We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

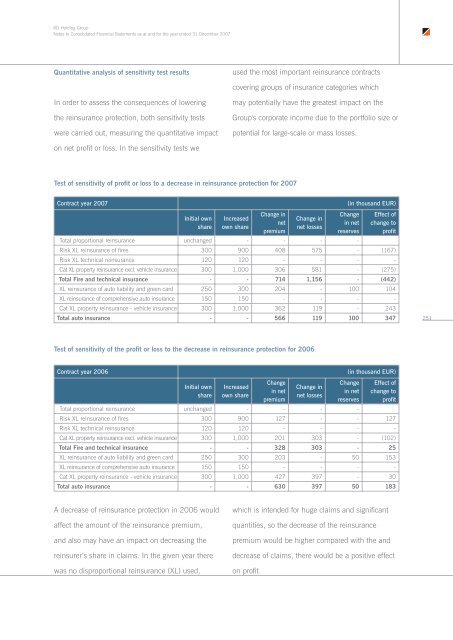

Quantitative analysis of sensitivity test results<br />

used the most important reinsurance contracts<br />

covering <strong>group</strong>s of insurance categories which<br />

In order to assess the consequences of lowering<br />

the reinsurance protection, both sensitivity tests<br />

were carried out, measuring the quantitative impact<br />

may potentially have the greatest impact on the<br />

Group's corporate income due to the portfolio size or<br />

potential for large-scale or mass losses.<br />

on net profit or loss. In the sensitivity tests we<br />

Test of sensitivity of profit or loss to a decrease in reinsurance protection for 2007<br />

Contract year 2007<br />

Initial own<br />

share<br />

Increased<br />

own share<br />

Change in<br />

net<br />

premium<br />

Change in<br />

net losses<br />

(in thous<strong>and</strong> EUR)<br />

Change<br />

in net<br />

reserves<br />

Effect of<br />

change to<br />

profit<br />

Total proportional reinsurance unchanged - - - -<br />

Risk XL reinsurance of fires 300 900 408 575 - (167)<br />

Risk XL technical reinsurance 120 120 - - - -<br />

Cat XL property reinsurance excl. vehicle insurance 300 1,000 306 581 - (275)<br />

Total Fire <strong>and</strong> technical insurance - - 714 1,156 - (442)<br />

XL reinsurance of auto liability <strong>and</strong> green card 250 300 204 - 100 104<br />

XL reinsurance of comprehensive auto insurance 150 150 - - - -<br />

Cat XL property reinsurance - vehicle insurance 300 1,000 362 119 - 243<br />

Total auto insurance - - 566 119 100 347<br />

251<br />

Test of sensitivity of the profit or loss to the decrease in reinsurance protection for 2006<br />

Contract year 2006<br />

Initial own<br />

share<br />

Increased<br />

own share<br />

Change<br />

in net<br />

premium<br />

Change in<br />

net losses<br />

(in thous<strong>and</strong> EUR)<br />

Change<br />

in net<br />

reserves<br />

Effect of<br />

change to<br />

profit<br />

Total proportional reinsurance unchanged - - - -<br />

Risk XL reinsurance of fires 300 900 127 - - 127<br />

Risk XL technical reinsurance 120 120 - - - -<br />

Cat XL property reinsurance excl. vehicle insurance 300 1,000 201 303 - (102)<br />

Total Fire <strong>and</strong> technical insurance - - 328 303 - 25<br />

XL reinsurance of auto liability <strong>and</strong> green card 250 300 203 - 50 153<br />

XL reinsurance of comprehensive auto insurance 150 150 - - - -<br />

Cat XL property reinsurance - vehicle insurance 300 1,000 427 397 - 30<br />

Total auto insurance - - 630 397 50 183<br />

A decrease of reinsurance protection in 2006 would<br />

affect the amount of the reinsurance premium,<br />

<strong>and</strong> also may have an impact on decreasing the<br />

reinsurer’s share in claims. In the given year there<br />

was no disproportional reinsurance (XL) used,<br />

which is intended for huge claims <strong>and</strong> significant<br />

quantities, so the decrease of the reinsurance<br />

premium would be higher compared with the <strong>and</strong><br />

decrease of claims, there would be a positive effect<br />

on profit.