We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

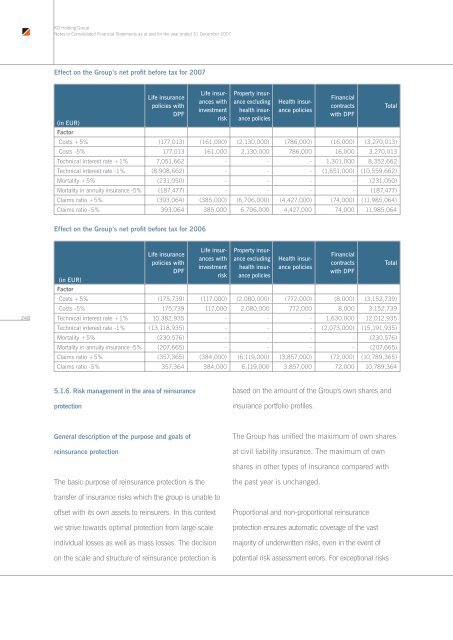

Effect on the Group’s net profit before tax for 2007<br />

(in EUR)<br />

Life insurance<br />

policies with<br />

DPF<br />

Life insurances<br />

with<br />

investment<br />

risk<br />

Property insurance<br />

excluding<br />

health insurance<br />

policies<br />

Health insurance<br />

policies<br />

Financial<br />

contracts<br />

with DPF<br />

Factor<br />

Costs +5% (177,013) (161,000) (2,130,000) (786,000) (16,000) (3,270,013)<br />

Costs -5% 177,013 161,000 2,130,000 786,000 16,000 3,270,013<br />

Technical interest rate +1% 7,051,662 - - - 1,301,000 8,352,662<br />

Technical interest rate -1% (8,908,662) - - - (1,651,000) (10,559,662)<br />

Mortality +5% (231,050) - - - - (231,050)<br />

Mortality in annuity insurance -5% (187,477) - - - - (187,477)<br />

Claims ratio +5% (393,064) (385,000) (6,706,000) (4,427,000) (74,000) (11,985,064)<br />

Claims ratio -5% 393,064 385,000 6,706,000 4,427,000 74,000 11,985,064<br />

Total<br />

Effect on the Group’s net profit before tax for 2006<br />

248<br />

(in EUR)<br />

Life insurance<br />

policies with<br />

DPF<br />

Life insurances<br />

with<br />

investment<br />

risk<br />

Property insurance<br />

excluding<br />

health insurance<br />

policies<br />

Health insurance<br />

policies<br />

Financial<br />

contracts<br />

with DPF<br />

Factor<br />

Costs +5% (175,739) (117,000) (2,080,000) (772,000) (8,000) (3,152,739)<br />

Costs -5% 175,739 117,000 2,080,000 772,000 8,000 3,152,739<br />

Technical interest rate +1% 10,382,935 - - - 1,630,000 12,012,935<br />

Technical interest rate -1% (13,118,935) - - - (2,073,000) (15,191,935)<br />

Mortality +5% (230,576) - - - - (230,576)<br />

Mortality in annuity insurance -5% (207,665) - - - - (207,665)<br />

Claims ratio +5% (357,365) (384,000) (6,119,000) (3,857,000) (72,000) (10,789,365)<br />

Claims ratio -5% 357,364 384,000 6,119,000 3,857,000 72,000 10,789,364<br />

Total<br />

5.1.6. Risk management in the area of reinsurance<br />

protection<br />

based on the amount of the Group's own shares <strong>and</strong><br />

insurance portfolio profiles.<br />

General description of the purpose <strong>and</strong> goals of<br />

reinsurance protection<br />

The Group has unified the maximum of own shares<br />

at civil liability insurance. The maximum of own<br />

shares in other types of insurance compared with<br />

The basic purpose of reinsurance protection is the<br />

the past year is unchanged.<br />

transfer of insurance risks which the <strong>group</strong> is unable to<br />

offset with its own assets to reinsurers. In this context<br />

we strive towards optimal protection from large-scale<br />

individual losses as well as mass losses. The decision<br />

on the scale <strong>and</strong> structure of reinsurance protection is<br />

Proportional <strong>and</strong> non-proportional reinsurance<br />

protection ensures automatic coverage of the vast<br />

majority of underwritten risks, even in the event of<br />

potential risk assessment errors. For exceptional risks