Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

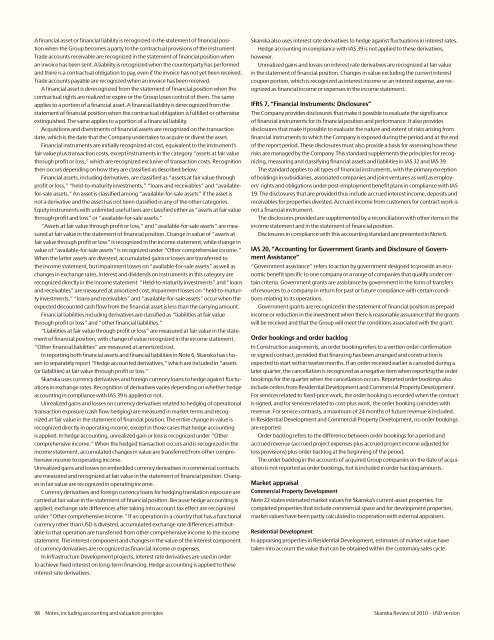

A financial asset or financial liability is recognized in the statement <strong>of</strong> financial position<br />

when the Group becomes a party to the contractual provisions <strong>of</strong> the instrument.<br />

Trade accounts receivable are recognized in the statement <strong>of</strong> financial position when<br />

an invoice has been sent. A liability is recognized when the counterparty has performed<br />

and there is a contractual obligation to pay, even if the invoice has not yet been received.<br />

Trade accounts payable are recognized when an invoice has been received.<br />

A financial asset is derecognized from the statement <strong>of</strong> financial position when the<br />

contractual rights are realized or expire or the Group loses control <strong>of</strong> them. The same<br />

applies to a portion <strong>of</strong> a financial asset. A financial liability is derecognized from the<br />

statement <strong>of</strong> financial position when the contractual obligation is fulfilled or otherwise<br />

extinguished. The same applies to a portion <strong>of</strong> a financial liability.<br />

Acquisitions and divestments <strong>of</strong> financial assets are recognized on the transaction<br />

date, which is the date that the Company undertakes to acquire or divest the asset.<br />

Financial instruments are initially recognized at cost, equivalent to the instrument’s<br />

fair value plus transaction costs, except instruments in the category “assets at fair value<br />

through pr<strong>of</strong>it or loss,” which are recognized exclusive <strong>of</strong> transaction costs. Recognition<br />

then occurs depending on how they are classified as described below.<br />

Financial assets, including derivatives, are classified as “assets at fair value through<br />

pr<strong>of</strong>it or loss,” “held-to-maturity investments,” “loans and receivables” and “availablefor-sale<br />

assets.” An asset is classified among “available-for-sale assets” if the asset is<br />

not a derivative and the asset has not been classified in any <strong>of</strong> the other categories.<br />

Equity instruments with unlimited useful lives are classified either as “assets at fair value<br />

through pr<strong>of</strong>it and loss” or “available-for-sale assets.”<br />

“Assets at fair value through pr<strong>of</strong>it or loss,” and “available-for-sale assets” are measured<br />

at fair value in the statement <strong>of</strong> financial position. Change in value <strong>of</strong> “assets at<br />

fair value through pr<strong>of</strong>it or loss” is recognized in the income statement, while change in<br />

value <strong>of</strong> “available-for-sale assets” is recognized under “Other comprehensive income.”<br />

When the latter assets are divested, accumulated gains or losses are transferred to<br />

the income statement, but impairment losses on “available-for-sale assets” as well as<br />

changes in exchange rates, interest and dividends on instruments in this category are<br />

recognized directly in the income statement. “Held-to-maturity investments” and “loans<br />

and receivables” are measured at amortized cost. Impairment losses on “held-to-maturity<br />

investments,” “loans and receivables” and “available-for-sale assets” occur when the<br />

expected discounted cash flow from the financial asset is less than the carrying amount.<br />

Financial liabilities including derivatives are classified as “liabilities at fair value<br />

through pr<strong>of</strong>it or loss” and “other financial liabilities.”<br />

“Liabilities at fair value through pr<strong>of</strong>it or loss” are measured at fair value in the statement<br />

<strong>of</strong> financial position, with change <strong>of</strong> value recognized in the income statement.<br />

“Other financial liabilities” are measured at amortized cost.<br />

In reporting both financial assets and financial liabilities in Note 6, <strong>Skanska</strong> has chosen<br />

to separately report “Hedge accounted derivatives,” which are included in “assets<br />

(or liabilities) at fair value through pr<strong>of</strong>it or loss.”<br />

<strong>Skanska</strong> uses currency derivatives and foreign currency loans to hedge against fluctuations<br />

in exchange rates. Recognition <strong>of</strong> derivatives varies depending on whether hedge<br />

accounting in compliance with IAS 39 is applied or not.<br />

Unrealized gains and losses on currency derivatives related to hedging <strong>of</strong> operational<br />

transaction exposure (cash flow hedging) are measured in market terms and recognized<br />

at fair value in the statement <strong>of</strong> financial position. The entire change in value is<br />

recognized directly in operating income, except in those cases that hedge accounting<br />

is applied. In hedge accounting, unrealized gain or loss is recognized under “Other<br />

comprehensive income.” When the hedged transaction occurs and is recognized in the<br />

income statement, accumulated changes in value are transferred from other comprehensive<br />

income to operating income.<br />

Unrealized gains and losses on embedded currency derivatives in commercial contracts<br />

are measured and recognized at fair value in the statement <strong>of</strong> financial position. Changes<br />

in fair value are recognized in operating income.<br />

Currency derivatives and foreign currency loans for hedging translation exposure are<br />

carried at fair value in the statement <strong>of</strong> financial position. Because hedge accounting is<br />

applied, exchange rate differences after taking into account tax effect are recognized<br />

under “Other comprehensive income.” If an operation in a country that has a functional<br />

currency other than <strong>USD</strong> is divested, accumulated exchange rate differences attributable<br />

to that operation are transferred from other comprehensive income to the income<br />

statement. The interest component and changes in the value <strong>of</strong> the interest component<br />

<strong>of</strong> currency derivatives are recognized as financial income or expenses.<br />

In Infrastructure Development projects, interest rate derivatives are used in order<br />

to achieve fixed interest on long-term financing. Hedge accounting is applied to these<br />

interest rate derivatives.<br />

<strong>Skanska</strong> also uses interest rate derivatives to hedge against fluctuations in interest rates.<br />

Hedge accounting in compliance with IAS 39 is not applied to these derivatives,<br />

however.<br />

Unrealized gains and losses on interest rate derivatives are recognized at fair value<br />

in the statement <strong>of</strong> financial position. Changes in value excluding the current interest<br />

coupon portion, which is recognized as interest income or an interest expense, are recognized<br />

as financial income or expenses in the income statement.<br />

IFRS 7, “Financial Instruments: Disclosures”<br />

The Company provides disclosures that make it possible to evaluate the significance<br />

<strong>of</strong> financial instruments for its financial position and performance. It also provides<br />

disclosures that make it possible to evaluate the nature and extent <strong>of</strong> risks arising from<br />

financial instruments to which the Company is exposed during the period and at the end<br />

<strong>of</strong> the report period. These disclosures must also provide a basis for assessing how these<br />

risks are managed by the Company. This standard supplements the principles for recognizing,<br />

measuring and classifying financial assets and liabilities in IAS 32 and IAS 39.<br />

The standard applies to all types <strong>of</strong> financial instruments, with the primary exception<br />

<strong>of</strong> holdings in subsidiaries, associated companies and joint ventures as well as employers’<br />

rights and obligations under post-employment benefit plans in compliance with IAS<br />

19. The disclosures that are provided thus include accrued interest income, deposits and<br />

receivables for properties divested. Accrued income from customers for contract work is<br />

not a financial instrument.<br />

The disclosures provided are supplemented by a reconciliation with other items in the<br />

income statement and in the statement <strong>of</strong> financial position.<br />

Disclosures in compliance with this accounting standard are presented in Note 6.<br />

IAS 20, “Accounting for Government Grants and Disclosure <strong>of</strong> Government<br />

Assistance”<br />

“Government assistance” refers to action by government designed to provide an economic<br />

benefit specific to one company or a range <strong>of</strong> companies that qualify under certain<br />

criteria. Government grants are assistance by government in the form <strong>of</strong> transfers<br />

<strong>of</strong> resources to a company in return for past or future compliance with certain conditions<br />

relating to its operations.<br />

Government grants are recognized in the statement <strong>of</strong> financial position as prepaid<br />

income or reduction in the investment when there is reasonable assurance that the grants<br />

will be received and that the Group will meet the conditions associated with the grant.<br />

Order bookings and order backlog<br />

In Construction assignments, an order booking refers to a written order confirmation<br />

or signed contract, provided that financing has been arranged and construction is<br />

expected to start within twelve months. If an order received earlier is canceled during a<br />

later quarter, the cancellation is recognized as a negative item when reporting the order<br />

bookings for the quarter when the cancellation occurs. Reported order bookings also<br />

include orders from Residential Development and Commercial Property Development.<br />

For services related to fixed-price work, the order booking is recorded when the contract<br />

is signed, and for services related to cost-plus work, the order booking coincides with<br />

revenue. For service contracts, a maximum <strong>of</strong> 24 months <strong>of</strong> future revenue is included.<br />

In Residential Development and Commercial Property Development, no order bookings<br />

are reported.<br />

Order backlog refers to the difference between order bookings for a period and<br />

accrued revenue (accrued project expenses plus accrued project income adjusted for<br />

loss provisions) plus order backlog at the beginning <strong>of</strong> the period.<br />

The order backlog in the accounts <strong>of</strong> acquired Group companies on the date <strong>of</strong> acquisition<br />

is not reported as order bookings, but is included in order backlog amounts.<br />

Market appraisal<br />

Commercial Property Development<br />

Note 22 states estimated market values for <strong>Skanska</strong>’s current-asset properties. For<br />

completed properties that include commercial space and for development properties,<br />

market values have been partly calculated in cooperation with external appraisers.<br />

Residential Development<br />

In appraising properties in Residential Development, estimates <strong>of</strong> market value have<br />

taken into account the value that can be obtained within the customary sales cycle.<br />

98 Notes, including accounting and valuation principles <strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong>