We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

(AAA-rated euro area central government bonds)<br />

based on the mortality tables used at the time when<br />

the product was issued on the market. Therefore for,<br />

2. Investment return<br />

In the calculation a 5.5% rate of return was used<br />

for the first 10 years <strong>and</strong> 5.16% years for the<br />

subsequent years, with a 7% rate of return for<br />

products involving investment risk.<br />

the LAT calculation, 55% of the probability included<br />

in the moratlity tables was used.<br />

For annuities contracts, the Group used the Austrian<br />

annuity tables from 1996, which, based on the<br />

opinion of the Management, shows the actual life<br />

expectancyof the population.<br />

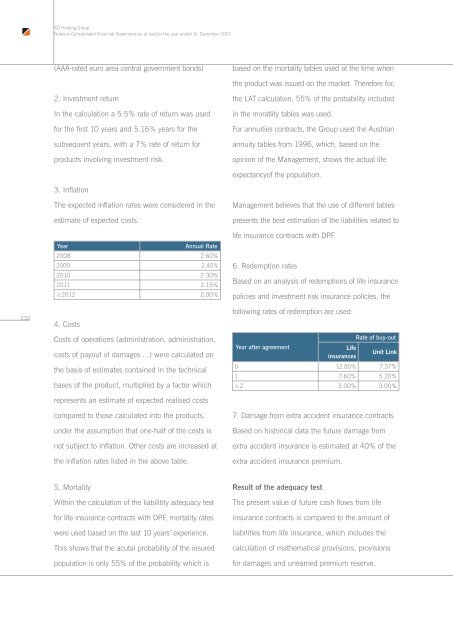

3. Inflation<br />

232<br />

The expected inflation rates were considered in the<br />

estimate of expected costs.<br />

Year<br />

Annual Rate<br />

2008 2.60%<br />

2009 2.45%<br />

2010 2.30%<br />

2011 2.15%<br />

≥2012 2.00%<br />

4. Costs<br />

Costs of operations (administration, administration,<br />

costs of payout of damages ...) were calculated on<br />

the basis of estimates contained in the technical<br />

bases of the product, multiplied by a factor which<br />

represents an estimate of expected realised costs<br />

compared to those calculated into the products,<br />

under the assumption that one-half of the costs is<br />

not subject to inflation. Other costs are increased at<br />

the inflation rates listed in the above table.<br />

Management believes that the use of different tables<br />

presents the best estimation of the liabilities related to<br />

life insurance contracts with DPF.<br />

6. Redemption rates<br />

Based on an analysis of redemptions of life insurance<br />

policies <strong>and</strong> investment risk insurance policies, the<br />

following rates of redemption are used:<br />

Year after agreement<br />

Rate of buy-out<br />

Life<br />

Unit Link<br />

insurances<br />

0 12.80% 7.37%<br />

1 7.60% 5.20%<br />

≥2 3.00% 3.00%<br />

7. Damage from extra accident insurance contracts<br />

Based on historical data the future damage from<br />

extra accident insurance is estimated at 40% of the<br />

extra accident insurance premium.<br />

5. Mortality<br />

Within the calculation of the liabilitity adequacy test<br />

for life insurance contracts with DPF, mortality rates<br />

were used based on the last 10 years’ experience.<br />

This shows that the acutal probability of the insured<br />

population is only 55% of the probability which is<br />

Result of the adequacy test<br />

The present value of future cash flows from life<br />

insurance contracts is compared to the amount of<br />

liabilities from life insurance, which includes the<br />

calculation of mathematical provisions, provisions<br />

for damages <strong>and</strong> unearned premium reserve.