We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

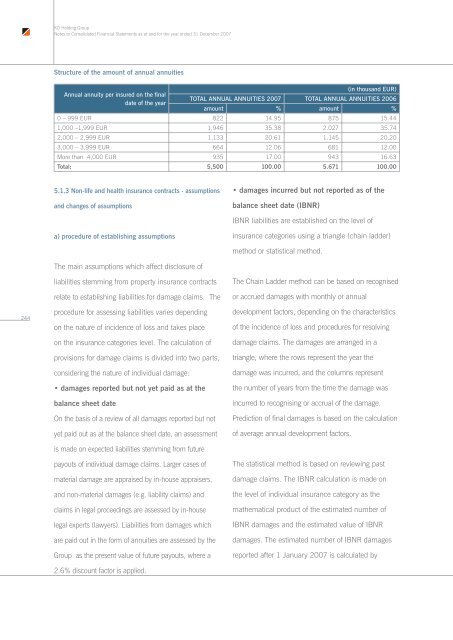

Structure of the amount of annual annuities<br />

(in thous<strong>and</strong> EUR)<br />

Annual annuity per insured on the final<br />

TOTAL ANNUAL ANNUITIES 2007 TOTAL ANNUAL ANNUITIES 2006<br />

date of the year<br />

amount % amount %<br />

0 – 999 EUR 822 14.95 875 15.44<br />

1,000 –1,999 EUR 1,946 35.38 2.027 35.74<br />

2,000 – 2,999 EUR 1,133 20.61 1.145 20.20<br />

3,000 – 3,999 EUR 664 12.06 681 12.00<br />

More than 4,000 EUR 935 17.00 943 16.63<br />

Total: 5,500 100.00 5.671 100.00<br />

5.1.3 Non-life <strong>and</strong> health insurance contracts - assumptions<br />

<strong>and</strong> changes of assumptions<br />

<br />

balance sheet date (IBNR)<br />

IBNR liabilities are established on the level of<br />

a) procedure of establishing assumptions<br />

insurance categories using a triangle (chain ladder)<br />

method or statistical method.<br />

The main assumptions which affect disclosure of<br />

244<br />

liabilities stemming from property insurance contracts<br />

relate to establishing liabilities for damage claims. The<br />

procedure for assessing liabilities varies depending<br />

on the nature of incidence of loss <strong>and</strong> takes place<br />

on the insurance categories level. The calculation of<br />

provisions for damage claims is divided into two parts,<br />

considering the nature of individual damage:<br />

<br />

balance sheet date<br />

On the basis of a review of all damages reported but not<br />

yet paid out as at the balance sheet date, an assessment<br />

is made on expected liabilities stemming from future<br />

payouts of individual damage claims. Larger cases of<br />

material damage are appraised by in-house appraisers,<br />

<strong>and</strong> non-material damages (e.g. liability claims) <strong>and</strong><br />

claims in legal proceedings are assessed by in-house<br />

legal experts (lawyers). Liabilities from damages which<br />

are paid out in the form of annuities are assessed by the<br />

Group as the present value of future payouts, where a<br />

2.6% discount factor is applied.<br />

The Chain Ladder method can be based on recognised<br />

or accrued damages with monthly or annual<br />

development factors, depending on the characteristics<br />

of the incidence of loss <strong>and</strong> procedures for resolving<br />

damage claims. The damages are arranged in a<br />

triangle, where the rows represent the year the<br />

damage was incurred, <strong>and</strong> the columns represent<br />

the number of years from the time the damage was<br />

incurred to recognising or accrual of the damage.<br />

Prediction of final damages is based on the calculation<br />

of average annual development factors.<br />

The statistical method is based on reviewing past<br />

damage claims. The IBNR calculation is made on<br />

the level of individual insurance category as the<br />

mathematical product of the estimated number of<br />

IBNR damages <strong>and</strong> the estimated value of IBNR<br />

damages. The estimated number of IBNR damages<br />

reported after 1 January 2007 is calculated by