We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

second half of the year, prices began falling on<br />

Balkan markets, driven to a great extent by the<br />

worsening political situation in that area of South<br />

Eastern Europe, resulting in a decrease in inflows of<br />

investors’ assets towards the end of the year.<br />

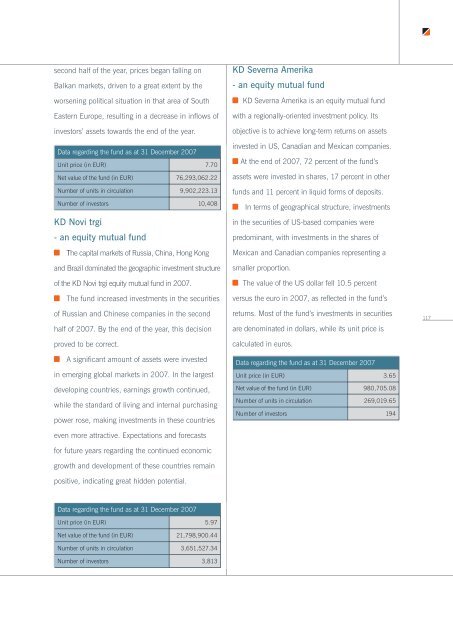

Data regarding the fund as at 31 December 2007<br />

Unit price (in EUR) 7.70<br />

Net value of the fund (in EUR) 76,293,062.22<br />

Number of units in circulation 9,902,223.13<br />

Number of investors 10,408<br />

KD Novi trgi<br />

- an equity mutual fund<br />

The capital markets of Russia, China, Hong Kong<br />

<strong>and</strong> Brazil dominated the geographic investment structure<br />

of the KD Novi trgi equity mutual fund in 2007.<br />

The fund increased investments in the securities<br />

of Russian <strong>and</strong> Chinese companies in the second<br />

half of 2007. By the end of the year, this decision<br />

proved to be correct.<br />

A significant amount of assets were invested<br />

in emerging global markets in 2007. In the largest<br />

developing countries, earnings growth continued,<br />

while the st<strong>and</strong>ard of living <strong>and</strong> internal purchasing<br />

power rose, making investments in these countries<br />

even more attractive. Expectations <strong>and</strong> forecasts<br />

for future years regarding the continued economic<br />

growth <strong>and</strong> development of these countries remain<br />

positive, indicating great hidden potential.<br />

KD Severna Amerika<br />

- an equity mutual fund<br />

KD Severna Amerika is an equity mutual fund<br />

with a regionally-oriented investment policy. Its<br />

objective is to achieve long-term returns on assets<br />

invested in US, Canadian <strong>and</strong> Mexican companies.<br />

At the end of 2007, 72 percent of the fund’s<br />

assets were invested in shares, 17 percent in other<br />

funds <strong>and</strong> 11 percent in liquid forms of deposits.<br />

In terms of geographical structure, investments<br />

in the securities of US-based companies were<br />

predominant, with investments in the shares of<br />

Mexican <strong>and</strong> Canadian companies representing a<br />

smaller proportion.<br />

The value of the US dollar fell 10.5 percent<br />

versus the euro in 2007, as reflected in the fund’s<br />

returns. Most of the fund’s investments in securities<br />

are denominated in dollars, while its unit price is<br />

calculated in euros.<br />

Data regarding the fund as at 31 December 2007<br />

Unit price (in EUR) 3.65<br />

Net value of the fund (in EUR) 980,705.08<br />

Number of units in circulation 269,019.65<br />

Number of investors 194<br />

117<br />

Data regarding the fund as at 31 December 2007<br />

Unit price (in EUR) 5.97<br />

Net value of the fund (in EUR) 21,798,900.44<br />

Number of units in circulation 3,651,527.34<br />

Number of investors 3,813