We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

New estimates are made for each subsequent financial<br />

year with the purpose of checking the adequacy of<br />

liabilities determined in this manner. If it is determined<br />

that established liabilities are adequate, assumptions<br />

remain unchanged. If the established liabilities prove<br />

to be inadequate, assumptions are revised to reflect<br />

new expectations. Consequently the provisions are<br />

measured according to the appropriate level.<br />

<br />

The Group established assumptions for returns on<br />

investments by taking into account present returns<br />

on government-issued securities <strong>and</strong> other financial<br />

instruments on the market. In addition to this, the<br />

structure of assets which are used to cover liabilities<br />

stemming from life insurance contracts (longterm<br />

<strong>business</strong> fund) is taken into consideration by<br />

determining weighted average returns.<br />

The assumptions used for insurance contracts<br />

described hereunder are as follows:<br />

<br />

<br />

Future costs are determined on the basis of current<br />

costs. The future inflation assumption was also applied.<br />

Depending on the type of contract the appropriate<br />

mortality table is chosen <strong>and</strong> adjusted to reflect<br />

(b) Changes in assumptions<br />

actual mortality of the insurance portfolio in past<br />

years <strong>and</strong> the current period.<br />

<br />

An analysis of the Group's experience of the past<br />

3 years is carried out by application of statistical<br />

methods, <strong>and</strong> the appropriate cancellation percentage<br />

is determined. Cancellation percentages vary by type<br />

of product <strong>and</strong> term of the insurance period. The<br />

analysis is carried out in order to determine the best<br />

estimate of the policyholders' behavior.<br />

In 2007 the Group made no changes to the assumptions<br />

used in the calculation of insurance contracts.<br />

5.1.5. Sensitivity analysis<br />

The Group made a sensitivity analysis of net profits<br />

before taxes on the last day of the financial year,<br />

with consideration of various parameters.<br />

247<br />

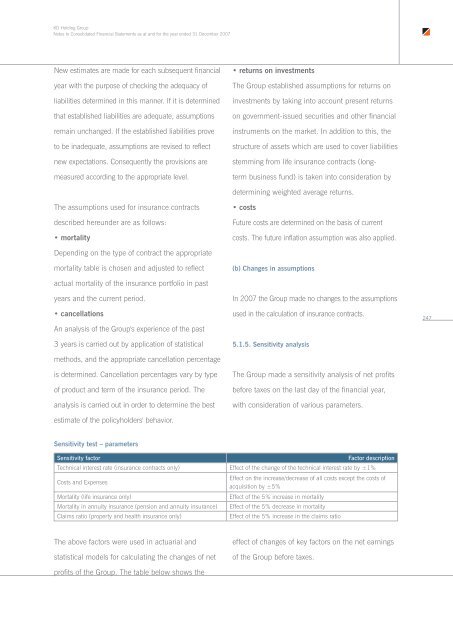

Sensitivity test – parameters<br />

Sensitivity factor<br />

Factor description<br />

Technical interest rate (insurance contracts only) Effect of the change of the technical interest rate by ±1%<br />

Costs <strong>and</strong> Expenses<br />

Mortality (life insurance only)<br />

Mortality in annuity insurance (pension <strong>and</strong> annuity insurance)<br />

Claims ratio (property <strong>and</strong> health insurance only)<br />

Effect on the increase/decrease of all costs except the costs of<br />

acquisition by ±5%<br />

Effect of the 5% increase in mortality<br />

Effect of the 5% decrease in mortality<br />

Effect of the 5% increase in the claims ratio<br />

The above factors were used in actuarial <strong>and</strong><br />

statistical models for calculating the changes of net<br />

effect of changes of key factors on the net earnings<br />

of the Group before taxes.<br />

profits of the Group. The table below shows the