Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

Review of 2010 â USD version - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

increase due to stricter energy and emission requirements<br />

and because both investors and tenants increasingly<br />

demand green commercial space.<br />

Non-residential, civil and residential construction<br />

and renovation<br />

The mission <strong>of</strong> <strong>Skanska</strong>’s Construction operations is to<br />

<strong>of</strong>fer building, civil and residential construction services,<br />

also including refurbishment as well as operation and<br />

maintenance <strong>of</strong> industrial and transport facilities. These<br />

operations are targeted to both corporate customers and<br />

public agencies. By virtue <strong>of</strong> its size and leading position,<br />

<strong>Skanska</strong> can accept the largest, most complex assignments<br />

from the most demanding customers.<br />

The Construction business stream also performs<br />

contracting assignments for <strong>Skanska</strong>’s other business<br />

streams in the development <strong>of</strong> commercial and residential<br />

properties as well as infrastructure. This collaboration<br />

generates both large construction assignments and<br />

synergies for the Group.<br />

Order backlog<br />

Order backlog, totaling <strong>USD</strong> 21.6 billion at year-end<br />

<strong>2010</strong>, is divided among several thousand projects. Nonresidential<br />

building construction accounts for 53 percent,<br />

civil construction 38 percent and residential construction<br />

5 percent <strong>of</strong> the Construction business stream’s order<br />

backlog. The remaining 4 percent consists <strong>of</strong> service<br />

assignments. At year-end, the part <strong>of</strong> this backlog that<br />

<strong>Skanska</strong> plans to carry out in 2011 was equivalent to<br />

69 (59) percent <strong>of</strong> <strong>2010</strong> revenue.<br />

A leading builder in selected markets<br />

The Construction business stream operates in a number<br />

<strong>of</strong> selected home markets − Sweden, Norway, Finland,<br />

Estonia, Poland, the Czech Republic, Slovakia, the U.K.,<br />

the U.S. and Latin America. In addition, there is a pan-<br />

Nordic unit for construction-related industrial production.<br />

In its selected markets, the <strong>Skanska</strong> Group is regarded<br />

as one <strong>of</strong> the leaders or have the potential to become a<br />

leader in terms <strong>of</strong> size and pr<strong>of</strong>itability. <strong>Skanska</strong> also<br />

endeavors to be the industry leader in sustainable development<br />

as well as in ethics, health and safety. In the<br />

Construction business stream, the Group’s primary goal<br />

is good pr<strong>of</strong>itability, followed by growth.<br />

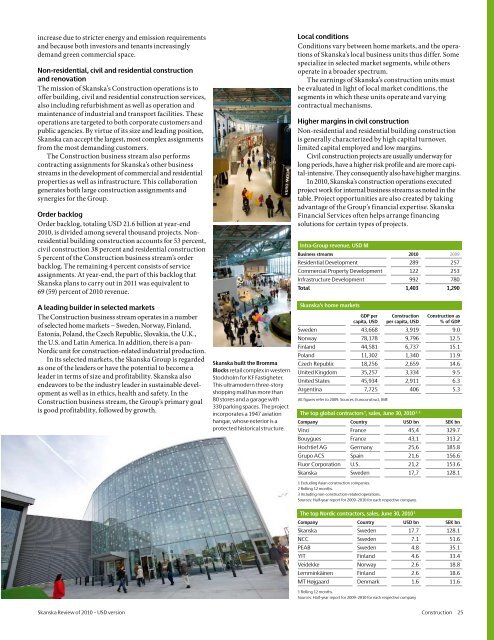

<strong>Skanska</strong> built the Bromma<br />

Blocks retail complex in western<br />

Stockholm for KF Fastigheter.<br />

This ultramodern three-story<br />

shopping mall has more than<br />

80 stores and a garage with<br />

330 parking spaces. The project<br />

incorporates a 1947 aviation<br />

hangar, whose exterior is a<br />

protected historical structure.<br />

Local conditions<br />

Conditions vary between home markets, and the operations<br />

<strong>of</strong> <strong>Skanska</strong>’s local business units thus differ. Some<br />

specialize in selected market segments, while others<br />

operate in a broader spectrum.<br />

The earnings <strong>of</strong> <strong>Skanska</strong>’s construction units must<br />

be evaluated in light <strong>of</strong> local market conditions, the<br />

segments in which these units operate and varying<br />

contractual mechanisms.<br />

Higher margins in civil construction<br />

Non-residential and residential building construction<br />

is generally characterized by high capital turnover,<br />

limited capital employed and low margins.<br />

Civil construction projects are usually underway for<br />

long periods, have a higher risk pr<strong>of</strong>ile and are more capital-intensive.<br />

They consequently also have higher margins.<br />

In <strong>2010</strong>, <strong>Skanska</strong>’s construction operations executed<br />

project work for internal business streams as noted in the<br />

table. Project opportunities are also created by taking<br />

advantage <strong>of</strong> the Group’s financial expertise. <strong>Skanska</strong><br />

Financial Services <strong>of</strong>ten helps arrange financing<br />

solutions for certain types <strong>of</strong> projects.<br />

Intra-Group revenue, <strong>USD</strong> M<br />

Business streams <strong>2010</strong> 2009<br />

Residential Development 289 257<br />

Commercial Property Development 122 253<br />

Infrastructure Development 992 780<br />

Total 1,403 1,290<br />

<strong>Skanska</strong>’s home markets<br />

GDP per<br />

capita, <strong>USD</strong><br />

Construction<br />

per capita, <strong>USD</strong><br />

Construction as<br />

% <strong>of</strong> GDP<br />

Sweden 43,668 3,919 9.0<br />

Norway 78,178 9,796 12.5<br />

Finland 44,581 6,737 15.1<br />

Poland 11,302 1,340 11.9<br />

Czech Republic 18,256 2,659 14.6<br />

United Kingdom 35,257 3,334 9.5<br />

United States 45,934 2,911 6.3<br />

Argentina 7,725 406 5.3<br />

All figures refer to 2009. Sources: Euroconstruct, IMF.<br />

The top global contractors 1 , sales, June 30, <strong>2010</strong> 2, 3<br />

Company Country <strong>USD</strong> bn SEK bn<br />

Vinci France 45,4 329.7<br />

Bouygues France 43,1 313.2<br />

Hochtief AG Germany 25,6 185.8<br />

Grupo ACS Spain 21,6 156.6<br />

Fluor Corporation U.S. 21,2 153.6<br />

<strong>Skanska</strong> Sweden 17,7 128.1<br />

1 Excluding Asian construction companies.<br />

2 Rolling 12 months.<br />

3 Including non-construction-related operations.<br />

Sources: Half-year report for 2009–<strong>2010</strong> for each respective company.<br />

The top Nordic contractors, sales, June 30, <strong>2010</strong> 1<br />

Company Country <strong>USD</strong> bn SEK bn<br />

<strong>Skanska</strong> Sweden 17.7 128.1<br />

NCC Sweden 7.1 51.6<br />

PEAB Sweden 4.8 35.1<br />

YIT Finland 4.6 33.4<br />

Veidekke Norway 2.6 18.8<br />

Lemminkäinen Finland 2.6 18.6<br />

MT Højgaard Denmark 1.6 11.6<br />

1 Rolling 12 months.<br />

Sources: Half-year report for 2009–<strong>2010</strong> for each respective company<br />

<strong>Skanska</strong> <strong>Review</strong> <strong>of</strong> <strong>2010</strong> – <strong>USD</strong> <strong>version</strong> Construction 25