We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

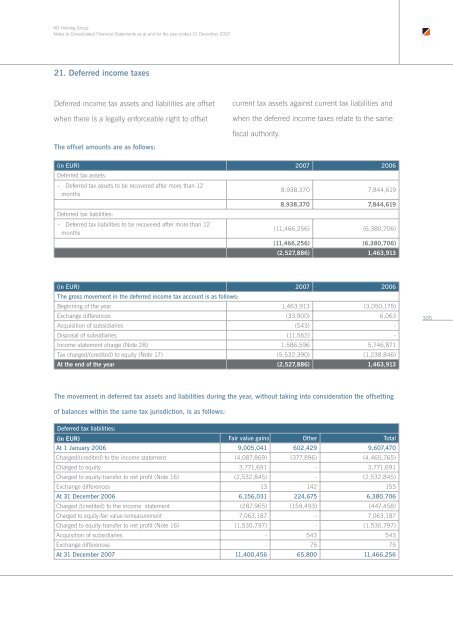

21. Deferred income taxes<br />

Deferred income tax assets <strong>and</strong> liabilities are offset<br />

when there is a legally enforceable right to offset<br />

current tax assets against current tax liabilities <strong>and</strong><br />

when the deferred income taxes relate to the same<br />

fiscal authority.<br />

The offset amounts are as follows:<br />

(in EUR) 2007 2006<br />

Deferred tax assets:<br />

– Deferred tax assets to be recovered after more than 12<br />

months<br />

8,938,370 7,844,619<br />

8,938,370 7,844,619<br />

Deferred tax liabilities:<br />

– Deferred tax liabilities to be recovered after more than 12<br />

months<br />

(11,466,256) (6,380,706)<br />

(11,466,256) (6,380,706)<br />

(2,527,886) 1,463,913<br />

(in EUR) 2007 2006<br />

The gross movement in the deferred income tax account is as follows:<br />

Beginning of the year 1,463,913 (3,050,175)<br />

Exchange differences (33,900) 6,063<br />

Acquisition of subsidiaries (543) -<br />

Disposal of subsidiaries (11,562) -<br />

Income statement charge (Note 28) 1,586,596 5,746,871<br />

Tax charged/(credited) to equity (Note 17) (5,532,390) (1,238,846)<br />

At the end of the year (2,527,886) 1,463,913<br />

305<br />

The movement in deferred tax assets <strong>and</strong> liabilities during the year, without taking into consideration the offsetting<br />

of balances within the same tax jurisdiction, is as follows:<br />

Deferred tax liabilities:<br />

(in EUR) Fair value gains Other Total<br />

At 1 January 2006 9,005,041 602,429 9,607,470<br />

Charged/(credited) to the income statement (4,087,869) (377,896) (4,465,765)<br />

Charged to equity 3,771,691 - 3,771,691<br />

Charged to equity-transfer to net profit (Note 16) (2,532,845) - (2,532,845)<br />

Exchange differences 13 142 155<br />

At 31 December 2006 6,156,031 224,675 6,380,706<br />

Charged /(credited) to the income statement (287,965) (159,493) (447,458)<br />

Charged to equity-fair value remeasurement 7,063,187 - 7,063,187<br />

Charged to equity-transfer to net profit (Note 16) (1,530,797) - (1,530,797)<br />

Acquisition of subsidiaries - 543 543<br />

Exchange differences - 75 75<br />

At 31 December 2007 11,400,456 65,800 11,466,256