We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

Issuers of securities in Slovenia do not have ratings,<br />

but the insurance part of the Group hase the highest<br />

concentration of investments in debt securities, bank <strong>and</strong><br />

government bonds. The credit risk of investment coupons<br />

<strong>and</strong> equity securities are controlled by diversification of<br />

investments.<br />

In the context of reinsurance, as for financial asset<br />

investment, credit risk management procedures relate<br />

to verifying the reinsurer’s credit rating. In accordance<br />

with the strategy of credit risk management, reinsurancerelated<br />

liabilities are reinsured by prime-grade reinsurers.<br />

This does not, however, discharge the Group’s liability<br />

as primary insurer. If a reinsurer fails to pay a claim for<br />

Procedures of verifying credit ratings are based on<br />

obtaining <strong>and</strong> reviewing publicly accessible data on<br />

the current financial status of the issuer of financial<br />

instruments <strong>and</strong> the issuer’s future solvency. The credit<br />

any reason, the Group remains liable for the payment<br />

to policyholder. The creditworthiness of reinsurers is<br />

considered on an annual basis by reviewing their financial<br />

strength prior to finalisation of any contract.<br />

rating of domestic the issuer’s of financial instruments is<br />

determined by the Group itself. In checking the issuer’s<br />

credit using its own sources, the Group checks the issuer’s<br />

future solvency, in particular the issuer’s adequacy of<br />

expected future cash flows from regular activities offset<br />

The Group restructures credit risk through establishing<br />

limits to the counterparty <strong>and</strong> also according to territory<br />

<strong>and</strong> industry. These risks are changing regulary.<br />

272<br />

against the outflows for settlement of future liabilities.<br />

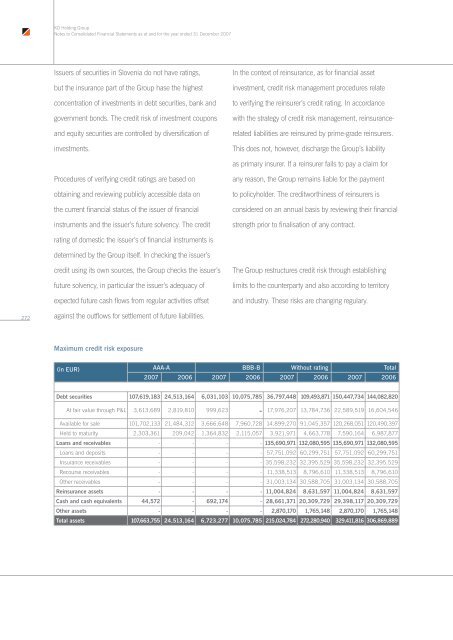

Maximum credit risk exposure<br />

(in EUR) AAA-A BBB-B Without rating Total<br />

2007 2006 2007 2006 2007 2006 2007 2006<br />

Debt securities 107,619,183 24,513,164 6,031,103 10,075,785 36,797,448 109,493,871 150,447,734 144,082,820<br />

At fair value through P&L 3,613,689 2,819,810 999,623 - 17,976,207 13,784,736 22,589,519 16,604,546<br />

Available for sale 101,702,133 21,484,312 3,666,648 7,960,728 14,899,270 91,045,357 120,268,051 120,490,397<br />

Held to maturity 2,303,361 209,042 1,364,832 2,115,057 3,921,971 4,663,778 7,590,164 6,987,877<br />

Loans <strong>and</strong> receivables - - - - 135,690,971 132,080,595 135,690,971 132,080,595<br />

Loans <strong>and</strong> deposits - - - - 57,751,092 60,299,751 57,751,092 60,299,751<br />

Insurance receivables - - - - 35,598,232 32,395,529 35,598,232 32,395,529<br />

Recourse receivables - - - - 11,338,513 8,796,610 11,338,513 8,796,610<br />

Other receivables - - - - 31,003,134 30,588,705 31,003,134 30,588,705<br />

Reinsurance assets - - - - 11,004,824 8,631,597 11,004,824 8,631,597<br />

Cash <strong>and</strong> cash equivalents 44,572 - 692,174 - 28,661,371 20,309,729 29,398,117 20,309,729<br />

Other assets - - - - 2,870,170 1,765,148 2,870,170 1,765,148<br />

Total assets 107,663,755 24,513,164 6,723,277 10,075,785 215,024,784 272,280,940 329,411,816 306,869,889