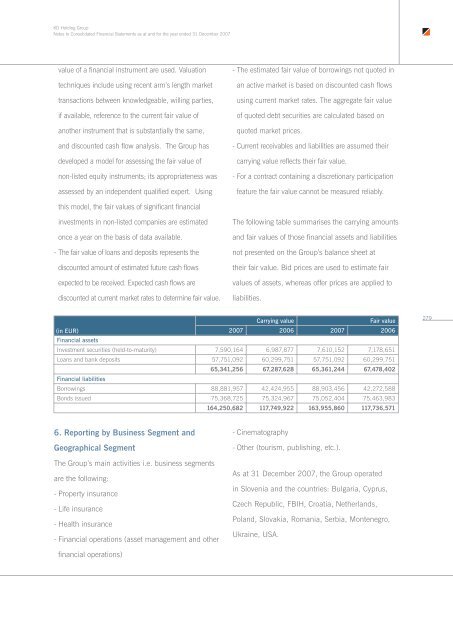

KD Holding Group Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007 value of a financial instrument are used. Valuation techniques include using recent arm’s length market transactions between knowledgeable, willing parties, if available, reference to the current fair value of another instrument that is substantially the same, <strong>and</strong> discounted cash flow analysis. The Group has developed a model for assessing the fair value of non-listed equity instruments; its appropriateness was assessed by an independent qualified expert. Using - The estimated fair value of borrowings not quoted in an active market is based on discounted cash flows using current market rates. The aggregate fair value of quoted debt securities are calculated based on quoted market prices. - Current receivables <strong>and</strong> liabilities are assumed their carrying value reflects their fair value. - For a contract containing a discretionary participation feature the fair value cannot be measured reliably. this model, the fair values of significant financial investments in non-listed companies are estimated once a year on the basis of data available. - The fair value of loans <strong>and</strong> deposits represents the discounted amount of estimated future cash flows expected to be received. Expected cash flows are discounted at current market rates to determine fair value. The following table summarises the carrying amounts <strong>and</strong> fair values of those financial assets <strong>and</strong> liabilities not presented on the Group’s balance sheet at their fair value. Bid prices are used to estimate fair values of assets, whereas offer prices are applied to liabilities. Carrying value Fair value (in EUR) 2007 2006 2007 2006 Financial assets Investment securities (held-to-maturity) 7,590,164 6,987,877 7,610,152 7,178,651 Loans <strong>and</strong> bank deposits 57,751,092 60,299,751 57,751,092 60,299,751 65,341,256 67,287,628 65,361,244 67,478,402 Financial liabilities Borrowings 88,881,957 42,424,955 88,903,456 42,272,588 Bonds issued 75,368,725 75,324,967 75,052,404 75,463,983 164,250,682 117,749,922 163,955,860 117,736,571 279 6. Reporting by Business Segment <strong>and</strong> Geographical Segment The Group’s main activities i.e. <strong>business</strong> segments are the following: - Property insurance - Life insurance - Health insurance - Financial operations (asset management <strong>and</strong> other - Cinematography - Other (tourism, publishing, etc.). As at 31 December 2007, the Group operated in Slovenia <strong>and</strong> the countries: Bulgaria, Cyprus, Czech Republic, FBIH, Croatia, Netherl<strong>and</strong>s, Pol<strong>and</strong>, Slovakia, Romania, Serbia, Montenegro, Ukraine, USA. financial operations)

KD Holding Group Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007 6.1 Primary reporting format – <strong>business</strong> segment 6.1.1 Performance by <strong>business</strong> segment The segment results for the year ended 31 December 2007 are as follows: Property Life Health Financial Cinema- Other Group (in EUR) insurance insurance insurance operations tography Total gross segment sales 123,271,148 54,579,703 77,890,381 18,146,895 16,108,308 23,130,838 313,127,273 Inter-segment sales (580,450) (317,192) (6,001) (3,245,230) (25,342) (215,619) (4,389,834) Sales 122,690,698 54,262,511 77,884,380 14,901,665 16,082,966 22,915,219 308,737,439 Operating profit/Segment result 16,246,123 2,622,709 2,146,382 8,578,393 (736,000) 1,005,734 29,863,341 Finance costs – net (271,683) 21,194 5,262 (3,985,445) (1,314,797) 31,669 (5,513,800) Property Life Health Financial Cinema- Other Group (in EUR) insurance insurance insurance operations tography Total gross segment sales 131,995,552 87,014,283 89,226,380 34,570,638 18,699,600 28,344,158 389,850,611 Inter-segment sales (536,557) (10,930,946) (6,049) (6,019,053) (20,629) (346,324) (17,859,558) Sales 131,458,995 76,083,337 89,220,331 28,551,585 18,678,971 27,997,834 371,991,053 Operating profit/Segment result 28,124,164 (101,495) 4,628,423 11,269,112 151,272 (1,202,966) 42,868,509 Finance costs – net (429,606) 1,107,568 (46,050) (4,142,700) (1,704,774) (1,337,071) (6,552,633) Share of profit of associates 898,260 262,634 - 9,973,103 (6,022) 13,049 11,141,024 Profit before income tax 28,592,818 1,268,707 4,582,373 17,099,515 (1,559,524) (2,526,988) 47,456,900 Income tax expense (6,321,004) (1,198,100) (1,563,428) (2,553,139) (862,618) (13,027) (12,511,316) Profit for the year 22,271,814 70,607 3,018,945 14,546,376 (2,422,142) (2,540,015) 34,945,584 The segment results for the year ended 31 December 2006 are as follows: 2007 280 2006 Share of profit of associates 2,057,261 206,685 - 2,134,693 (31,614) 5,805 4,372,830 Profit before income tax 18,031,701 2,850,588 2,151,644 6,727,641 (2,082,411) 1,043,208 28,722,371 Income tax expense (5,663,729) (974,587) (622,137) (333,588) 782,862 (1,034,423) (7,845,602) Profit for the year 12,367,972 1,876,001 1,529,507 6,394,053 (1,299,549) 8,785 20,876,769 The costs are allocated to segments as they originally occur in the operations of the each <strong>business</strong> segment <strong>and</strong> as it is reported by the subsidiaries which are included in the relevant segment. Other segment items included in the income statement for the year ended 31 December 2007 are as follows: 2007 Property Life Health Financial Cinema (in EUR) insurance insurance insurance operations tography Other Group Depreciation <strong>and</strong> amortisation (1,649,232) (739,127) (751,799) (659,514) (4,156,186) (259,698) (8,215,555) Impairment of trade receivables (8,771,977) (237,771) (1,107,971) (114,118) (103,372) (181,630) (10,516,839) Other segment items included in the income statement for the year ended 31 December 2006 are as follows: 2006 Property Life Health Financial Cinema (in EUR) insurance insurance insurance operations tography Other Group Depreciation <strong>and</strong> amortisation (2,231,485) (380,792) (62,185) (574,691) (3,501,736) (166,816) (6,917,705) Impairment of l<strong>and</strong> <strong>and</strong> property - - - (1,569,005) - - (1,569,005) Impairment of trade receivables (2,048,932) (47,046) (1,468,736) (6,948) (407,774) (35,231) (4,014,667)

- Page 2:

“With extended pictures and image

- Page 6 and 7:

Contents Company profile Important

- Page 8 and 9:

Company profile Parent company: KD

- Page 10 and 11:

Sales of financial services Last ye

- Page 12:

When we gathered together at the fi

- Page 15 and 16:

Management Team 14 Janez Bojc, Depu

- Page 17 and 18:

16 Aljoša Tomaž, Assistant to the

- Page 19 and 20:

18 Matija Šenk, President of the M

- Page 21 and 22:

KD Holding Group key divisions Inve

- Page 23 and 24:

Companies in the KD Holding Group b

- Page 25 and 26:

24 Piran saltpans, Slovenia

- Page 27 and 28:

26 Ljubljanica River, Slovenia

- Page 29 and 30:

2005 Establishment of the first spe

- Page 31 and 32:

30 Key events in 2007 January The o

- Page 33 and 34:

November KD Investments in Slovenia

- Page 35 and 36:

34 Old city centre, Ljubljana, Slov

- Page 37 and 38:

1. Poslovno poročilo Skupine KD Ho

- Page 39 and 40:

1.1 Strategic orientations of the K

- Page 41 and 42:

Continuing along the same path in 2

- Page 43 and 44:

Share price movement There were 3,2

- Page 45 and 46:

Ownership structure The largest sha

- Page 47 and 48:

1.3 Corporate governance report Res

- Page 49 and 50:

Alojz Penko Alojz Penko was first a

- Page 51 and 52:

The members of the Management Board

- Page 53 and 54:

7. AUDITING AND THE SYSTEM OF INTER

- Page 55 and 56:

Highlights from the income statemen

- Page 57 and 58:

Sales revenue Sales revenue 8 amoun

- Page 59 and 60:

Operating expenses Operating expens

- Page 61 and 62:

Net profit by business segment in 2

- Page 63 and 64:

Financing Due to the high growth in

- Page 65 and 66:

1.5 Risk Management 64 The Manageme

- Page 67 and 68:

66 Parameters defining the insuranc

- Page 69 and 70:

68 Bratislava, Slovakia

- Page 71 and 72:

70 Croatian Istria - portrait

- Page 73 and 74:

1.6 Human resource management At th

- Page 75 and 76:

Employee educational structure More

- Page 77 and 78:

Number and educational structure of

- Page 79 and 80:

78 Kalemegdan - Belgrade, Serbia

- Page 81 and 82:

80 Belgrade, Serbia

- Page 83 and 84:

1.7 Corporate communications Intern

- Page 85 and 86:

1.8 Information support using the s

- Page 87 and 88:

to Fondpolica investment funds with

- Page 89:

88 Belgrade, Serbia

- Page 92 and 93:

cultural institutions and with indi

- Page 94 and 95:

The main focus at Adriatic Slovenic

- Page 96 and 97:

Corporate social responsibility in

- Page 98 and 99:

Kalemegdan - Belgrade, Serbia 97

- Page 100 and 101:

Slovenija - solinar Fisherman, isla

- Page 102 and 103:

Celica Hostel, Ljubljana, Slovenia

- Page 104 and 105:

2. Operations of the companies with

- Page 106 and 107:

107

- Page 108 and 109:

In asset management business, our i

- Page 110 and 111:

2. 1 Asset management The Group’s

- Page 112 and 113:

Challenges in 2008: Maintaining our

- Page 114 and 115:

Slovenia KD Investments, družba za

- Page 116 and 117:

KD Rastko - an equity mutual fund A

- Page 118 and 119:

second half of the year, prices beg

- Page 120 and 121:

The structure of the portfolio, com

- Page 122 and 123:

Croatia KD Investments d. o. o., Za

- Page 124 and 125:

KD Adria Bond, - a bond mutual fund

- Page 126 and 127:

Slovakia KD Investments, správ. sp

- Page 128 and 129:

Bratislava, Slovakia 127

- Page 130 and 131:

Romania SAI KD Investments Romania,

- Page 132 and 133:

KD Multifond - a fund of funds At t

- Page 134 and 135:

Bulgaria KD Investments EAD, Sofia

- Page 136 and 137:

KD Equity Bulgaria - an equity mutu

- Page 138 and 139:

Serbia KD Investments, a. d., Belgr

- Page 140 and 141:

Slovenia KD BPD, borznoposredniška

- Page 142 and 143:

We successfully responded to Sloven

- Page 144 and 145:

Bulgaria KD Securities EAD, Sofia N

- Page 146 and 147:

Our insurance activities embody the

- Page 148 and 149:

147

- Page 150 and 151:

Structure of insurance within KD Ho

- Page 152 and 153:

Structure of health insurance premi

- Page 154 and 155:

was above average in terms of reput

- Page 156 and 157:

In 2007 Adriatic Slovenica’s work

- Page 158 and 159:

Structure of KD Življenje premiums

- Page 160 and 161:

Romania KD Life Asigurari S. A., Bu

- Page 162 and 163:

Slovakia KD LIFE, Insurance company

- Page 164 and 165:

Eastern Orthodox priest, Macedonia

- Page 166 and 167:

Do you think it is possible to comb

- Page 168 and 169:

Operations in 2007 To increase sale

- Page 170 and 171:

Terazije, Belgrade, Serbia 169

- Page 172 and 173:

But we also build literally: we hav

- Page 174 and 175:

Investment strategy The amount inve

- Page 176 and 177:

Closed-end Investment fund BIG d. d

- Page 178 and 179:

Challenges in 2008: The company’s

- Page 180 and 181:

179

- Page 182 and 183:

Challenges in 2008: To obtain the r

- Page 184 and 185:

may choose between the following ma

- Page 186 and 187:

A selection of the most important a

- Page 188 and 189:

The company designed, developed and

- Page 190 and 191:

Sofia, Bulgaria 189

- Page 192 and 193:

KD Holding Group Consolidated Finan

- Page 194 and 195:

KD Holding Group Consolidated Finan

- Page 196 and 197:

KD Holding Group Consolidated Finan

- Page 198 and 199:

KD Holding Group Consolidated Finan

- Page 200 and 201:

KD Holding Group Consolidated Finan

- Page 202 and 203:

KD Holding Group Notes to Consolida

- Page 204 and 205:

KD Holding Group Notes to Consolida

- Page 206 and 207:

KD Holding Group Notes to Consolida

- Page 208 and 209:

KD Holding Group Notes to Consolida

- Page 210 and 211:

KD Holding Group Notes to Consolida

- Page 212 and 213:

KD Holding Group Notes to Consolida

- Page 214 and 215:

KD Holding Group Notes to Consolida

- Page 216 and 217:

KD Holding Group Notes to Consolida

- Page 218 and 219:

KD Holding Group Notes to Consolida

- Page 220 and 221:

KD Holding Group Notes to Consolida

- Page 222 and 223:

KD Holding Group Notes to Consolida

- Page 224 and 225:

KD Holding Group Notes to Consolida

- Page 226 and 227:

KD Holding Group Notes to Consolida

- Page 228 and 229: KD Holding Group Notes to Consolida

- Page 230 and 231: KD Holding Group Notes to Consolida

- Page 232 and 233: KD Holding Group Notes to Consolida

- Page 234 and 235: KD Holding Group Notes to Consolida

- Page 236 and 237: KD Holding Group Notes to Consolida

- Page 238 and 239: KD Holding Group Notes to Consolida

- Page 240 and 241: KD Holding Group Notes to Consolida

- Page 242 and 243: KD Holding Group Notes to Consolida

- Page 244 and 245: KD Holding Group Notes to Consolida

- Page 246 and 247: KD Holding Group Notes to Consolida

- Page 248 and 249: KD Holding Group Notes to Consolida

- Page 250 and 251: KD Holding Group Notes to Consolida

- Page 252 and 253: KD Holding Group Notes to Consolida

- Page 254 and 255: KD Holding Group Notes to Consolida

- Page 256 and 257: KD Holding Group Notes to Consolida

- Page 258 and 259: KD Holding Group Notes to Consolida

- Page 260 and 261: KD Holding Group Notes to Consolida

- Page 262 and 263: KD Holding Group Notes to Consolida

- Page 264 and 265: KD Holding Group Notes to Consolida

- Page 266 and 267: KD Holding Group Notes to Consolida

- Page 268 and 269: KD Holding Group Notes to Consolida

- Page 270 and 271: KD Holding Group Notes to Consolida

- Page 272 and 273: KD Holding Group Notes to Consolida

- Page 274 and 275: KD Holding Group Notes to Consolida

- Page 276 and 277: KD Holding Group Notes to Consolida

- Page 280 and 281: KD Holding Group Notes to Consolida

- Page 282 and 283: KD Holding Group Notes to Consolida

- Page 284 and 285: KD Holding Group Notes to Consolida

- Page 286 and 287: KD Holding Group Notes to Consolida

- Page 288 and 289: KD Holding Group Notes to Consolida

- Page 290 and 291: KD Holding Group Notes to Consolida

- Page 292 and 293: KD Holding Group Notes to Consolida

- Page 294 and 295: KD Holding Group Notes to Consolida

- Page 296 and 297: KD Holding Group Notes to Consolida

- Page 298 and 299: KD Holding Group Notes to Consolida

- Page 300 and 301: KD Holding Group Notes to Consolida

- Page 302 and 303: KD Holding Group Notes to Consolida

- Page 304 and 305: KD Holding Group Notes to Consolida

- Page 306 and 307: KD Holding Group Notes to Consolida

- Page 308 and 309: KD Holding Group Notes to Consolida

- Page 310 and 311: KD Holding Group Notes to Consolida

- Page 312 and 313: KD Holding Group Notes to Consolida

- Page 314 and 315: KD Holding Group Notes to Consolida

- Page 316 and 317: KD Holding Group Notes to Consolida

- Page 318 and 319: KD Holding Group Consolidated Finan