We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

We build business networks and relationships ... - skupina kd group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KD Holding Group<br />

Notes to Consolidated Financial Statements as at <strong>and</strong> for the year ended 31 December 2007<br />

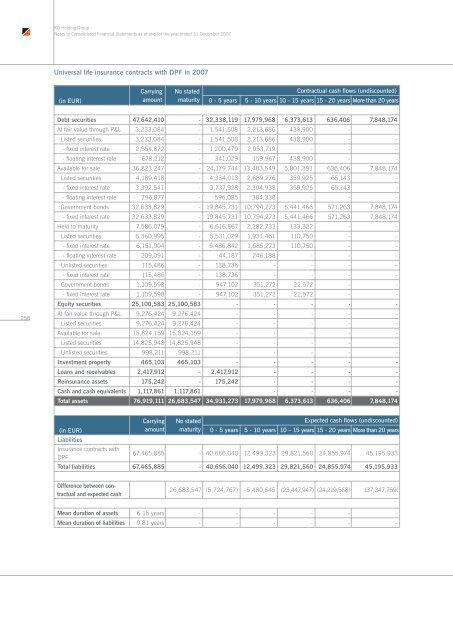

Universal life insurance contracts with DPF in 2007<br />

(in EUR)<br />

Carrying<br />

amount<br />

No stated<br />

maturity<br />

Contractual cash flows (undiscounted)<br />

0 - 5 years 5 - 10 years 10 - 15 years 15 - 20 years More than 20 years<br />

258<br />

Debt securities 47,642,410 - 32,338,119 17,979,968 6,373,613 636,406 7,848,174<br />

At fair value through P&L 3,233,084 - 1,541,508 2,213,686 438,900 - -<br />

Listed securities 3,233,084 - 1,541,508 2,213,686 438,900 - -<br />

- fixed interest rate 2,554,872 - 1,200,479 2,053,719 - - -<br />

- floating interest rate 678,212 - 341,029 159,967 438,900 - -<br />

Available for sale 36,823,247 - 24,179,744 13,483,549 5,801,391 636,406 7,848,174<br />

Listed securities 4,189,418 - 4,334,013 2,689,276 359,925 65,143 -<br />

- fixed interest rate 3,392,541 - 3,737,928 2,304,938 359,925 65,143 -<br />

- floating interest rate 796,877 - 596,085 384,338 - - -<br />

Government bonds 32,633,829 - 19,845,731 10,794,273 5,441,466 571,263 7,848,174<br />

- fixed interest rate 32,633,829 - 19,845,731 10,794,273 5,441,466 571,263 7,848,174<br />

Held to maturity 7,586,079 - 6,616,867 2,282,733 133,322 - -<br />

Listed securities 6,360,995 - 5,531,029 1,931,461 110,750 - -<br />

- fixed interest rate 6,151,904 - 5,486,842 1,685,273 110,750 - -<br />

- floating interest rate 209,091 - 44,187 246,188 - - -<br />

Unlisted securities 115,486 - 138,736 - - - -<br />

- fixed interest rate 115,486 - 138,736 - - - -<br />

Government bonds 1,109,598 - 947,102 351,272 22,572 - -<br />

- fixed interest rate 1,109,598 - 947,102 351,272 22,572 - -<br />

Equity securities 25,100,583 25,100,583 - - - - -<br />

At fair value through P&L 9,276,424 9,276,424 - - - - -<br />

Listed securities 9,276,424 9,276,424 - - - - -<br />

Available for sale 15,824,159 15,824,159 - - - - -<br />

Listed securities 14,825,948 14,825,948 - - - - -<br />

Unlisted securities 998,211 998,211 - - - - -<br />

Investment property 465,103 465,103 - - - - -<br />

Loans <strong>and</strong> receivables 2,417,912 - 2,417,912 - - - -<br />

Reinsurance assets 175,242 - 175,242 - - - -<br />

Cash <strong>and</strong> cash equivalents 1,117,861 1,117,861 - - - -<br />

Total assets 76,919,111 26,683,547 34,931,273 17,979,968 6,373,613 636,406 7,848,174<br />

Carrying No stated<br />

Expected cash flows (undiscounted)<br />

(in EUR)<br />

amount maturity 0 - 5 years 5 - 10 years 10 – 15 years 15 - 20 years More than 20 years<br />

Liabilities<br />

Insurance contracts with<br />

DPF<br />

67,465,885 - 40,656,040 12,499,323 29,821,560 24,855,974 45,195,933<br />

Total liabilities 67,465,885 - 40,656,040 12,499,323 29,821,560 24,855,974 45,195,933<br />

Difference between contractual<br />

<strong>and</strong> expected cash<br />

26,683,547 (5,724,767) 5,480,645 (23,447,947) (24,219,568) (37,347,759)<br />

Mean duration of assets 6.15 years - - - - - -<br />

Mean duration of liabilities 9.81 years - - - - - -