We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

- Net income – financial assets for trading <strong>and</strong><br />

financial assets at initial recognition – dividends,<br />

interests have been reclassified from net income<br />

- financial assets at fair value through P&L to<br />

investment income;<br />

- Impairment – intangible assets (goodwill) has been<br />

reclassified from other expenses to depreciation<br />

<strong>and</strong> impairment expenses;<br />

- Expenses from other liabilities have been<br />

reclassified from finance costs to other expenses;<br />

- Income tax receivable <strong>and</strong> liability are presented as<br />

The strategic risk refers to the Group’s<br />

long-term development as much as to the each<br />

of its subsidiaries. The management of the Group<br />

manages these risks defining its vision <strong>and</strong> strategy<br />

<strong>and</strong> monitoring their appropriateness on a regular<br />

basis. According to the variety of Group’s <strong>business</strong>es<br />

the appropriate long-term investment decisions are<br />

the key factor when managing strategic risks. The<br />

corporate governance of the Group helps it to follow<br />

the long-term <strong>business</strong> development <strong>and</strong> growth to<br />

achieve the required rate of return.<br />

a separate line in the balance sheet.<br />

236<br />

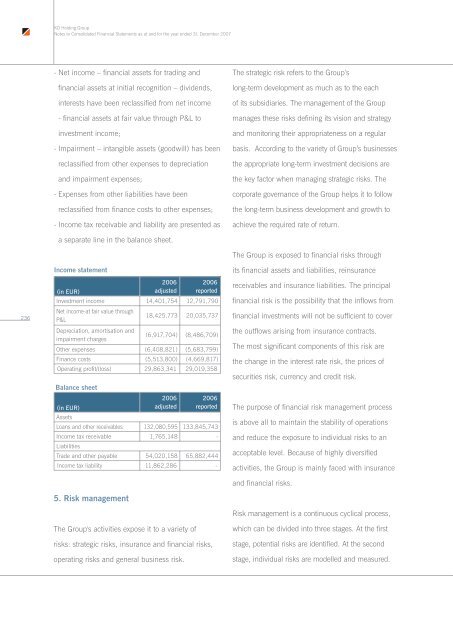

Income statement<br />

(in EUR)<br />

2006<br />

adjusted<br />

2006<br />

reported<br />

Investment income 14,401,754 12,791,790<br />

Net income-at fair value through<br />

P&L<br />

18,425,773 20,035,737<br />

Depreciation, amortisation <strong>and</strong><br />

impairment charges<br />

(6,917,704) (8,486,709)<br />

Other expenses (6,408,821) (5,683,799)<br />

Finance costs (5,513,800) (4,669,817)<br />

Operating profit/(loss) 29,863,341 29,019,358<br />

Balance sheet<br />

(in EUR)<br />

2006<br />

adjusted<br />

2006<br />

reported<br />

Assets<br />

Loans <strong>and</strong> other receivables 132,080,595 133,845,743<br />

Income tax receivable 1,765,148 -<br />

Liabilities<br />

Trade <strong>and</strong> other payable 54,020,158 65,882,444<br />

Income tax liability 11,862,286 -<br />

5. Risk management<br />

The Group's activities expose it to a variety of<br />

risks: strategic risks, insurance <strong>and</strong> financial risks,<br />

operating risks <strong>and</strong> general <strong>business</strong> risk.<br />

The Group is exposed to financial risks through<br />

its financial assets <strong>and</strong> liabilities, reinsurance<br />

receivables <strong>and</strong> insurance liabilities. The principal<br />

financial risk is the possibility that the inflows from<br />

financial investments will not be sufficient to cover<br />

the outflows arising from insurance contracts.<br />

The most significant components of this risk are<br />

the change in the interest rate risk, the prices of<br />

securities risk, currency <strong>and</strong> credit risk.<br />

The purpose of financial risk management process<br />

is above all to maintain the stability of operations<br />

<strong>and</strong> reduce the exposure to individual risks to an<br />

acceptable level. Because of highly diversified<br />

activities, the Group is mainly faced with insurance<br />

<strong>and</strong> financial risks.<br />

Risk management is a continuous cyclical process,<br />

which can be divided into three stages. At the first<br />

stage, potential risks are identified. At the second<br />

stage, individual risks are modelled <strong>and</strong> measured.